Neiman Marcus 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

appropriate to prevent dilution or enlargement of rights.

2. Grant of Options. Pursuant to, and subject to, the terms and conditions set forth herein and in the Plan, the Company hereby restates the

prior grant to the Participant of a Fair Value Option with respect to ( ) shares of Common Stock of the Company and a Performance Option with respect to

( ) shares of Common Stock of the Company, such that the total number of shares of Common Stock of the Company granted to the

Participant hereunder as a Non-Qualified Stock Option is ( ) shares (the “Option”).

3. Grant Date. The Grant Date of the Performance Option is December 15, 2009 and the Grant Date of the Fair Value Option is October 6,

2005.

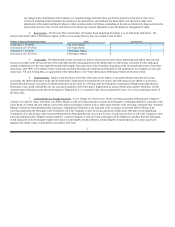

4. Exercise Price.

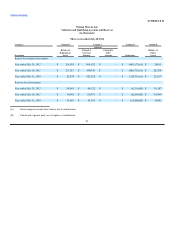

(a) The Exercise Price of each share of Common Stock underlying the Option is as set forth in the table below.

Number of Shares Underlying the Option Type Exercise Price

[Shares vested as of March 28, 2012] Fair Value Option $1,227.50

[Shares unvested as of March 28, 2012] Fair Value Option N/A

[Shares vested as of March 28, 2012] Performance Option $992.50

[Shares unvested as of March 28, 2012] Performance Option $775.00

(b) The portion of the Option that is a Performance Option will have an Accreting Exercise Price that shall increase at a 10.00% compound rate

on each anniversary of the Grant Date of such Performance Option until the earlier to occur of (i) the exercise of the Option, (ii) the fourth anniversary of the

Grant Date of such Performance Option, or (iii) the occurrence of a Change of Control of the Company; provided, however, that the Exercise Price shall cease

to increase as provided herein on a portion of the outstanding Performance Option following the sale by the Majority Stockholder of shares of Common Stock

as follows: the pro rata portion of the Performance Option held by a Participant with respect to which the Exercise Price shall cease to increase shall be the

portion of the Performance Option that bears the same ratio to the total Performance Option held by a Participant as the total number of shares of Common

Stock sold by the Majority Stockholder bears to the total number of shares of Common Stock owned by the Majority Stockholder immediately prior to such

sale.

5. Vesting Date.

(a) The Fair Value Option shall become exercisable as follows: 20% of the shares underlying such Fair Value Option shall vest and become

exercisable on the first anniversary of the Grant Date of such Fair Value Option and the remaining portion of the Fair Value Option shall vest and become

exercisable in forty-eight (48) equal monthly installments over the forty-eight (48) months following the first anniversary of the Grant Date of such Fair Value

Option, beginning on the one-month anniversary of such first anniversary, until 100% of the Fair Value Option is fully vested

2