Kentucky Fried Chicken 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004or2003forthoseforeigncurrencyforwardcontracts

designatedascashflowhedges.

Equity Derivative Instruments On December3, 2004,

weenteredintoanacceleratedsharerepurchaseprogram

(the“Program”).In connectionwith theProgram,athird-

partyinvestmentbankborrowedapproximately5.4million

sharesofourCommonStockfromshareholders.Wethen

repurchased those shares at their then market value of

$46.58 per share from the investment bank for approxi-

mately$250million.Therepurchasewasmadepursuantto

thesharerepurchaseprogramauthorizedbyourBoardof

DirectorsinMay2004.

Simultaneously, we entered into a forward contract

withtheinvestmentbankthatwasindexedtothenumberof

sharesrepurchased.Underthetermsoftheforwardcontract,

wewererequiredtopayorentitledtoreceiveapriceadjust-

mentbasedonthedifferencebetweentheweightedaverage

price of our Common Stock during the duration of the

Programandtheinitialpurchasepriceof$46.58pershare.

Atourelection,anypaymentswewereobligatedtomake

wereeithertobeincashorinsharesofourCommonStock

(nottoexceed15millionsharesasspecifiedintheforward

contract).TheProgramwascompletedduringthequarter

endedMarch19,2005andwemade a cashpaymentof

approximately$3milliontotheinvestmentbanktosettle

theforwardcontractinfull.Thispaymentrepresentingthe

changeinfairvalueoftheforwardcontractwasrecognized

inaccordancewithEITF00-19,“AccountingforDerivative

FinancialInstrumentsIndexed to, and Potentially Settled

In,aCompany’sOwnStock”asanadjustmenttoCommon

StockandisincludedinsharerepurchasesinNote18.

CommodityDerivativeInstruments Wealsoutilize,ona

limited basis, commodity futures and options contracts

tomitigate our exposure to commodityprice fluctuations

over the next twelve months. Those contracts have not

beendesignatedashedgesunderSFAS133.Commodity

futureandoptionscontractsdidnotsignificantlyimpactthe

ConsolidatedFinancialStatementsin2005,2004or2003.

DeferredAmountsinAccumulatedOtherComprehensive

Income(Loss) AsofDecember31,2005,wehadanet

deferredlossassociatedwithcashflowhedgesofapproxi-

mately$1million,netoftax.Theloss,whichprimarilyarose

fromthesettlementoftreasurylocksenteredintopriorto

theissuanceofcertainamountsofourfixed-ratedebt,will

bereclassifiedintoearningsfromJanuary1,2006through

2012asanincreasetointerestexpenseonthisdebt.

Credit Risks Credit risk from interest rate swaps and

foreignexchangecontractsisdependentbothonmovement

in interest and currency rates and the possibilityofnon-

paymentbycounterparties.Wemitigatecreditriskbyentering

intotheseagreementswithhigh-qualitycounterparties,and

settleswapandforwardratepaymentsonanetbasis.

Accountsreceivableconsistsprimarilyofamountsdue

from franchisees andlicensees for initialand continuing

fees.Inaddition,wehavenotesandleasereceivablesfrom

certainofourfranchisees.Thefinancialconditionofthese

franchisees andlicenseesis largely dependentuponthe

underlyingbusinesstrendsofourConcepts.Thisconcentra-

tionofcreditriskismitigated,inpart,bythelargenumber

offranchiseesandlicenseesofeachConceptandtheshort-

termnatureofthefranchiseandlicensefeereceivables.

Fair Value At December31, 2005 and December25,

2004,thefairvaluesofcashandcashequivalents,short-

terminvestments,accountsreceivableandaccountspayable

approximatedthecarryingvaluesbecauseoftheshort-term

natureoftheseinstruments.Thefairvalueofnotesreceiv-

ableapproximatesthecarryingvalueafterconsiderationof

recordedallowances.

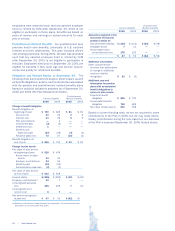

Thecarryingamountsandfairvaluesofourotherfinancial

instrumentssubjecttofairvaluedisclosuresareasfollows:

2005 2004

Carrying Fair Carrying Fair

Amount Value Amount Value

Debt

Short-termborrowingsand

long-termdebt,excluding

capitalleasesandthe

derivativeinstrument

adjustments $1,752 $1,931 $1,593 $1,900

Debt-relatedderivative

instruments:

Opencontractsina

netasset(liability)

position (5) (5) 38 38

Foreigncurrency-related

derivativeinstruments:

Opencontractsina

netasset(liability)

position — — (2) (2)

Leaseguarantees 16 27 13 29

Guaranteessupporting

financialarrangements

ofcertainfranchisees,

unconsolidatedaffiliates

andotherthirdparties 7 7 7 8

Lettersofcredit — 1 — 2

Weestimatedthefairvalueofdebt,debt-relatedderivative

instruments,foreigncurrency-relatedderivativeinstruments,

guaranteesandlettersofcreditusingmarketquotesand

calculationsbasedonmarketrates.

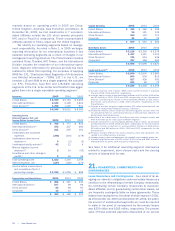

14.PENSIONAND

POSTRETIREMENTMEDICALBENEFITS

Pension Benefits We sponsor noncontributory defined

benefit pension plans covering substantially all full-time

U.S.salariedemployees,certainU.S.hourlyemployeesand

certaininternationalemployees.Themostsignificantofthese

plans,theYUMRetirementPlan(the“Plan”),isfundedwhile

benefitsfromtheotherplansarepaidbytheCompanyas

incurred.During2001,theplanscoveringourU.S.salaried

Yum!Brands,Inc. | 69.