North Face 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

constant dollar revenue growth in 2012, and continued to expand distribution

and capture new consumers with industry-leading innovations. Global

revenues for the Lee® brand, which continued to face challenges in the

mid-tier channel in the U.S., were flat on a constant dollar basis. Yet, here

too, our product innovation pipeline is robust, giving us great confidence in

our long-term ability to achieve growth. The real 2012 story in Jeanswear,

however, was the significant improvement in profitability with a 13 percent

increase in operating income and an operating margin reaching 16.7 percent,

moving closer to our historic levels.

Imagewear, VF’s third-largest coalition, has now delivered 11 consecutive

quarters of revenue growth, posting a 5 percent increase in revenues for

the full year with strength on both sides of the business — Image and

Licensed Sports Group.

Sportswear coalition revenues were up 6 percent in 2012, with growth in both

our Nautica® and Kipling® (U.S.) brands. Both brands contributed to

the year’s growth and continued improvement in profitability, combining to

deliver a 30 percent increase in operating income and a 230 basis point

improvement in operating margin to 12.6 percent. This improvement for both

brands provides a foundation for what we expect to be a strong contribution

to our portfolio for years to come.

And finally, the story in our Contemporary Brands coalition is also one of

both top and bottom line growth. Excluding the John Varvatos Enterprises

Inc. business, which we sold in April of 2012, Contemporary Brands

achieved a 5 percent increase in revenues for the full year. Our 7 For All

Mankind®, Splendid® and Ella Moss® brands each achieved higher

revenues during the year, reflecting growth in their direct-to-consumer and

wholesale businesses. The 37 percent increase in operating income was

quite impressive, representing a 360 basis point improvement in operating

margin over the coalition’s performance in 2011.

Positioned To Win

VF’s balance sheet continues to be in great shape. We ended the year with

nearly $600 million in cash after buying back 2 million shares of our stock,

paying down all outstanding commercial paper borrowings and contributing

more than $100 million to our pension plan. Our strong working capital

discipline was also evidenced by a $99 million reduction in inventories

year-over-year. And, we didn’t miss a beat in servicing our businesses’ needs;

on-time shipping performance was at our highest level ever.

In summary, we are thrilled to have wrapped up another great year for VF

and our shareholders, and we have tremendous confidence in our ability to

deliver another year of strong, balanced and profitable growth in 2013. We

are winning and we intend to keep winning.

VF’s record revenues, profit and cash flow from operations in 2012

were driven by a relentless focus on delivering the industry’s most

innovative products, deepening relationships with our customers

and consumers and driving operational excellence in every area of

our business. Amid a year that included compounding impacts

from two consecutive warmer-than-normal winters and a continued

recession in Europe, we are quite pleased to have delivered yet

another year of excellent returns to our shareholders.

• Revenues increased 15 percent to a record $10.9 billion from $9.5 billion in

2011. On a constant dollar basis, full year revenues increased 17 percent.

The Timberland Company (consisting of the Timberland® and SmartWool®

brands) accounted for 9 percentage points, or $907 million, of the revenue

growth in 2012.

• Gross margin rose by 75 basis points to a record 46.5 percent, compared

with 45.8 percent in 2011, reflecting the continued shift in our revenue mix

toward higher margin businesses.

• Operating income rose 18 percent to $1.5 billion from $1.2 billion in 2011.

Operating margin was 13.5 percent versus 13.2 percent in 2011, reflecting

a 90 basis point negative impact from Timberland’s operations, in which

margins are lower than VF’s average.

• Net income on an adjusted basis rose 18 percent to $1.1 billion, compared

to $913 million in 2011. On a GAAP basis, net income rose 22 percent, to

$1.1 billion, compared to $888 million.

• Adjusted earnings per share increased 17 percent to $9.63 per share.

On a GAAP basis, earnings per share grew 22 percent to $9.70 per share.

• VF’s cash flow from operations reached a record $1.3 billion in 2012,

which helped fund a 21 percent increase in our quarterly dividend rate,

and marked the 40th-consecutive year of increasing dividend payments

to shareholders.

VF’s strategy is engineered to deliver consistent, sustainable growth. Our

diversified portfolio, brand-building expertise, global expansion efforts,

strong partnerships with wholesale customers, and ability to connect with

consumers through our direct-to-consumer business all contributed to

strong top and bottom line results in 2012.

Coalition Performance

In Outdoor & Action Sports, we continued to build on our momentum with

revenues rising by 29 percent. On an organic basis, excluding the results

from Timberland, revenues rose 10 percent. Driving this result were

The North Face® and Vans® brands, which both reached record revenue

levels for the year growing 9 percent and 23 percent, respectively. And

although still quite young in the context of VF’s portfolio, Timberland’s

integration is on track with our expectations. In 2012, Timberland contributed

$1.12 to our full year earnings per share. We remain very excited about

helping this global brand realize its true potential. The profitability of our

Outdoor & Action Sports coalition remains a highlight with a 23 percent

increase in operating income to an operating margin of 17.4 percent — a

strong performance we’re confident we can improve upon in 2013.

In 2012, global revenues for VF’s Jeanswear business were up 2 percent, or

4 percent in constant dollars, a performance that reflected a mid single-digit

increase in the Americas, a high single-digit increase in Asia and a decline

in sales in Europe, where our brands remained strong yet were impacted

by the prolonged recession there. Driven by notable strength in its Western

Specialty and Mass businesses, the Wrangler® brand posted 3 percent

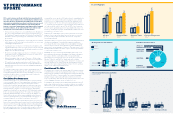

VF PERFORMANCE

UPDATE

Bob Shearer

Senior Vice President & Chief Financial Officer

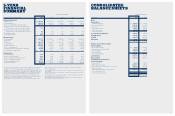

Total Revenues By Coalition

OUTDOOR &

ACTION SPORTS

JEANSWEAR 26%

54%

10%5% 4%

IMAGEWEAR

SPORTSWEAR

CONTEMPORARY BRANDS

OTHER (1%)

Dividends Per Share

(Dollars)

Earnings Per Share

(Dollars)

Cash Flow from Operations

(Millions)

Revenues

(Millions)

Financial Highlights

10

$7,703

11

$9,459

12

$10,880

10

$1,001

11

$1,081

12

$1,275

10

$5.18

11

$7.9 8

12

$9.70

10

$2.43

11

$2.61

12

$3.03

3-Year Coalition Revenues and Profits

(Dollars in Millions)

Revenues

Profits

Outdoor &

Action Sports

10

$3,205$637

11

$4,562$828

12

$5,866

$1,019

Jeanswear

10

$2,538$432

11

$2,732$413

12

$2,789

$467

Imagewear

10

$909$111

11

$1,025$146

12

$1,076

$145

Sportswear

10

$498$52

11

$544$56

12

$577

$73

Contemporary Brands

10

$439$14

11

$485$36

12

$446

$49

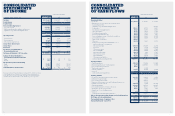

S&P 500 Index

VF Corporation

VF Corporation vs. The S&P 500

21%

21%

Dividend yield

Capital gain

15%

16%

50%

2%

13%

2%

14%

2%

0%

2%

18%

3%

19%

2%

47%

3%

1110 12