JP Morgan Chase 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

ucts, and trade finance services to the world’s leading

companies and institutional investors. We now serve

more than 2,800 clients around the world. In 2008,

TSS brought in more than 250 significant new client

relationships, representing more than $80 million in

annualized revenue. In a business with global scale,

50% of TSS’ revenue is from business outside the

United States, and in 2008, this revenue grew by

15%. TSS further strengthened its international

presence, expanding services in more than 20 coun-

tries throughout Europe, the Middle East, Africa,

Asia and Latin America – we now do business in

more than 45 countries.

Notably, TSS also broke its single-day U.S. dollar-

clearing volume record – by clearing a staggering $5

trillion in a single day, 59% over its average. Due to

market conditions, TSS assets under custody decreased

by 17% to $13.2 trillion. Yet, at the same time, average

liability balances were up 22% to $280 billion, reflect-

ing a flight to quality as clients were drawn to the

stability of J.P. Morgan.

TSS is preparing for continued stress in the equity

markets in 2009, declining securities lending balances

and the negative impact of 0% interest rates.

Nevertheless, it remains an excellent business, serving

clients from all five of our other businesses, and we

expect it to produce strong results for years to come.

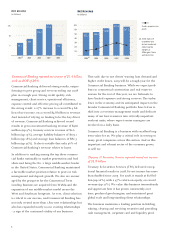

Asset Management reported net income of $1.4 billion

with an ROE of 24%

Asset Management, with assets under supervision of

$1.5 trillion, experienced a turbulent year in 2008. As

anticipated in this letter last year, earnings dropped

(by 31%). But overall, the year’s results were the result

of three trends: continued strong growth in Private

Banking, a small reduction in assets under manage-

ment (but a large change in the mix of asset types)

and a rigorous management of risk.

Private Banking had an exceptional year, bringing in a

record number of new clients and a record level of net

new assets (approximately $80 billion, for a total of

$538 billion). Earnings grew 12%. Over the past two

years, more than 235 new bankers have joined the

Private Bank and promise to contribute significantly

to its future growth.

Assets under management were $1.13 trillion at the

end of 2008 versus $1.19 trillion in 2007. Net new

inflows were a healthy $151 billion, up 31% from the

prior year. Unfortunately, this was more than offset by

the declines in market values. In addition, there was a

large change in the mix of assets. The cash we manage

for all our clients increased dramatically, with liquidity

balances growing by $210 billion to reach $613 billion

by year-end, as clients globally sought safety away

from higher-risk investments. Equities and alternatives

went in the opposite direction, with a 49% decline to

$240 billion from $472 billion, largely due to a 41%

drop in the value of equity markets. Finally, alternative

assets dropped 17% to $100 billion from $121 billion.

The current turmoil has reinforced the importance of

managing risk. Our culture of strong risk management

(proper due diligence, documentation, auditing, among

other measures) is consistent with our philosophy of

putting clients’ interests first and has enabled us to

avoid many of the negative developments that sur-

faced last year.

We anticipate another difficult year in 2009, with

earnings continuing to be affected by market condi-

tions. But this is a great business, and we intend to

keep it that way by focusing on helping our clients

through the current environment.

The Corporate sector reported net income of $557 million

In 2008, we reported a net loss of $700 million in

Private Equity – a different story from 2007, when we

reported pre-tax private equity gains of more than $4

billion. We love the private equity business, but as we

indicated in prior years, private equity returns are by

their nature lumpy, and we did not expect the stellar

2007 results to be repeated in 2008. We will remain

patient and still expect this business to deliver in

excess of 20% return on equity for us over time.