Napa Auto Parts 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are pleased to report that Genuine Parts Company achieved

another record level of sales and earnings in 2006.

Total sales for 2006 rose to $10.5 billion, an increase of 7% com-

pared to 2005, and our first year to surpass the $10 billion revenue

milestone. is is a significant achievement for the GPC team!

Our progress in 2006 follows 8% increases in revenues in both 2004

and 2005 and we remain encouraged by the positive trend in total

sales growth for the Company. Net earnings for the year were $475

million, an increase of 9% compared to 2005, and earnings per share

were $2.76, up 10%. 2006 represents our third consecutive year of

double-digit growth in earnings per share.

With another record year behind us, we have now increased sales in 56

of the last 57 years and increased profits in 44 of the last 46 years. We

are proud of this record and we feel that it reflects our unending com-

mitment to steady and consistent growth at Genuine Parts Company.

Financial Strength

Ongoing asset management initiatives and the continued generation

of consistent and strong cash flows helped to further strengthen our

financial condition in 2006. Our year-end ratio of current assets to

current liabilities was 3.2 to 1 and working capital as a percentage of

sales improved for the third consecutive year to 25%. Cash flow from

operations was consistent with last year at $434 million and, after

deducting dividends and capital expenditures, we generated positive

free cash flow of $79 million. At December 31, 2006, our total debt

was $500 million, which was unchanged from the prior year.

During 2006, we used our cash to repurchase 2.9 million shares of

our Company stock. We continue to view this as a good use of cash

and, at our August 2006 Board meeting, our Directors authorized

an additional 15 million shares for repurchase. As of December 31,

2006, we have 15.3 million shares available for repurchase under

our current program. We will continue to make opportunistic share

repurchases in 2007. We also invested $126 million in capital expen-

ditures in our businesses and we returned $228 million to shareholders

through dividends paid in 2006.

Dividends

e Company has paid a cash dividend to shareholders every year

since going public in 1948, and in 2006 we improved our dividend

by 8% to $1.35 per share, representing our 50th consecutive year

of increases. e Board of Directors, at its meeting on February 19,

2007, raised the cash dividend payable April 2, 2007 by 8% to an

annual rate of $1.46 per share, or 53% of our 2006 earnings. 2007

will be our 51st consecutive year of increased dividends paid to our

shareholders.

Progress In Operations

Again in 2006, each of our four business segments contributed to

our overall progress for the year. Motion Industries, our Industrial

Distribution company, reported very strong results, with its sales

increasing 11% for the third consecutive year. Looking ahead to

2007, the outlook for the industrial markets served by Motion is

promising. e manufacturing sector of the economy, as measured

by the Industrial Production and Manufacturer Capacity Utilization

indices, remains healthy and customer demand is likely to provide

us further growth opportunities. EIS, our Electrical/Electronic

segment, also benefited from the strength in the manufacturing

sector and, in 2006, reported a 20% increase in sales for the year.

We expect 2007 to be another good year for EIS.

S.P. Richards, our Office Products company, improved sales by 7%

for the year, and this follows an 8% increase in sales in 2005. e

Office Products Group generates consistent and steady results and we

are encouraged by its performance in 2006. is year’s solid progress

reflects our product and customer expansion efforts and the continued

development of effective marketing programs and dealer services. In

2007, we expect these initiatives, combined with the ongoing growth

in Gross Domestic Product (GDP) and white-collar employment, to

drive additional progress for the Office Products Group.

e Automotive Parts Group, our largest business group, increased

sales by 3% in 2006, following 6% increases in 2004 and 2005. Core

NAPA operations, which excludes our Johnson Industries subsidiary,

improved revenues by 5%, so the progress made in our ongoing

Automotive operations was somewhat offset by our decision in 2005

to downsize the operations at Johnson Industries. We continue to

believe this was the right decision for the Company. Looking ahead,

we expect our Automotive growth initiatives to position the group for

solid progress in 2007 and beyond. In addition, market factors such

as total vehicles on the road, the age and mix of the vehicles and miles

driven, remain positive for the industry and they create excellent

growth opportunities for the Automotive Parts Group.

GPC Directors

e GPC Board, at its meeting in November 2006, elected George C.

“Jack” Guynn as a new Director. Mr. Guynn is the retired President

and Chief Executive Officer of the Federal Reserve Bank of Atlanta.

Jack is an experienced and successful executive and we are pleased to

have him joining our Board. We look forward to his contributions in

the years ahead. We are asking the shareholders to elect Jack, along

with all other Directors, at the April 23, 2007 Shareholders’ Meeting.

Management

During 2006, there were a number of management changes and

promotions that we would like to share with you. G. omas Braswell,

our Senior Vice President – Information Technology, retired from the

Company in February 2007. Tom’s impressive career at Genuine Parts

Company spans over 40 years and the Company has benefited greatly

To our

Shareholders

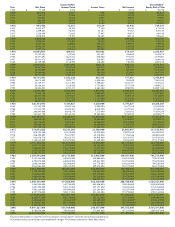

Date amount oneShareBecame

march1959 100% 2ShareS

april1962 200% 6ShareS

DecemBer1967 50% 9ShareS

may1970 50% 13.5ShareS

may1972 100% 27ShareS

april1979 50% 40.5ShareS

april1984 50% 60.75ShareS

may1987 50% 91.125ShareS

april1992 50% 136.69ShareS

april1997 50% 205.04ShareS

Summary of Stock Dividends

4