MasterCard 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

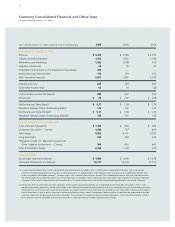

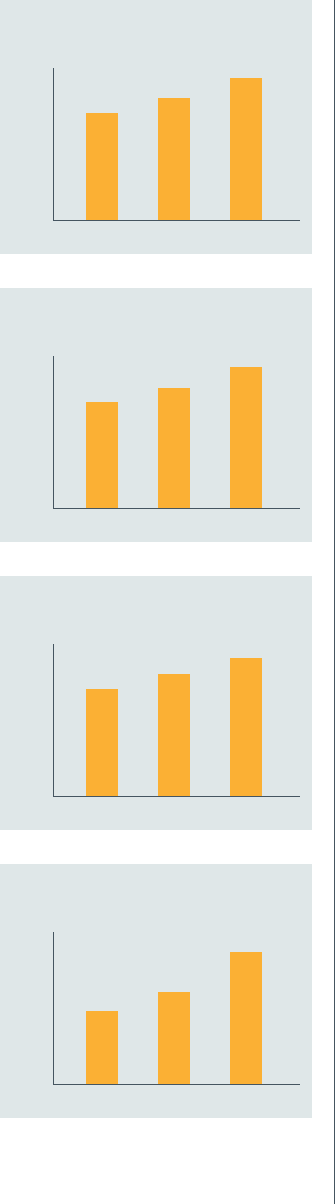

2005 2006

Net Revenue

($ million)

2004

$2,593

$2,938

$3,326

$3,500

2,800

2,100

1,400

700

0

2005 2006

Processed Transactions

(million)

2004

12,152

13,733

16,137

16,500

13,200

9,900

6,600

3,300

0

2005 2006

Gross Dollar Volume

($ billion)

2004

$1,478

$1,690

$1,956

$2,000

1,600

1,200

800

400

0

Accomplishments and Initiatives

The year 2006 saw many signifi cant accomplishments and initiatives, such

as the launch of our new corporate positioning. The name MasterCard

Worldwide embraces what MasterCard represents, from our world-renowned

brands and advanced network, to our unifi ed global structure and our

talented, multinational workforce. Importantly, the name underscores our

commitment to meeting the unique needs of customers worldwide.

To that end, we substantially advanced our strategy by deepening relationships

with target customers around the world. Throughout the year, we shared

industry insights, delivered custom-tailored solutions and provided innovative

payments options, such as MasterCard PayPass® contactless technology and

the World Elite MasterCard.

™ We will continue to demonstrate the value we

bring by leveraging our assets to the advantage of our customers.

In 2006, we also continued to build upon major upgrades to our core

technologies, enabling our customers to connect to a single, unifi ed network

with unsurpassed speed, fl exibility and scale. Through our leading-edge

technology and applications, our customers have the ability to expand

operations worldwide, deliver customized value to partners and cardholders,

and introduce breakthrough technologies without making major changes

to their own infrastructures.

We also strengthened ties with major merchants and launched a number

of signifi cant co-branding programs. To give merchants a stronger voice on

strategic business initiatives that can benefi t them and their customers, we

held Merchant Advisory Group meetings in Australia, Canada, Mexico, South

Africa, the United Kingdom and the United States. In addition, MasterCard

endeavored to meet a key merchant demand to bring greater transparency

to the way we conduct business. Thus in 2006, we became the fi rst payments

company to announce that we would publish our interchange rates that apply

to merchants in the United States, along with comprehensive information

that merchants need to better understand these rates.

At the same time, we continued to address mutually critical security issues.

We co-hosted Payment Card Industry Security Forums in Australia, Japan and

New Zealand; piloted advanced counterfeit card detection systems with retailer

Best Denki in Singapore; and advanced MasterCard SecureCode® as a superior

e-commerce security solution for customers and online merchants. We also

hosted four Global Risk Management Symposia, bringing together bank and

security experts from around the world.

Meanwhile, fi nancial institutions in Europe continue to accommodate the

requirements of the Single Euro Payments Area (SEPA) initiative. In 2006, we

established SEPA fall-back interchange rates for Maestro® that are necessary

for a competitive, transparent payment system across the euro zone. We

believe that Maestro is fi rmly positioned as the solution that will best enable

a smooth transition from national-use-only debit payment schemes to global

and pan-European solutions.

2005 2006

Net Income1

($ million)

2004

$252

$317

$457

$500

400

300

200

100

0