Louis Vuitton 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Louis Vuitton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 LVMH ANNUAL

REPORT 2003

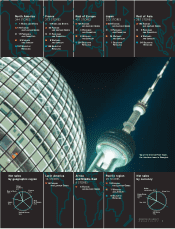

ONE OF THE BEST PERFORMERS

IN THE CAC 40

After the serious geopolitical tensions

that marked the first half of the year,

the appearance of SARS (Severe Acute

Respiratory Syndrome), and the

decline of the US dollar, the economic

outlook improved thanks to a quick

end to the war in Iraq and an economic

recovery in the United States and Asia.

Following a three-year negative trend,

the international stock markets per-

formed significantly better against the

backdrop of this improved economic

outlook. In particular, the CAC 40 and

the DJ-EuroStoxx50 gained 16%, while

the Dow Jones Industrial average rose

25% over the year.

In 2003, the LVMH share performed

remarkably well on the stock market,

posting a gain of 47%. After a stable

performance over the first three

months, demonstrating outstanding

resistance in a difficult environment,

the share price continued its strong

upward trend until the end of the year.

This performance is even more note-

worthy when compared with the CAC

40 Index. LVMH outperformed the

CAC 40 by over 25% for the second

consecutive year, outperforming it by

27% in 2003 to close the year at 57.70

euros.

At year-end, the market capitalization

of LVMH was 28.3 billion euros,

making it the tenth largest on the

Paris stock exchange. LVMH is inclu-

ded in the principal French and Euro-

pean indices used by fund managers:

CAC 40, DJ-EuroStoxx 50, MSCI

Europe, FTSE Eurotop 100, Euronext

100.

LVMH shares are listed on the Premier

Marché of Euronext Paris (Reuters

code: LVMH.PA, Bloomberg code:

MC FP; and ISIN code FR0000121014).

In addition, options on LVMH shares

are traded on the Paris Monep options

exchange.

LVMH is among the French companies

recognized by the three principal US,

French and European socially respon-

sible investment indices.

AN UNUSUALLY GOOD RETURN

FOR THE SHAREHOLDER

An LVMH shareholder who invested

1,000 euros on January 1, 1999 would

have 2,009 euros at December 31,

2003, factoring in a one-for-ten stock

allotment in June 1999 and reinvested

dividends. The initial investment

would, therefore, have grown an

average 15% a year.

THE LVMH SHARE

THE LVMH SHARE PERFORMS REMARKABLY WELL ON THE

STOCK MARKET

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

14,000,000

20

25

30

35

40

45

50

55

60

DNOSAJJMAMFJ

Comparison between LVMH share price and CAC 40 since january 1, 2003

Trading volume LVMH CAC 40 Average monthly volume