Marks and Spencer 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

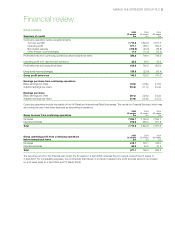

MARKS AND SPENCER GROUP PLC 5

International Retail

2005 2004

52 weeks 52 weeks

Turnover (£m)

– Marks & Spencer branded businesses 455.8 426.2

– Kings Super Markets 219.8 238.8

675.6 665.0

Operating profit (£m)

– Marks & Spencer branded businesses 60.7 41.8

– Kings Super Markets 4.3 2.4

65.0 44.2

Number of stores (at the end of the year)

– Owned 45 43

– Franchise 191 155

Selling space at the end of the year (000 sq ft)

– Owned 1,024 908

– Franchise 1,317 1,068

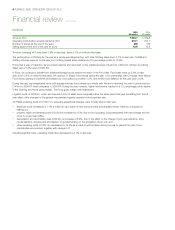

Turnover for the year in the Marks & Spencer branded businesses (Republic of Ireland, franchises and Hong Kong) increased by 6.9%

(9.1% at constant exchange rates).

Operating profit for the Marks & Spencer branded businesses increased by 45.2% to £60.7m. In the Republic of Ireland, sales were ahead

of last year and the performance of the new stores in Blanchardstown and Dundrum has been encouraging. Our franchisees have seen

good like-for-like sales increases and are investing in new footage. Hong Kong had a strong year, however, in 2005/06 some of our leases

will be surrendered to the landlord for development.

Sales at Kings Super Markets were broadly level over the period at constant exchange rates, compared with the same period last year.

Operating profit at Kings over the period was £4.3m as a result of actions taken last year to improve financial performance.

Financial Services

The Financial Services business was sold to HSBC on 9 November 2004 for £768.6m and the results of the business up to the date

of disposal have been included under the heading of discontinued operations.

The Group has also entered into an agreement with HSBC, whereby the Group will continue to share in the success of the Financial

Services business. Under this agreement, the Group will receive income in the form of fees representing an amount equivalent to costs

incurred, 50% of the profits of M&S Money (after a notional tax charge and after deducting agreed operating and capital costs) plus an

amount relating to the growth in sales of financial services products. Fees received under this agreement since the date of disposal have

been included within other operating income in UK Retail.

Exceptional items

The Group has recorded exceptional income of £126.8m in the year, as follows:

2005 2004

Exceptional items £m £m

Operating exceptional items

Head office relocation 8.8 19.6

Head office restructuring programme 6.3 22.5

Board restructure 8.4 –

Closure of Lifestore 29.3 –

Defence costs 38.6 –

91.4 42.1

Non-operating exceptional items

Loss/(profit) on sale of property and other fixed assets 0.4 (18.7)

Profit on disposal of Financial Services (208.9) –

Release of European closure provision (9.7) –

(218.2) (18.7)

Total exceptional (income)/charges (126.8) 23.4

During the year, £8.8m of revenue costs were incurred in connection with the relocation of the head office and have been charged as

exceptional operating costs. This relocation was completed at the end of October.