Kohl's 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

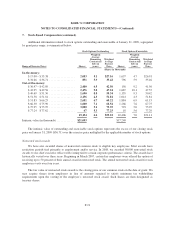

9. Quarterly Financial Information (Unaudited) (continued)

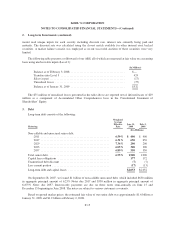

2007

First Second Third Fourth

(In Millions, Except Per Share Data)

Net sales ..................................................... $3,572 $3,589 $3,825 $5,487

Gross margin .................................................. $1,318 $1,396 $1,418 $1,882

Net income ................................................... $ 209 $ 269 $ 194 $ 412

Basic shares ................................................... 322 320 317 313

Basic net income per share ....................................... $ 0.65 $ 0.84 $ 0.61 $ 1.32

Diluted shares ................................................. 325 323 319 314

Diluted net income per share ...................................... $ 0.64 $ 0.83 $ 0.61 $ 1.31

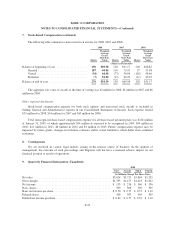

Due to changes in stock prices during the year and timing of issuance of shares, the sum of quarterly net

income per share may not equal the annual net income per share.

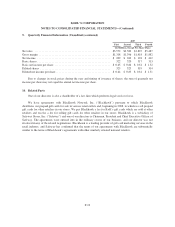

10. Related Party

One of our directors is also a shareholder of a law firm which performs legal services for us.

We have agreements with Blackhawk Network, Inc. (“Blackhawk”) pursuant to which Blackhawk

distributes our prepaid gift cards for sale in various retail outlets and, beginning in 2008, to which we sell prepaid

gift cards for other retailers in our stores. We pay Blackhawk a fee for Kohl’s gift cards which are sold at other

retailers and receive a fee for selling gift cards for other retailers in our stores. Blackhawk is a subsidiary of

Safeway Stores, Inc. (“Safeway”) and one of our directors is Chairman, President and Chief Executive Officer of

Safeway. The agreements were entered into in the ordinary course of our business, and our director was not

involved in any of the related negotiations. Blackhawk is a leading provider of gift card marketing services in the

retail industry, and Safeway has confirmed that the terms of our agreements with Blackhawk are substantially

similar to the terms of Blackhawk’s agreements with other similarly situated national retailers.

F-23