JP Morgan Chase 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As we move into 2009, we are not resting on our

laurels. We know we operate in a risky business with

many tough competitors who inevitably will come

back strong – even if some currently are distracted.

We also know that the investment banking business,

in many ways, will never be the same. Leverage will be

lower, and certain structured financial products will

likely cease to exist. But the fundamental business will

remain the same: advising corporations and investors,

raising capital, executing trades, providing research,

making markets, and giving our clients the best ideas

and the financing to make those plans a reality.

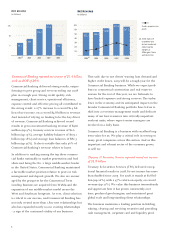

Retail Financial Services reported net income of

$880 million with an ROE of 5%

With $880 million in earnings, Retail Financial

Services (RFS) had a poor year overall. For its two

primary businesses – Retail Banking and Consumer

Lending – it was a tale of two cities.

On the plus side, Retail Banking, which includes

Consumer Banking and Business Banking, earned

$3 billion and, more important, grew its franchise –

both organically and through the acquisition of

Washington Mutual. We expect the WaMu acquisition

to contribute more than $2 billion in annual earnings,

and it has extended our branch network to more than

5,000 branches in 23 states, adding 7,200 bankers and

increasing our ATMs to 14,500, the second-largest ATM

network nationally. In Retail Banking, since the Bank

One merger and the addition of The Bank of New York

and WaMu branch networks, we have exponentially

grown our footprint, adding 4,400 branches through

acquisition and 500 organically. This five-year expan-

sion is reflected in more checking accounts (from 2.3

million to 24 million), more deposits (from $89 billion

to $342 billion) and more states in which we operate

(from four to 23).

On the negative side, Consumer Lending, which

includes the Mortgage, Home Equity, Student Loan

and Auto Finance businesses, reported a loss of $2.1

billion, driven by a 274% increase, to $9.5 billion, in

the provision for credit losses, primarily in the home

lending businesses. Despite these losses, Consumer

Lending remains core to what we do. It enables us

to serve customers across many products and extend

$352 billion in loans. However, continued pressure

on home prices, the effects of past poor underwriting

standards and the deepening recession have pushed

up, and, unfortunately, will continue to push up, credit

costs. Our current expectation is that quarterly charge-

offs for the Mortgage and Home Equity portfolios

could range from $1.8 billion to $2.4 billion (an

extremely high annualized loss rate of 3.5% to 5%).

By the end of 2008, we had reserves of more than $8

billion across all of RFS, and, with the expectation of

higher charge-offs, we also expect to build additional

reserves in 2009. However, there is one area that has

shown an improving trend: third-party mortgage

servicing. This business relies on scale and efficiency

and, including the addition of the WaMu portfolio,

it grew 91% to $1.17 trillion of loans.

We believe we have corrected for the underwriting

mistakes of the past. Essentially, by the end of 2008,

we saw a return to old-fashioned home lending stan-

dards (a maximum of 80% loan-to-value, with fully

documented income). In addition, we closed down all

business originated by mortgage brokers. My worst

mistake of the past several years was not doing this

sooner. In general, the credit losses in the broker-

originated business are two to three times worse

than that of our own directly originated business.

Unfortunately, approximately 30% of our home loans

were originated through the broker channel. Although

we will be paying for this bad underwriting for years

to come, we will continue to build the Consumer

Lending business with new standards in place.

We have always loved the Retail Banking business and

believe that the exceptional economics of the branch-

based businesses will fuel growth and earn a return on

equity (ROE) of more than 30% over time. As for the

Consumer Lending business, it should produce returns

of 15%-20%, especially as we capitalize on the benefits

of cross-selling and cross-underwriting.

4