Mattel 1999 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1999 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Mattel, Inc. and Subsidiaries

Gross profit, as a percentage of net sales, was 4 7.2% in 1 99 9, down from

51 .8% in 1 99 8, were largely due to lower profit margins at Learning Company.

Excluding the Learning Company division, gross profit was 4 7.8 % in 19 99 , down

1.6 percentage points from 1 99 8 mainly due to overall change in product mix, higher

ocean freight costs and slightly higher product costs due to strengthening currencies

in countries where Mattel manufactures its products. As a percentage of net sales, adver-

tising and promotion expenses increased nearly one percentage point to 17 .2% mainly

as a result of higher rebates offered to consumers on Learning Company products and

increased marketing expenses incurred to promote certain Learning Company titles.

Excluding the Learning Company division, advertising as a percentage of net sales

was 15 .4%, a decrease of 1 .6 percentage points over 1998. Other selling and

administrative expenses increased from 2 0.3% of net sales in 1 99 8 to 21 .6% of

net sales in 1 99 9, primarily due to increased Learning Company bad debt expense.

Amortization of intangibles decreased by $ 37 .8 million, mainly as a result of completed

amortization of intangibles related to certain Learning Company acquisitions, partially

offset by higher amortization resulting from 1 99 8 acquisitions.

Interest expense increased $2 3.1 million, primarily due to increased short-

and long-term borrowings to fund Learning Company’s cash requirements and to

finance Mattel’s 1 99 8 acquisitions.

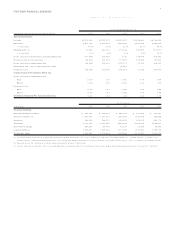

Business Segment Results

Mattel’s reportable segments are separately managed business units and include Toy

Marketing, Consumer Software and Operations. The Toy Marketing segment is divided

on a geographic basis between domestic and international. The domestic Toy Marketing

segment is further divided into USA Toys, US Fisher-Price/ Tyco Preschool and Other.

USA Toys principally sells products in the Girls, Entertainment and Wheels categories.

US Fisher-Price/ Tyco Preschool principally sells products in the Infant and Preschool

categories. The Other segment principally sells specialty products in the Girls category.

The International Toy Marketing segment sells products in all toy categories. The

Consumer Software segment consists of educational, productivity and entertainment

software products developed and sold by Learning Company on a worldwide basis.

The Operations segment manufactures toy products, which are sold to the Toy Marketing

segments. Additional financial information regarding Mattel’s segments can be found

in Note 8 to the consolidated financial statements.

The USA Toys segment sales reached $2 .2 billion, consistent with 19 98 . This

segment achieved these results through increased sales of Barbie®, Entertainment and

Wheels products. The US Fisher-Price/ Tyco Preschool segment sales grew by 4% mainly

due to increased sales of core Fisher-Price®and Power Wheels®products, partially offset

by lower sales of Tyco Preschool products as a result of last year’s success of Sesame

Street®products, including ‘ Tickle Me Elmo’ . Sales in the Other segment increased by

24 % due to incremental sales resulting from the July 199 8 acquisition of Pleasant

Company. The International Toy Marketing segment sales decrease of 7 % w as partially

attributable to the unfavorable foreign exchange effect due to the generally stronger

US dollar relative to 1998 and unfavorable industry-wide trends, especially the shift by

European retailers to just-in-time inventory management. Mattel expects this trend to

continue worldwide. By brand, the International Toy Marketing segment experienced

lower sales of Barbie®and Infant and Preschool products, partially offset by sales

increases in Wheels and Entertainment products. The Consumer Software segment

sales decreased 8%, mainly due to a decrease in sales of CD-ROM products at retail

and a higher proportion of sales of relatively lower priced and lower margin products.

Operating profit in the USA Toys and International Toy Marketing segments

declined by 7% and 28 %, respectively. The decline in operating profit in each of these

segments was largely attributable to lower sales volume and unfavorable shift in product

mix, partially offset by lower advertising costs. The US Fisher-Price/ Tyco Preschool seg-

ment operating profit increased 8%, largely due to a favorable shift in product mix and

lower advertising and overhead spending to support the Fisher-Price®product line. The

Other segment operating profit declined by 7 3%, largely due to incremental amortization

and overhead expenses resulting from the July 19 98 acquisition of Pleasant Company.

The Consumer Software segment realized an operating loss of $2 05 .5 million in 1 99 9

compared to a profit of $1 14 .3 million in 1 99 8. The negative results of the Learning

Company division in 1 99 9 w ere attributable to a number of factors. In 1 99 9, Learning

Company experienced a decrease in sales of CD-ROM products at retail and a higher pro-

portion of sales of relatively low er priced and lower margin products. During the second

half of 19 99 , Learning Company was in the process of revising its distribution channel

arrangements. These changes in distribution terms combined w ith the general weakness

in the CD-ROM market resulted in increased product returns. Significant price and promo-

tional competition caused Learning Company to incur higher than anticipated price conces-

sions and marketing expenses, including increased use of rebate programs, price protec-

tion and advertising. In addition, increased bad debt reserves of approximately $5 6 mil-

lion, including $ 35 million related to one of Learning Company’s major distributors, con-

tributed to its operating loss.

1998 Compared to 1997

Consolidated Results

Net income for 19 98 was $ 20 6.1 million or $ 0.4 7 per diluted share as compared to

a loss of $ 18 2.7 million or $ 0.5 2 per diluted share in 19 97. Profitability for 19 98

was negatively impacted by nonrecurring charges, including an incomplete technology

writeoff of $5 6.8 million related to the acquisition of Mindscape, Inc. in March 19 98 ,

restructuring and other charges of $ 11 3.3 million related to 199 8 acquisitions and

one-time charges of $ 44 .0 million in connection with the voluntary recall of Power

Wheels®ride-on vehicles and a Toys R Us-related antitrust litigation settlement. Total

19 98 nonrecurring charges of approximately $1 63 million after-tax impacted earnings

by $ 0.3 9 per diluted share. Profitability for 19 97 was impacted by restructuring and

other charges of $ 34 3.6 million related to the Mattel restructuring plan, the merger

and integration of Tyco, and other Learning Company merger charges. The 19 97

results also included an incomplete technology writeoff of $20.3 million related to

products being developed by Creative Wonders L.L.C., Parsons Technology Inc., and

Living Books and an extraordinary charge of $4.6 million after-tax for the early retire-

ment of debt assumed as part of the Tyco merger. Total 1 99 7 nonrecurring charges of

approximately $2 86 .2 million after-tax impacted earnings by $ 0.77 per diluted share.

Net sales for 1 99 8 reached $5 .6 billion, an increase of 3% from $5.5 billion

in 199 7. Sales to customers within the US increased 6 % and accounted for 71 % and

69 % of consolidated net sales in 1 99 8 and 1 99 7, respectively. Sales to customers

outside the US were down 4%, including an unfavorable foreign exchange effect due

to the generally stronger US dollar relative to 199 7.

Sales in the Girls category decreased 4% largely due to a 1 4% decline in

Barbie®products, as a result of high retail inventory levels entering 19 98 and domes-

tic toy retailers shift to a just-in-time buying pattern. As a result of the Pleasant

Company acquisition in July 1 99 8, the American Girl®brand contributed $213.2 mil-

lion in sales, which helped to partially offset the decline in Barbie®. Sales in the Infant

and Preschool category decreased 3 %, largely attributable to declines in Sesame Street®

and Fisher-Price®products, partially offset by an increase in Disney’s Winnie the Pooh®.

Sales in the Wheels category grew 21%, reflecting growth in both Hot Wheels®and

Matchbox®vehicles and playsets. Sales in the Entertainment category, which includes