Lifetime Fitness 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Lifetime Fitness annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

!

February 26, 2010

To Our Shareholders,

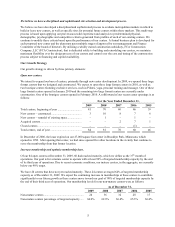

In 2009, we aligned our company around a number of key goals and I am proud to say we met or

exceeded most of them.

First, we wanted to immediately become free cash flow positive and pay down debt due to the

uncertainty in the financing world. We were free cash flow positive every quarter and saw

sequential improvement each quarter. And, for the year, we generated nearly $40 million of free

cash flow.

Second, we wanted to reduce unnecessary expenses wherever possible. In total, we reduced our

infrastructure cost by $10 million without any impact to our members’ experience. In doing so,

we became a much leaner and more capable organization that is equipped to make better, faster

decisions.

Third, we set a goal of delivering $1.70 of diluted earnings per common share, the high end of

our initial range of expectations for fiscal 2009. Through the tireless efforts of our team

members, we achieved diluted earnings per common share of $1.82.

In addition to these goals, we established two stretch goals for 2009: achieving positive

comparable center revenue growth for our mature centers and returning our attrition to a

normalized rate in the mid 30-percent range. We knew these were difficult targets and, despite

our progress during the year, we did not hit them.

While I had hoped that some of our initiatives to address these goals would have begun to trickle

into our results by the third and fourth quarters, I was disappointed when we did not see adequate

response in light of our enormous efforts. Based on indications late in 2009 and thus far in 2010,

however, we are encouraged with the progress we are seeing. Plus, our initiatives have become

more and more a part of our culture, which is exactly what we want.

For 2010, our two key goals are clear. First, we plan to achieve positive comparable center

revenue growth in our mature centers in the second half of the year. Second, we expect to see

improvement in our member attrition rate during the year. We intend to win on these two key

goals despite macroeconomic forces and high levels of unemployment, which remain

challenging trends.

Another key objective for 2010 is to reestablish ourselves as a healthy-way-of-life growth

company. We plan to grow square footage, memberships, in-center programs and our corporate

businesses. As a result, we expect to grow top-line revenue and earnings per share, while

continuing to strengthen our balance sheet.