Mattel 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Mattel, Inc. and Subsidiaries

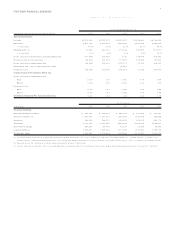

In the fourth quarter of 1 99 9, Mattel adjusted its restructuring and integra-

tion plan and other nonrecurring charges, resulting in a net reduction of approximately

$3 million. The credits to the restructuring plan of approximately $2 6 million were

mainly due to Mattel’s recent decision not to close certain of its marketing offices and

one of its manufacturing facilities. The remaining credits include other changes in

estimates and lower than anticipated costs compared to the previous estimates for

completed components of the plan. Approximately 90 0 employees will not be termi-

nated as a result of these changes.

The fourth quarter restructuring charge of approximately $1 8 million relates to

the termination of an additional 15 0 Learning Company employees at its domestic offices.

This action was taken to further consolidate the operations of Learning Company’s

domestic offices. The fourth quarter other nonrecurring charge relates to a $ 4.0 mil-

lion increase to the reserve for the October 1 99 8 recall of Mattel’s Power Wheels®

vehicles and a $ 1.1 million additional charge related to the Toys R Us-related antitrust

litigation settlement.

A description of the components of the restructuring and other nonrecurring

charges is as follows:

Severance and other compensation costs relate to the termination of

approximately 3,3 00 employees around the world. Approximately 2,30 0 of these

employees are hourly workers located in certain of Mattel’s manufacturing facilities,

of which approximately 2,2 00 were employed in the manufacturing facility in Kuala

Lumpur, which ceased operations in September 1999. The remainder of the w ork

force reductions consist of downsizing sales and marketing groups in the US, Europe

and Asia-Pacific regions as well as the elimination of duplicate administrative person-

nel following the consolidation of back-office functions, the majority of which are in

Europe. As of December 31 , 199 9, approximately $3 0 million had been paid to

nearly 2,7 00 terminated employees. Cash severance payments will extend beyond

the completion of the workforce reductions due to the severance payment options avail-

able to affected employees.

Mattel terminated its sponsorship agreements related to certain attractions

for a total cost of $37.5 million, inclusive of the writeoff of related capitalized

costs. The cash portion of this charge was paid as of July 1999. Mattel also recog-

nized a $ 17 .5 million charge, mainly related to settlements for termination of cer-

tain foreign distributor agreements in conjunction with the realignment of its sales

and distribution network.

Mattel’s restructuring plan resulted in the impairment of certain long-lived

assets related to the operations being closed. The sum of the undiscounted future

cash flows of these assets was not sufficient to cover the carrying amount of these

assets. As a result, these long-lived assets were written down to fair market value

and will be depreciated over their remaining useful lives. Fair value of the impaired

assets was determined by either third-party appraisals or past experience in disposing

of similar assets. Buildings and, to the extent possible, equipment will be sold while

the remainder of the impaired assets w ill be abandoned when taken out of service.

Nearly all of the revenue-generating activities related to these assets will continue as

a result of more effective utilization of other assets. A significant portion of the fixed

asset w ritedowns is concentrated in the Operations and Learning Company segments.

In addition, other asset writeoffs include approximately $1 0 million of goodwill related

to a recently acquired software business, which was closed following the merger with

Learning Company.

Lease termination costs include penalties imposed upon canceling existing

leases and future obligations under long-term rental agreements at facilities being

vacated following the merger and realignment.

Merger-related transaction costs consist of investment banking fees, legal,

accounting and printing costs, registration fees and other costs recognized in connec-

tion with the merger. Also included in this amount are the contractual change of con-

trol payments arising from the merger. The majority of all merger-related transaction

costs were paid during the second quarter of 1 99 9.

Other nonrecurring charges principally include an additional $2 0.0 million related

to the October 1 99 8 recall of Mattel’s Power Wheels®vehicles and $ 14 .0 million for envi-

ronmental remediation costs related to a manufacturing facility on a leased property in

Beaverton, Oregon, based on the completion and approval of the remediation plan and

feasibility study.

Mattel is currently undertaking a comprehensive review of its entire interactive

business to identify additional opportunities to improve operating productivity and realize

costs savings. Following this review, Mattel expects to incur pre-tax reorganizational

charges totaling approximately $7 5 million to $1 00 million in the first quarter of 2 00 0.

These charges are designed to streamline the infrastructure, product development cycle

and operations of Mattel Interactive. Additionally, compensation expense of approximately

$5 0 million, including forgiveness of certain executive loans, will be incurred in the first

quarter of 20 00 related to the recent departure of certain senior executives.

Litigation

Power Wheels®Recall and Related Matters

On October 2 2, 1 998, Mattel announced that Fisher-Price, in cooperation with the

Consumer Product Safety Commission, would conduct a voluntary recall involving up to

10 million battery-powered Power Wheels®ride-on vehicles. The recall did not result

from any serious injury, and involves the replacement of electronic components that

may overheat, particularly when consumers make alterations to the product. The

recall involves vehicles sold nationwide since 1 98 4 under nearly 10 0 model names.

Additionally, Fisher-Price has been notified by the Consumer Product Safety Commission

that the Commission is considering whether Fisher-Price may be subject to a fine for

delayed reporting of the facts underlying the recall.

In the third quarter of 1 99 8, Mattel recognized a $3 8.0 million pre-tax

charge related to the recall. During the second and fourth quarters of 19 99 , Mattel

recognized additional pre-tax charges totaling $2 0.0 million related to the recall.

Greenwald Litigation and Related Matters

On October 1 3, 1 995, Michelle Greenwald filed a complaint ( Case No. YC 02 5 00 8)

against Mattel in Superior Court of the State of California, County of Los Angeles.

Ms. Greenwald is a former employee whom Mattel terminated in July 1 99 5. Her

complaint sought $5 0 million in general and special damages, plus punitive damages,

for breach of oral, written and implied contract, wrongful termination in violation of

public policy and violation of California Labor Code Section 9 70 . Ms. Greenwald

claimed that her termination resulted from complaints she made to management con-

cerning general allegations that Mattel did not account properly for sales and certain

costs associated with sales and more specific allegations that Mattel failed to account

properly for certain royalty obligations to The Walt Disney Company. On December 5,

19 96 , Mattel’s motion for summary adjudication of Ms. Greenwald’s public policy claim

was granted. On March 7, 19 97 , Mattel filed a motion for summary judgment on the

remaining causes of action. On December 9 , 19 97 , Mattel’s motion for summary

judgment of Ms. Greenw ald’s remaining claims was granted. On February 4, 19 98 ,

Ms. Greenwald appealed from the dismissal of her suit. The appeal has been fully

briefed, and a hearing took place on March 3, 20 00 . Mattel intends to continue to

defend the action vigorously, including the appeal.