Oki 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

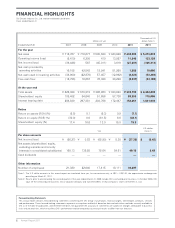

600

(Billions of yen)

(Ended March 31)

500

400

300

200

100

0

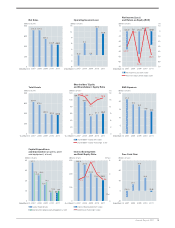

Net Sales*

2008 2009 2010 2011 2012

(est.)

581.5 491.6

443.9 432.7 436.0

18

(Billions of yen)

(Ended March 31)

15

12

9

6

3

0

Operating Income*

2008 2009 2010 2011 2012

(est.)

2.4

5.6

14.0

11.0

15.0

*Excluding the semiconductor business

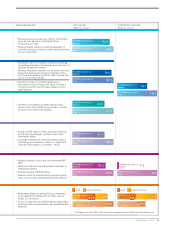

What are your thoughts on the OKI Group’s performance in fiscal year 2010,

and what are your targets for fiscal year 2011?

In fiscal year 2010, we posted year-on-year declines in both sales and profits,

due to stagnant public sector demand and other factors. Nevertheless,

we were able to establish solid management bases to underpin future business growth.

Annual Report 2011 5

INTERVIEW WITH THE PRESIDENT:

TOWARD FUTURE GROWTH

We will steadily implement growth strategies,

while further enhancing our management bases.

Q

A

In fiscal year 2010, the OKI Group reorganized its business

structure and integrated some Group companies. We also

implemented the program for the enhancement of our man-

agement bases. In these ways, we worked to establish solid

management bases to underpin future business growth.

Consolidated net sales for the year amounted to ¥432.7

billion, down ¥11.2 billion from the previous fiscal year. The

decline stemmed from several factors, including a changeover

in large-scale replacement projects for some public sector

agencies, the appreciation of the yen, delayed economic

recovery in some parts of Europe, and the impact of the

Great East Japan Earthquake.

Despite efforts to improve profitability, which included fur-

ther reductions in operating expenses and a reassessment of

fixed costs, operating income decreased ¥3.0 billion to ¥11.0

billion, due mainly to the negative impact of the yen’s apprecia-

tion, falling sales prices, higher sales costs, optimization of

treatment plans, and the earthquake. The Group posted a net

loss of ¥27.0 billion, compared with net income of ¥3.6 billion

in the previous fiscal year. This was due mainly to strategic allo-

cation of expenditures to enhance our management bases.

While placing highest priority on ensuring stable, continu-

ous returns to shareholders, OKI is working hard to improve

profitability. In fiscal year 2010, however, we posted a major

net loss. Due also to the fact that we have not yet finished

building a financial base to allow stable dividend payments,

we have decided to forego payment of cash dividends for

fiscal year 2010.

In the year ahead, we will draw on the management

bases built in fiscal year 2010 to implement growth-oriented

strategies, with the aim of making fiscal year 2011 the year

for expediting efforts to lay the groundwork for robust profit

generation and growth.

For this fiscal year, we forecast an increase in consolidated

net sales, to ¥436.0 billion. This will be achieved through the

expansion of our services business, growth in demand for

upgrading and replacement of social infrastructure systems,

increased sales of ATMs in Japan and China, and growth in

our EMS business. We forecast operating income of ¥15.0 bil-

lion, to be attained through rigorous cost-reduction efforts and

the revamping of our business structure, with the aim of gen-

erating stable profits, which should compensate for the

negative impact of the optimization of our treatment plans.

We forecast net income of ¥7.5 billion, to be achieved through

an increase in operating income, as well as an improvement in

non-operating income/expenses and a major improvement in

extraordinary income/loss.