Mitsubishi 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We're connected !

We're connected!

2

I am pleased to report that the determined and fo-

cused efforts of everyone at MMC and group compa-

nies, as well as the unwavering support of our share-

holders and customers, enabled us to meet the ma-

jority of the restructuring and reform targets in the

RM2001 management plan initiated in 1998.

The Company of which you are part owner is

now leaner, more responsive, more efficient, more

competitive and less burdened by debt −this the re-

sult of the restructuring and other reforms. We are

ready to reach further, faster, and more competitively

in both passenger car and

commercial vehicle segments

−aided in this by equity and

operating alliances formed re-

cently with two powerful allies:

DaimlerChrysler and AB Volvo.

In other words, we are now in a

position to seek the growth that

will add value to the Company,

create added value for our

shareholders and employees, and deliver enhanced

value to our customers.

If there is one fact of life I have been keenly

aware of over the last two years, it is that the auto

business is a moving target! We must constantly seek

to transform and evolve into a stronger, more com-

petitive enterprise. We simply cannot afford to stand

still or fail to seek greater efficiencies.

The paradox I face as I write this letter to you to-

day is that of MMC having achieved so much this

past year, only for those achievements to fail to be

fully reflected in the bottom line. Although thwarted

in our task of generating the acceptable level of net

profit and restoration of dividend that were targets

for fiscal 1999, I can confidently say that we have

turned the corner and now are well on the road to re-

covery that we embarked upon three years ago. The

reforms are kicking in; "making it work, making it

pay." Now we can start to harvest the rewards as we

complete our metamorphosis into a stronger, healthi-

er and so much more competitive player.

The juice is there. The partners are there. The in-

formation and communications infrastructure so vital

today is there and being upgraded all the time. Yes, I

can report to you with confidence that "we're con-

nected!"

In fiscal 1999, the continuing lethargy in the

Japanese economy saw firm minicar sales countered

by depressed sales in other passenger car categories,

while truck and bus sales

plunged to historical lows.

Exports were lower, owing both

to increased local production at

overseas facilities and to the

stronger Yen.

MMC increased its sales

volume in North America,

Europe and Asia, while concert-

ed cost reduction and other

group-wide efforts exceeded expectations in improv-

ing the financial standing of MMC companies. A

drop in export shipments to markets in the Middle

East and to Central and South America and the

strengthening Yen cast a shadow on these bright

spots.

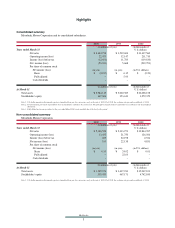

In its consolidated operations, MMC reported

sales income of ¥3,335 billion, 5.1% down over fis-

cal 1998, owing primarily to a small drop in sales

volume and to the stronger Yen. The Company re-

ported an operating profit of ¥22.5 billion, an ordi-

nary loss of ¥3.8 billion, and a net loss for the year

of ¥23.3 billion; all down over the previous year.

Cash flows from operating activities were up, while

cash flows from acquisition or disposal of tangible

assets and other investing activities decreased. Cash

flows relating to financial service activities were

down. Total cash flows decreased by ¥33.7 billion.