Mattel 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Mattel, Inc. and Subsidiaries

Results of Operations

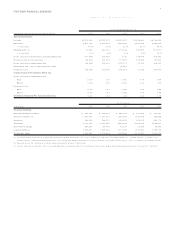

The following is a percentage analysis of operating results for the past three years:

For the Year

19 9 9 1 9 9 8 1 9 97

Net sales 10 0 .0 % 10 0 .0 % 10 0 .0 %

Gross profit 47 .2 % 51 .8 % 51 .7 %

Advertising and promotion expenses 17 .2 16 .3 15 .5

Other selling and administrative expenses 21 .6 20 .3 18 .6

Amortization of intangibles 1.7 2.3 8.9

Restructuring and other charges 6.3 2.8 6.3

Charge for incomplete technology – 1.0 0.4

Other income, net ( 0 .3) ( 0 .2) ( 0 .1)

Operating profit 0.7 9.3 2.1

Interest expense 2.7 2.3 2.1

Income ( loss) before income taxes and extraordinary item ( 2 .0) % 7.0 % – %

1999 Compared to 1998

Consolidated Results

Net loss for 1 99 9 w as $ 82 .4 million or $0 .21 per diluted share as compared to net

income of $2 06 .1 million or $0 .47 per diluted share in 1998. The 19 99 results

were negatively impacted by restructuring and other charges totaling $3 46 .0 million,

approximately $2 65 million after-tax or $0 .64 per diluted share, related to the

Mattel restructuring plan, the merger and integration of Learning Company, and other

nonrecurring charges. Additionally, Mattel’s 19 99 results were negatively impacted by

the results of operations of its Learning Company division, which reported a pre-tax loss

of $2 05 .5 million for the full year 19 99 . The 1 998 results of operations were nega-

tively impacted by nonrecurring charges, including an incomplete technology writeoff of

$5 6.8 million related to the acquisition of Mindscape, Inc. in March 19 98 , restructuring

and other charges of $1 13 .3 million related to 19 98 acquisitions and one-time charges

of $4 4.0 million in connection with the voluntary recall of Pow er Wheels®ride-on

vehicles and a Toys R Us-related antitrust litigation settlement. Total 19 98 nonrecurring

charges of approximately $1 63 million after-tax impacted the earnings by $0 .39 per

diluted share.

The negative results of the Learning Company division in 19 99 were attribut-

able to a number of factors. In 1 99 9, Learning Company experienced a decrease in

sales of CD-ROM products at retail and a higher proportion of sales of relatively low er

priced and lower margin products. During the second half of 1999, Learning

Company was in the process of revising its distribution channel arrangements. These

changes in distribution terms combined with the general weakness in the CD-ROM

market resulted in increased product returns. Significant price and promotional com-

petition caused the Learning Company division to incur higher than anticipated price

concessions and marketing expenses, including increased use of rebate programs,

price protection and advertising. In addition, increased bad debt reserves of approxi-

mately $5 6 million, including $3 5 million related to one of Learning Company’s major

distributors, contributed to its operating loss.

In 2 00 0, Mattel will attempt to improve the results of its Learning Company

division by reducing the number of software products it develops and sells, decreasing

the length of its software product development cycle and eliminating a number of its

lower margin software titles. In addition, Mattel has implemented a more strict sales

control policy with its distributors and retailers and plans to decrease the use of rebates

to consumers and price and marketing concessions to distributors and retailers. Mattel

intends to focus on areas w here potential growth opportunities exist, including expan-

sion of its interactive products to new platforms such as game consoles and the

Internet, as well as increased sales in the international markets. Mattel also plans to

continue its strategy of creating stand-alone on-line ventures utilizing Learning

Company assets, such as Genealogy.com, LLC and GoodHome, LLC, in which Mattel

retains an equity interest, and will consider strategic dispositions, licensing agreements

and other similar transactions. In 1 99 9 and 20 00 , Mattel replaced the senior man-

agement at its Learning Company division. There can be no assurance that the

Learning Company division’s results w ill improve as a result of Mattel’s efforts.

Mattel is also currently undertaking a comprehensive review of its entire

interactive business to identify additional opportunities to improve operating productiv-

ity and realize costs savings. Following this review, Mattel expects to incur pre-tax

reorganizational charges totaling approximately $7 5 million to $1 00 million in the

first quarter of 20 00. These charges are designed to streamline the infrastructure,

product development cycle and operations of Mattel Interactive.

Net sales for 1 99 9 w ere $ 5.5 billion, a decrease of 2% from $5.6 billion in

19 98 . Sales to customers within the US remained relatively flat and accounted for

72 % and 71% of consolidated net sales in 19 99 and 1 99 8, respectively. Sales to

customers outside the US were down 6%, including an unfavorable foreign exchange

effect of approximately $2 2 million due to the generally stronger US dollar relative to

19 98 . At comparable foreign exchange rates, sales internationally declined by 4 %,

partially due to unfavorable industry-wide trends, especially the shift amongst

European retailers to just-in-time inventory management. Mattel plans to grow its

international business by adapting products to local tastes, economic conditions and

price requirements. To accomplish this goal, Mattel continues to work on an exten-

sive market-specific strategy aimed at improving sales of its core product lines in inter-

national markets. In addition, Mattel’s September 19 99 distribution agreement w ith

Bandai Co. Ltd. ( “ Bandai” ), the largest toy company in Japan, to distribute certain

Mattel products in Japan is also part of Mattel’s strategy for international growth and

market penetration.

Sales in the Girls category decreased 3% largely due to declines in Barbie®

and Cabbage Patch Kids®products, partially offset by incremental sales of American

Girl®products resulting from the Pleasant Company acquisition. Pleasant Company

was acquired in July 1 99 8 and therefore the results of operations for 19 98 only

reflect six months of results. Sales in the Infant and Preschool category declined 3 %,

largely attributable to last year’s success of Sesame Street®products, including ‘ Tickle

Me Elmo’ and decreased sales of Disney’s Winnie the Pooh®products, partially offset

by an increase in sales of core Fisher-Price®and Power Wheels®products. Sales in

the Wheels category grew 6%, demonstrating continued strength in Hot Wheels®,

Matchbox®, and Tyco®Radio Control. Sales in the Entertainment category, including

Disney and Nickelodeon®, increased 1 1% largely due to this year’s success of toys

associated with Disney’s feature motion picture ‘ ’ Toy Story 2’’ . Sales of Learning

Company consumer software products decreased 8 %, mainly due to a decrease in

sales of CD-ROM products at retail and a higher proportion of sales of relatively low er

priced and lower margin products. This decrease w as partially offset by an increase

in licensing revenues of approximately $5 0 million largely generated from licensing

agreements, including Genealogy.com, LLC in the third quarter of 1 99 9 and

GoodHome, LLC in the second quarter of 1 99 9. Mattel views e-commerce and licens-

ing transactions to be a significant source of potential revenues for its Learning

Company division and intends to continue to attempt to leverage the value of its

Internet properties through joint ventures, licensing and other similar transactions.