Marks and Spencer 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6MARKS AND SPENCER GROUP PLC

Financial review continued

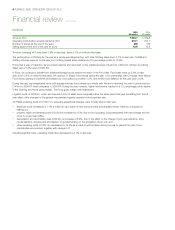

We have also incurred a further £6.3m of costs in the year in connection with the implementation of the head office restructuring

programme which was announced at the end of last year.

Lifestore closure costs represent the anticipated cost of closing the Lifestore programme. These costs include stock provisions, asset

write-offs and other property-related costs.

Defence costs of £38.6m represent the costs incurred, primarily for professional advice, in developing and implementing the new business

strategy as a consequence of the possible offer from Revival Acquisitions Limited. Costs of £8.4m have also been incurred in making the

necessary changes to the Board.

The Group successfully completed the sale of the Financial Services business to HSBC on 9 November 2004. This resulted in a profit

on disposal, after costs, of £208.9m.

Following the disposal of two properties in Germany during the year, we have completed the majority of the actions required to close our

European operations and we have released, unutilised, £9.7m of the closure provision which we now anticipate is no longer required.

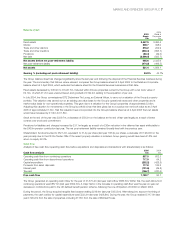

Interest

Net interest expense was £102.3m compared to £44.5m (52 week basis) for last year. The average rate of interest on borrowings during

the period was 5.7% (last year 5.3%).

Taxation

The tax charge reflects an effective tax rate for the full year of 28.5% before exceptional income, compared to 30.1% last year. The rate is

lower than the standard UK tax rate of 30% due to the impact of prior year credits and relief in respect of the exercise of employee share

options. The European Court of Justice heard the Group’s group relief claim on 1 February 2005 and their judgement is expected later this

year. No asset has been recognised in respect of this claim.

Shareholder returns and dividends

Adjusted earnings per share, which excludes the effect of exceptional items, has decreased by 11.3% to 21.9p per share (on a 52 week

basis, a decrease of 6.4%). Return on equity was 41.4% compared to 25.2% last year.

A final dividend of 7.5p per share (last year 7.1p per share) is proposed, making the total dividend for the year 12.1p per share (last year

11.5p per share), an increase of 5.2%.

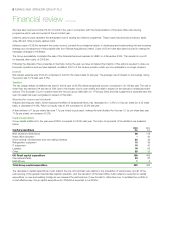

Capital expenditure

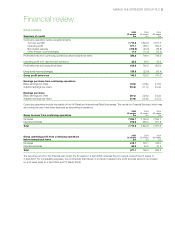

Group capital additions for the year were £220m compared to £434m last year. The major components of the additions are analysed

below:

2005 2004

Capital expenditure £m £m

New stores and extensions 88 118

Head office relocation –40

Store renewal, refurbishment and new selling initiatives 25 44

Refrigeration equipment 10 39

IT equipment 18 40

Logistics 16 95

Other 29 32

UK Retail capital expenditure 186 408

International Retail 33 20

M&S Money 16

Total Group capital expenditure 220 434

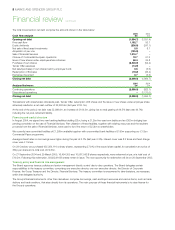

The decrease in capital expenditure in part reflects the one-off costs last year relating to the acquisition of warehouses, as part of the

restructuring of the general merchandise logistics operation, and the relocation of the head office. It also reflects a reduction in capital

expenditure on new and existing footage as we reviewed the performance of new formats to determine how to revitalise the portfolio in

a cost effective way. Group capital expenditure for 2005/06 is expected to be £350m.