Mattel 1999 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Mattel, Inc. and Subsidiaries

approximately 0.6 million Mattel common shares. In addition, each share of Tyco

Series B and Series C preferred stock was converted into like Mattel preferred stock.

Learning Company also merged with Palladium Interactive, Inc. and P.F. Magic,

Inc. in 1 99 8 and TEC Direct, Inc., Microsystems Software, Inc., Skills Bank Corporation

and Learning Company Services, Inc. in 1 99 7, each of which were accounted for as

poolings of interests. The consolidated financial statements have not been retroactively

restated for the results of operations and financial position of these companies as the

effect of each acqusition individually and in the aggregate on Learning Company’s bal-

ance sheet and results of operations was less than three percent.

Acquisitions

Mattel and Learning Company acquired the following companies during the years

ended December 3 1, 19 98 and 19 97 . Each of these acquisitions was accounted for

using the purchase method of accounting. The results of operations of the acquired

companies have been included in Mattel’s consolidated financial statements from their

respective dates of acquisition. Intercompany accounts and transactions betw een the

acquired companies and Mattel, as applicable, have been eliminated.

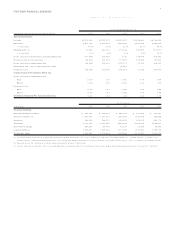

( Assets) /

Method of Liabilities Incomplete

( In millions) Month Price Payment Assumed Intangibles Technology

1998

Pleasant Company July $71 5 .0 Cash $( 25 .0 ) $6 9 0 .0 $ –

Bluebird Toys PLC June 80 .0 Cash ( 2 0 .0) 60 .0 –

Sofsource, Inc. June 45 .0 Stock 6.7 36.8 14 .9

Mindscape, Inc. March 15 2 .6 Cash/ stock 6.4 11 9 .0 40.0

1997

Creative Wonders, L.L.C. October $ 37.8 Cash $ 7.3 $ 44.0 $ 1.1

Parsons Technology August 31 .0 Cash ( 1 1 .7) 9.3 10 .0

The acquisition price includes investment advisor and other directly-related

expenses as applicable. The portion of the purchase price allocated to incomplete

technology was charged to expense in the year of acquisition.

Mattel also made other minor acquisitions during the last three years w hich were

accounted for using the purchase method. These acquisitions resulted in the issuance of 0.4

million shares of common stock in the year ended December 31 , 1997.

New Venture

In the third quarter of 1 99 9, Mattel executed stock purchase and distribution agree-

ments with Bandai, the largest toy company in Japan. In the purchase agreement,

Mattel acquired approximately five percent of the outstanding common stock of

Bandai. The distribution agreements allow Bandai to distribute certain Mattel prod-

ucts in Japan, while Mattel was granted the right to distribute certain Bandai products

in Latin America. Mattel and Bandai will discuss other distribution opportunities in the

US on a case-by-case basis.

Restructuring and Other Charges

In 1 99 9 Mattel incurred restructuring and other nonrecurring charges totaling

$3 46 .0 million, approximately $2 65 million after-tax or $0 .64 per diluted share.

During the first quarter of 19 99, Mattel incurred a nonrecurring pre-tax charge

of $3 .9 million, largely related to the restructuring and integration of acquisitions

made by its Learning Company division in the fourth quarter of 1 99 8.

During the second quarter of 19 99 , Mattel completed its merger w ith Learning

Company and finalized a previously announced plan of restructuring and integration.

These actions, along with other one-time events, resulted in a nonrecurring pre-tax

charge against operations of $ 34 5.0 million. In the fourth quarter of 1 99 9, Mattel

incurred an additional $2 3.5 million charge relating to its restructuring and integration

plan and other one-time charges which had previously not met the requirement for

accrual. In addition, Mattel reversed $ 26 .4 million of the second quarter charge based

on lower than anticipated costs and revisions to previous estimates. The impact of

these new developments combined with the initial second quarter charge resulted in a

full year nonrecurring charge of $3 42 .1 million. Of the pre-tax restructuring and inte-

gration charges totaling $3 07 .0 million, approximately $1 32 million was spent in

19 99 , $ 11 1 million is expected to be spent in 2 00 0 and the remaining $6 4 million

represents non-cash charges. Total cash outlay will be funded from existing cash bal-

ances and internally generated cash flows from operations.

The restructuring and integration plan, expected to be substantially complete

by June 2 00 0, provides for the consolidation and realignment of Mattel’s operations.

The plan was aimed at leveraging global resources in areas of manufacturing, market-

ing and distribution, eliminating duplicative functions w orldwide and achieving

improved operating efficiencies. The plan, which w as designed to reduce product

costs and overhead spending and recognize synergy savings, resulted in actual cost

savings of approximately $4 0 million in 1 99 9. Mattel expects savings of at least

$3 50 million over the next three years. The realized cost savings for 1 99 9 and

beyond is lower than the previously estimated savings of approximately $5 0 million

and $ 40 0 million, respectively, largely due to not realizing the revenue synergies

with Learning Company. These savings are net of anticipated incremental integration-

related spending of approximately $1 2 million. This incremental spending includes

approximately $3 million for capital investment at existing manufacturing facilities as

well as network consolidation, and charges for the relocation of employees and move-

ment of equipment, employee transition/ training, and manufacturing start-up costs.

The following are the major restructuring and integration initiatives:

- Consolidation of the Infant and Preschool businesses;

- Consolidation of the domestic and international back-office functions;

- Consolidation of direct marketing operations;

- Realignment of the North American sales force;

- Termination of various international distributor contracts; and

- Closure of three higher cost manufacturing facilities.

Components of the restructuring and other nonrecurring charges, including

related adjustments, are as follows:

Balance

Adjustm ents Total Amounts Dec. 31 ,

( In millions) Plan ( Credits) Charges Charges Incurred 19 9 9

Severance and other compensation $ 1 08 $ ( 13) $ 1 8 $ 1 1 3 $ ( 3 0) $ 8 3

Distributor, license and other

contract terminations 57 ( 2) – 55 ( 4 5 ) 10

Writedown of assets 42 ( 2) – 40 ( 4 0 ) –

Lease termination costs 22 ( 4) – 18 – 1 8

Total restructuring costs and asset w ritedow ns 22 9 (2 1 ) 18 22 6 (1 1 5 ) 111

Merger-related transaction and other costs 86 ( 5 ) – 81 ( 7 6 ) 5

Other nonrecurring charges 30 – 5 35 ( 1 6 ) 19

Total restructuring, asset writedowns

and other charges $3 4 5 $( 26 ) $ 2 3 $342 $ ( 2 0 7 ) $ 1 3 5