MasterCard 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

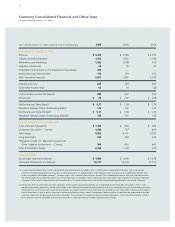

Years Ended December 31 (in millions except per-share and operating data) 2006 2005 2004

Statement of Operations Data

Revenue $ 3,326 $ 2,938 $ 2,593

General and Administrative 1,505 1,352 1,186

Advertising and Marketing 1,052 1,008 916

Litigation Settlements 25 75 22

Charitable Contributions to The MasterCard Foundation 415 — —

Depreciation and Amortization 100 110 122

Total Operating Expenses 3,097 2,545 2,246

Operating Income 229 393 347

Total Other Income (loss) 65 14 (23)

Income before Income Tax Expense 294 407 324

Net Income $ 50 $ 267 $ 238

Net Income per Share (basic)1 $ 0.37 $ 1.98 $ 1.76

Weighted Average Shares Outstanding (basic)1 135 135 135

Net Income per Share (diluted)1 $ 0.37 $ 1.98 $ 1.76

Weighted Average Shares Outstanding (diluted)1 136 135 135

Balance Sheet Data (at period end)

Cash and Cash Equivalents $ 1,185 $ 545 $ 329

Investment Securities — Current 1,299 737 809

Total Assets 5,082 3,701 3,265

Long-Term Debt 230 230 230

Obligations under U.S. Merchant Lawsuit and

Other Litigation Settlements — Current 360 416 469

Total Stockholders’ Equity 2,364 1,169 975

Operating Data

Gross Dollar Volume (in billions) $ 1,956 $ 1,690 $ 1,478

Processed Transactions (in millions)2 16,137 13,733 12,152

(1) As more fully described in Note 2 to the Consolidated Financial Statements included in Item 8 in MasterCard Incorporated’s 2006 Form 10-K, in connection

with the ownership and governance transactions, we reclassified all of our approximately 100 outstanding shares of existing Class A redeemable common stock

so that our previous stockholders received 1.35 shares of our Class B common stock for each share of Class A redeemable common stock that they held prior to

the reclassification and a single share of our Class M common stock. Accordingly, shares and per-share data were retroactively restated in the financial statements

subsequent to the reclassification to reflect the reclassification as if it were effective at the start of the first period being presented in the financial statements.

(2) The data set forth for processed transactions represents all transactions processed by MasterCard, including PIN-based online debit transactions. Prior to 2005,

processed transactions reported by MasterCard included certain MasterCard-branded (excluding Maestro and Cirrus) transactions for which we received transaction

details from our customers but which were not processed by our systems. In the first quarter of 2006, we updated our transaction detail to remove online balance

inquiry transactions, as well as online transactions that were declined for various reasons. Management determined that it would be more appropriate to exclude

such transactions from the processed transactions calculation. The processed transactions for the years ended December 31, 2005 and 2004, have been restated

to be consistent with the calculation of processed transactions in 2006. Revenue has not been impacted by this change.

Summary Consolidated Financial and Other Data

All figures throughout report in U.S. dollars