Mercury Insurance 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Insurance rates in Georgia, New York, New Jersey, Pennsylvania, and Nevada require prior approval from

the state DOI, while insurance rates in Illinois, Texas, Virginia, Arizona, and Michigan must only be filed with

the respective DOI before they are implemented. Oklahoma and Florida have a modified version of prior

approval laws. In all states, the insurance code provides that rates must not be excessive, inadequate, or unfairly

discriminatory.

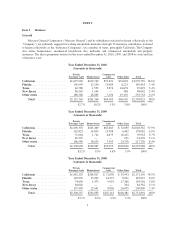

The DOI in each state in which the Company operates is responsible for conducting periodic financial and

market conduct examinations of the Insurance Companies in their states. Market conduct examinations typically

review compliance with insurance statutes and regulations with respect to rating, underwriting, claims handling,

billing, and other practices. The following table presents a summary of current financial and market conduct

examinations:

State Exam Type Period Under Review Status

OK Financial 2008 to 2010 Fieldwork will begin in the first quarter of 2011.

OK Market Conduct 2007 to 2009 Fieldwork will begin in the first quarter of 2011.

CA Financial 2008 to 2010 Fieldwork began on January 31, 2011.

FL Financial 2005 to 2009 Received final report on February 4, 2011.

TX Financial 2005 to 2009 Received final report draft on December 20, 2010.

TX Market Conduct Mar 2009 to Feb 2010 Received final report on September 29, 2010.

IL Market Conduct Jul 2009 to Jun 2010 Fieldwork completed. Awaiting final report.

IL Financial 2005 to 2009 Fieldwork began on August 30, 2010.

During the course of and at the conclusion of these examinations, the examining DOI generally reports

findings to the Company, and none of the findings reported to date is expected to be material to the Company’s

financial position.

For discussion of current regulatory matters in California, see “Regulatory and Legal Matters” in “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The operations of the Company are dependent on the laws of the states in which it does business and

changes in those laws can materially affect the revenue and expenses of the Company. The Company retains its

own legislative advocates in California. The Company made financial contributions of $133,350 and $148,200 to

officeholders and candidates in 2010 and 2009, respectively. The Company believes in supporting the political

process and intends to continue to make such contributions in amounts which it determines to be appropriate.

The Company supported the Continuous Coverage Auto Insurance Discount Act (“Proposition 17”), a

California initiative on the June 2010 ballot which did not pass. It would have provided for a portable persistency

discount, allowing insurance companies to offer new customers discounts based on having continuous insurance

coverage from any insurance company. Currently, the California DOI allows insurance companies to provide

persistency discounts based on continuous coverage only with existing customers. The Company made financial

contributions of $12.1 million and $3.5 million in 2010 and 2009, respectively, related to this initiative. The

Company continues to offer a competitive product in California.

Risk-Based Capital

The Insurance Companies must comply with minimum capital requirements under applicable state laws and

regulations, and must have adequate reserves for claims. The minimum statutory capital requirements differ by

state and are generally based on balances established by statute, a percentage of annualized premiums, a

percentage of annualized loss, or risk-based capital (“RBC”) requirements. The RBC requirements are based on

guidelines established by the NAIC. The RBC formula was designed to capture the widely varying elements of

risks undertaken by writers of different lines of insurance having differing risk characteristics, as well as writers

11