Nikon 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Nikon Group posted a solid recovery in performance in the

year ended March 2005. This turnaround was not achieved by

means of short-term solutions or one-off gains. It was the product

of real structural reforms undertaken over the past few years

— reforms that constitute a fi rst step toward sustained earnings

growth over the medium and long term. In this sense, we fi nished

laying the foundations for future profi ts. Here, we review the

results achieved and explain the ongoing systemic improvements

that promise to drive the ongoing growth of the Nikon Group.

to our

shareholders

and investors

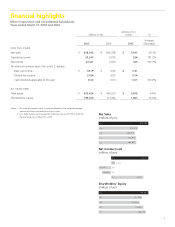

Record high sales and net income

Three key achievements led to the signifi cantly

improved results for the Nikon Group. First, we

boosted our sales in expanding markets by devel-

oping competitive new products and conducting

aggressive marketing campaigns. The results were

particularly good in digital cameras and LCD expo-

sure systems. Second, we focused on improving

our fi nancial position by cutting inventory levels

and squeezing trade receivables, which allowed us

to reduce debt levels. Third, we reformed our busi-

ness processes and systems to make our operations

capable of swifter and more-effective responses to

rapidly changing market conditions.

The effects of these changes are manifested

in our top and bottom lines. On a consolidated

basis, net sales advanced 26.1% year-on-year to

¥638,468 million. Operating income was ¥30,545

million, which represented more than a sevenfold

gain compared with the previous year. Special gains

included a US$145 million (¥15,879 million) legal

settlement related to a patent dispute with ASML

Holding N.V. and others. Net income rose by a fac-

tor of ten to ¥24,141 million. The net sales and net

income fi gures both marked new record highs.

The key operating results in our core busi-

nesses are summarized below. Please refer to the

separate sections in the Review of Operations for

further details.

• Precision equipment: Sales rose 35.6% to

¥214,326 million due to growth in sales of IC

and LCD steppers. Operating income improved

substantially, recovering to ¥11,387 million

from a prior-year loss of ¥20,806 million.

• Imaging products: Strong sales of the Nikon

D70 digital SLR camera lifted total sales,

which increased 24.9% to ¥355,489 mil-

lion, but savage price erosion in the digital

compact sector squeezed overall margins,

resulting in a 33.2% year-on-year fall in

operating income to ¥16,841 million.

• Instruments: Although sales of biological

microscopes were fl at, growth in indus-

trial microscopes, measuring instruments

and semiconductor inspection equipment

pushed overall sales up to ¥52,184 million,

a gain of 8.7% compared with the previ-

ous year. Operating income rose 5.3% to

¥2,826 million.

• Other businesses: Sales gained 11.6% to

¥44,253 million; operating loss shrank

signifi cantly to ¥647 million, an improve-

ment of ¥2,585 million compared with the

previous year.

The business segment analysis confi rms that

there remain a signifi cant number of issues that

we must address – despite the fact that profi t-

ability improved dramatically at the consolidated

level. To put it another way, we see considerable

scope for further gains in earnings.

Engineering gains in profi tability along

with stable growth

Nikon Group profi ts are currently supported on

two main pillars: the precision equipment busi-

ness and the imaging products business. To use a

transport analogy, we are driving a two-wheeler.

Over the medium and long term, our aim is to

make growth more stable by converting this

vehicle to three and, ultimately, to four wheels.

We see this task as the prime strategic directive

of our new senior management team.

Stepper roadmap clarifi ed with the advent

of immersion technology

Our fi rst objective is to make the current two-

wheeler run better. In the precision equipment

business, the key to long-term growth is to estab-

lish Nikon as the clear technological leader. During

the year we conducted on-site tests of our new

immersion scanner technology with the help of

customers. These confi rmed Nikon‘s superiority in

the industry in bringing to market the next genera-

tion of technology. Immersion techniques extend

the limits of ArF excimer scanners, raising lens res-

olution to unprecedented levels (with N.A. values

above 1.0). Moreover, we also have a clear road-

map as we develop EUVL, which will take us into

yet another generation. In LCD exposure systems,

our proprietary multi-lens scanning technology has

a huge technical advantage because it comes into

its own as LCD panels increase in size. Our latest

LCD exposure systems are designed for 7th and

8th generation LCD manufacturing processes, and

we expect sales of these models to expand rapidly.

We expect to be profi table in this fi scal year, which

ends in March 2006, despite the fact that it will

likely mark the bottom of the current silicon cycle.

From 2006-7 onward we expect to generate sig-

nifi cant growth from stepper operations.

2