Kentucky Fried Chicken 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

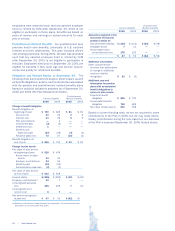

AsummaryofoptionactivityasofDecember31,2005,

andchangesduringtheyearthenendedispresentedbelow.

Weighted-

Weighted- Average Aggregate

Average Remaining Intrinsic

Exercise Contractual Value(in

Shares Price Term millions)

Outstandingatthe

beginningoftheyear 37,108 $21.53

Granted 4,516 46.58

Exercised (8,442) 17.46

Forfeitedorexpired (1,463) 30.88

Outstandingattheend

oftheyear 31,719 $25.75 5.81 $670

Exercisableattheend

oftheyear 18,960 $19.79 4.56 $514

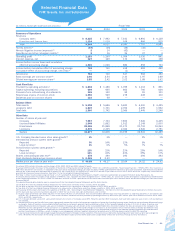

The weighted-average grant-date fair value of options

granted during 2005, 2004, and 2003 were $17.78,

$15.11,and$9.43,respectively.Thetotalintrinsicvalue

ofoptionsexercisedduringtheyearsendedDecember31,

2005,December25,2004,andDecember27,2003,was

$271million,$282millionand$90million,respectively.

AsofDecember31,2005,therewas$119millionof

unrecognizedcompensationcost,whichwillbereducedby

anyforfeituresthatoccur,relatedtounvestedstockoptions

thatisexpectedtoberecognizedoveraweighted-average

period of 2.7 years. The total fair value at grant date of

stockoptions vested during 2005,2004, and 2003 was

$57million,$103million,and$95million,respectively.

Cashreceivedfromoptionsexercisesfor2005,2004

and2003,was$148million,$200millionand$110million,

respectively.Taxbenefitsrealizedfromtaxdeductionsassoci-

atedwithoptionsexercisesfor2005,2004and2003totaled

$94million,$102millionand$26million,respectively.

TheCompanyhasapolicyofrepurchasingsharesonthe

openmarkettosatisfyshareoptionexercisesandexpects

torepurchaseapproximately8.0millionsharesduring2006

basedonestimatesofoptionexercisesforthatperiod.

16.OTHER

COMPENSATIONANDBENEFITPROGRAMS

ExecutiveIncomeDeferralProgram(the“EIDPlan”) The

EIDPlan allowsparticipants todefer receiptofaportion

of their annual salary and all ora portion of their incen-

tivecompensation. Asdefinedby the EIDPlan, wecredit

theamountsdeferred withearnings basedonthe invest-

ment options selected by the participants. In 2004 and

2003,theseinvestmentoptionswerelimitedtocashand

phantomsharesofourCommonStock.In2005,weadded

twonewphantominvestmentoptionstotheplan,aStock

IndexFundandtheBondIndexFund.Additionally,theEID

Planallows participants todeferincentive compensation

to purchase phantom shares of our Common Stock at a

25%discountfromtheaveragemarketpriceatthedateof

deferral (the“Discount StockAccount”).Deferralsto the

DiscountStockAccountaresimilartoarestrictedstockunit

awardinthatparticipantswillforfeitboththediscountand

incentivecompensationamountsdeferredtotheDiscount

StockAccountiftheyvoluntarilyseparatefromemployment

duringthetwoyearvestingperiod.Weexpensetheintrinsic

valueofthediscountoverthevestingperiod.Investments

incash,theStockIndexfundandtheBondIndexfundwill

bedistributedincashatadateaselectedbytheemployee

andthereforeareclassifiedasaliabilityonourConsolidated

BalanceSheets.Werecognizecompensationexpensefor

theappreciationordepreciationoftheseinvestments.As

investmentsinthephantomsharesofourCommonStock

canonlybesettledinsharesofourCommonStock,wedo

notrecognizecompensationexpensefortheappreciationor

thedepreciation,ifany,oftheseinvestments.Deferralsinto

thephantomsharesofourCommonStockarecreditedto

theCommonStockAccount.

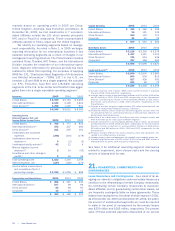

AsofDecember31,2005totaldeferralstophantom

shares of ourCommonStock within the EID Plan totaled

approximately3.3millionshares.Werecognizedcompensa-

tionexpenseof$4millionin2005and2004and$3million

in2003fortheEIDPlan.

RestrictedStock InNovember1997,wegrantedperfor-

mancerestrictedstockunitsofYUM’sCommonStockin

the amountof $3.6million toourChief Executive Officer

(“CEO”). The award was made under the 1997 LTIP and

wastobepaidinCommonStockorcashatthediscretion

oftheCompensationCommitteeoftheBoardofDirectors.

PaymentoftheawardwasmadeincashonFebruary6,2006

onattainmentofcertainpre-establishedearningsthresh-

olds.Theannualexpenserelatedtothisawardincludedin

earningswas$0.4millionfor2005,2004and2003.

Contributory 401(k) Plan We sponsor a contributory

plantoprovideretirementbenefitsundertheprovisionsof

Section401(k)oftheInternalRevenueCode(the“401(k)

Plan”) for eligible U.S. salaried and hourly employees.

Participants are able toelect tocontribute up to25% of

eligiblecompensationonapre-taxbasis.Participantsmay

allocatetheircontributionstooneoranycombinationof10

investmentoptionswithinthe401(k)Plan.Wematch100%

oftheparticipant’scontributiontothe401(k)Planupto3%

ofeligiblecompensationand50%oftheparticipant’scontri-

butiononthenext2%ofeligiblecompensation.Allmatching

contributionsaremadetotheYUMCommonStockFund.

Werecognizedascompensationexpenseourtotalmatching

contributionof$12millionin2005,$11millionin2004and

$10millionin2003.

17.SHAREHOLDERS’RIGHTSPLAN

In July 1998, our Board of Directors declared a dividend

distributionofonerightforeach shareofCommonStock

outstandingasofAugust3,1998(the“RecordDate”).As

aresultofthetwoforonestocksplitdistributedonJune17,

2002,eachholderofCommonStockisentitledtooneright

Yum!Brands,Inc. | 73.