Kentucky Fried Chicken 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

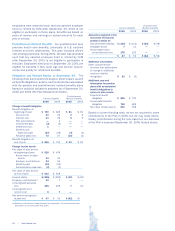

10.ACCOUNTSPAYABLE

ANDOTHERCURRENTLIABILITIES

2005 2004

Accountspayable $ 398 $ 414

Accruedcompensationandbenefits 274 263

Othercurrentliabilities 566 512

$1,238 $1,189

11.SHORT-TERM

BORROWINGSANDLONG-TERMDEBT

2005 2004

Short-termBorrowings

Currentmaturitiesoflong-termdebt $ 211 $ 11

Long-termDebt

UnsecuredInternationalRevolving

CreditFacility,expiresNovember2010 180 —

UnsecuredRevolvingCreditFacility,

expiresSeptember2009 — 19

Senior,UnsecuredNotes,dueApril2006 200 200

Senior,UnsecuredNotes,dueMay2008 251 251

Senior,UnsecuredNotes,dueApril2011 646 646

Senior,UnsecuredNotes,dueJuly2012 398 398

Capitalleaseobligations(SeeNote12) 114 128

Other,duethrough2019(6% –12%) 77 79

1,866 1,721

Lesscurrentmaturitiesoflong-termdebt (211) (11)

Long-termdebtexcluding

SFAS133adjustment 1,655 1,710

Derivativeinstrumentadjustmentunder

SFAS133(SeeNote13) (6) 21

Long-termdebtincluding

SFAS133adjustment $1,649 $1,731

Ourprimarybankcreditagreementcomprisesa$1.0billion

senior unsecured Revolving Credit Facility (the “Credit

Facility”), which matures in September 2009. TheCredit

Facility is unconditionally guaranteed by our principal

domestic subsidiaries and contains financial covenants

relating to maintenance of leverage and fixed charge

coverageratios.TheCreditFacilityalsocontainsaffirmative

andnegativecovenantsincluding,amongotherthings,limi-

tationsoncertainadditionalindebtedness,guaranteesof

indebtedness,levelofcashdividends,aggregatenon-U.S.

investmentandcertainothertransactionsasspecifiedinthe

agreement.Wewereincompliancewithalldebtcovenantsat

December31,2005.

Undertheterms of the Credit Facility,wemayborrow

uptothemaximumborrowinglimitlessoutstandingletters

ofcredit.AtDecember31,2005,ourunusedCreditFacility

totaled $809million, net of outstanding letters of credit

of$191million.TherewerenoborrowingsundertheCredit

Facilityattheendof2005whileoutstandingborrowingsat

December25,2004were$19million.Theinterestratefor

borrowingsundertheCreditFacility ranges from0.35%to

1.625%overtheLondonInterbankOfferedRate(“LIBOR”)or

0.00%to0.20%overanAlternateBaseRate,whichisthe

greaterofthePrimeRateortheFederalFundsEffectiveRate

plus0.50%.TheexactspreadoverLIBORortheAlternateBase

Rate,asapplicable,willdependuponourperformanceunder

specifiedfinancialcriteria.Interestonanyoutstandingborrow-

ingsundertheCreditFacilityispayableatleastquarterly.In

2005,2004and2003,weexpensedfacilityfeesofapproxi-

mately$2million,$4millionand$6million,respectively.

Additionally,onNovember8,2005,weexecutedafive-

yearrevolvingcreditfacility(the“InternationalCreditFacility”

or“ICF”)onbehalfofthreeofourwhollyownedinternational

subsidiaries.Thetotalfacilityamountis$350million,with

separatesublimitsforeachofthethreesubsidiaries.TheICF

isunconditionallyguaranteedbyYUMandbyYUM’sprincipal

domesticsubsidiariesandcontainscovenantssubstantially

identicaltothoseoftheCreditFacility.Wewereincompli-

ancewithalldebtcovenantsattheendof2005.

There were borrowingsof $180million and available

credit of $170million outstanding under the ICF at the

end of 2005. The interest rate for borrowings under the

CreditFacilityrangesfrom0.20%to1.20%overtheLIBOR

or0.00%to0.20%overaCanadianAlternateBaseRate,

whichisthegreateroftheCitibank,N.A.,CanadianBranch’s

publiclyannouncedreferencerateorthe“CanadianDollar

OfferedRate”plus0.50%.TheexactspreadoverLIBORor

theCanadianAlternateBaseRate,asapplicable,depends

uponYUM’sperformanceunderspecifiedfinancialcriteria.

Interest on any outstanding borrowings under the ICF is

payableatleastquarterly.

OnNovember15,2004,wevoluntarilyredeemedallof

our7.45%SeniorUnsecured NotesthatweredueinMay

2005(the“2005Notes”)inaccordancewiththeiroriginal

terms. The 2005 Notes, which had a total face value of

$350million,wereredeemedforapproximately$358million

usingprimarilycashonhandaswellassomeborrowings

underourCreditFacility.Theredemptionamountapproxi-

matedthe carrying valueofthe 2005 Notes,including a

derivativeinstrumentadjustmentunderSFAS133,resulting

innosignificantimpactonnetincomeuponredemption.

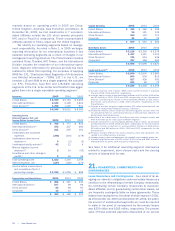

In1997,wefiledashelfregistrationstatementwiththe

SecuritiesandExchangeCommissionforofferingsofupto

$2billionofseniorunsecureddebt,ofwhich$150millionis

availableforissuanceatDecember31,2005.Thefollowing

table summarizes all Senior Unsecured Notes issued

under this shelf registration that remain outstanding at

December31,2005:

Principal InterestRate

IssuanceDate(a) MaturityDate Amount Stated Effective(b)

May1998 May2008 250 7.65% 7.81%

April2001 April2006 200 8.50% 9.04%

April2001 April2011 650 8.88% 9.20%

June2002 July2012 400 7.70% 8.04%

(a)Interestpaymentscommencedsixmonthsafterissuancedateandarepayable

semi-annuallythereafter.

(b)Includestheeffectsoftheamortizationofany(1)premiumordiscount;(2)debt

issuancecosts;and(3)gainorlossuponsettlementofrelatedtreasurylocks.

ExcludestheeffectofanyinterestrateswapsasdescribedinNote13.

Yum!Brands,Inc. | 67.