Neiman Marcus 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

· Section 4.13(e) will be amended and restated to read as follows: Other Changes. In the event of any change in the capitalization of the

Company or a corporate change other than those specifically referred to in Sections 4.13(a), (b) or (c) hereof, including without limitation

the payment of an extraordinary cash dividend, the Board shall, in its discretion, make such adjustments in the number and kind of

shares or other securities subject to Options outstanding on the date on which such change occurs and in the per-share Exercise Price of

each such Option as the Board may consider appropriate to prevent dilution or enlargement of rights.

4. Exercise Price.

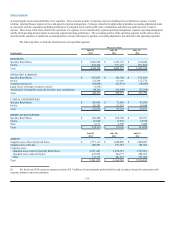

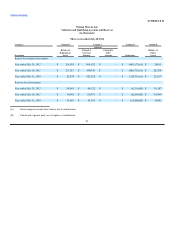

(a) The Exercise Price of each share of Common Stock underlying the Option is as set forth in the table below.

Number of Shares Underlying the Option Type Exercise Price

7,269.3851 Fair Value Option $1,227.50

472.3333

[Shares vested as of March 28, 2012] Performance Option $992.50

2,479.74666

[Shares unvested as of March 28, 2012] Performance Option $775.00

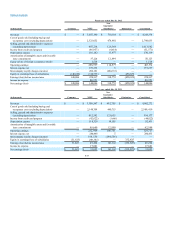

(b) The portion of the Option that is a Performance Option shall have an Accreting Exercise Price that shall increase at a 10.00% compound

rate on December 15, 2010 and each December 15 thereafter until the earlier to occur of (i) the exercise of the Option, (ii) December 15, 2013, or (iii) the

occurrence of a Change of Control of the Company; provided, however, that the Exercise Price shall cease to increase as provided herein on a portion of the

outstanding Performance Option following the sale by the Majority Stockholder of shares of Common Stock as follows: the pro rata portion of the

Performance Option held by a Participant with respect to which the Exercise Price shall cease to increase shall be the portion of the Performance Option that

bears the same ratio to the total Performance Option held by a Participant as the total number of shares of Common Stock sold by the Majority Stockholder

bears to the total number of shares of Common Stock owned by the Majority Stockholder immediately prior to such sale.

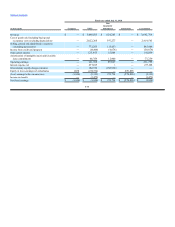

5. Exercise Dates. Except as otherwise provided herein, the Option shall become exercisable as follows:

(a) Fair Value Option Grant. The Fair Value Option Grant is fully and immediately exercisable.

(b) Performance Option Grant. A portion of the Performance Option Grant with respect to 1,417 shares of Common Stock shall become

exercisable December 15, 2010 and the remaining portion of the Performance Option shall become exercisable in thirty-six (36) equal monthly installments

over the thirty-six (36) months following December 15, 2010, beginning on January 15, 2011, until 100% of the Performance Option is fully exercisable;

provided that the Performance Option shall become fully exercisable on a Change of Control.

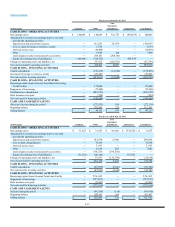

(c) Forfeiture of Option. Should the Participant’s employment be terminated for Cause, the unexercised portion of the Option, whether or not

then exercisable, shall be immediately forfeited.

2