Kohl's 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the earlier of the date when we become legally obligated for the rent payments or the date when we take

possession of the building or land for initial setup of fixtures and merchandise or land improvements.

New Accounting Pronouncements

In January 2009, the FASB issued FASB Staff Position (“FSP”) EITF 99-20-1, “Amendments to the

Impairment Guidance of EITF Issue No. 99-20.” This standard prescribes that if the fair value of an

available-for-sale or held-to-maturity debt security is less than its cost basis at the measurement date, U.S.

Generally Accepted Accounting Principles (“GAAP”) requires that the reporting entity assess the impaired

security to determine whether the impairment is other than temporary. The adoption of this statement in the

fourth quarter of 2008 had no impact on our consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting

Principles.” This statement identifies the sources of accounting principles and the framework for selecting the

principles used in the preparation of financial statements of nongovernmental entities that are presented in

conformity with GAAP. We adopted this statement in the fourth quarter of 2008 without a material impact on our

consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”). SFAS

No. 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair

value measurements. A portion of this statement was effective for 2008, while the remaining portion of the

statement is effective for our fiscal 2009. In February 2008, the FASB issued FSP FAS 157-1, “Application of

FASB Statement No. 157 to FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair

Value Measurements for Purposes of Lease Classification or Measurement under Statement 13” and also issued

FSP FAS 157-2, “Effective Date of FASB Statement No. 157,” which collectively remove certain leasing

transactions from the scope of SFAS No. 157 and partially delay the effective date of SFAS No. 157 for one year

for certain non-financial assets and liabilities. In October 2008, the FASB also issued FSP FAS 157-3,

“Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active,” which clarifies

the application of SFAS No. 157 in an inactive market and illustrates how an entity would determine fair value

when the market for a financial asset is not active. Although we will continue to evaluate the application of SFAS

No. 157, we do not currently believe adoption of the remaining portions of SFAS No. 157 will have a material

impact on our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities—Including an amendment of FASB Statement No. 115,” (“SFAS No. 159”). This standard

permits entities to measure many financial instruments and certain other items at fair value. The objective is to

improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings

caused by measuring related assets and liabilities differently without having to apply complex hedge accounting

provisions. A portion of this statement was effective for 2008, while the remaining portion of the statement is

effective for our fiscal 2009. We do not expect the adoption of the remaining portions of this statement will have

a material impact on our consolidated financial statements.

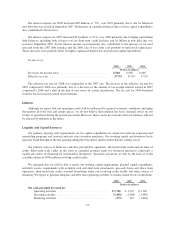

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

All of our long-term debt at year-end 2008 is at fixed interest rates and, therefore, is not affected by changes

in interest rates. When our long-term debt instruments mature, we may refinance them at then existing market

interest rates, which may be more or less than interest rates on the maturing debt.

Borrowings under our revolving credit facilities are at variable rates and are affected by changes in interest

rates. For 2008, average borrowings under our revolving credit facilities were $40 million. If interest rates on the

average 2008 variable rate debt changed by 100 basis points, our annual interest expense would change by

$400,000, assuming comparable borrowing levels.

We were not a party to any derivative financial instruments in 2008, 2007 or 2006.

30