JP Morgan Chase 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

III. FUNDAMENTAL CAUSES AND

CONTRIBUTIONS TO THE FINANCIAL

CRISIS

After Lehman’s collapse, the global financial system

went into cardiac arrest. There is much debate over

whether Lehman’s crash caused it – but looking back,

I believe the cumulative trauma of all the aforemen-

tioned events and some large flaws in the financial

system are what caused the meltdown. If it hadn’t

been Lehman, something else would have been the

straw that broke the camel’s back.

The causes of the financial crisis will be written about,

analyzed and subject to historical revisions for decades.

Any view that I express at this moment will likely

be proved incomplete or possibly incorrect over time.

However, I still feel compelled to attempt to do so

because regulation will be written soon, in the next

year or so, that will have an enormous impact on our

country and our company. If we are to deal properly

with this crisis moving forward, we must be brutally

honest and have a full understanding of what caused

it in the first place. The strength of the United States

lies not in its ability to avoid problems but in our

ability to face problems, to reform and to change. So

it is in that spirit that I share my views.

Albert Einstein once said, “Make everything as simple

as possible, but not simpler.” Simplistic answers or

blanket accusations will lead us astray. Any plan for

the future must be based on a clear and comprehen-

sive understanding of the key underlying causes of –

and multiple contributors to – the crisis, which

include the following:

• The burst of a major housing bubble

• Excessive leverage pervaded the system

• The dramatic growth of structural risks and

the unanticipated damage they caused

• Regulatory lapses and mistakes

• The pro-cyclical nature of virtually all policies,

actions and events

• The impact of huge trade and financing imbalances

on interest rates, consumption and speculation

Each main cause had multiple contributing factors.

As I wrote about these causes, it became clear to me

that each main cause and the related contributors

could easily be rearranged and still be fairly accurate.

It was also surprising to realize that many of the

main causes, in fact, were known and discussed abun-

dantly before the crisis. However, no one predicted

that all of these issues would come together in the

way that they did and create the largest financial and

economic crisis of our lifetime.

Even the more conservative of us, and I consider

myself to be among them, looked at the past major

crises (the 1974, 1982 and 1990 recessions; the 1987 and

2001 market crashes) or some mix of them as the worst-

case events for which we needed to be prepared. We

even knew that the next one would be different – but

we missed the ferocity and magnitude that was lurking

beneath. It also is possible that had this crisis played

out differently, the massive and multiple vicious cycles

of asset price reductions, a declining economy and a

housing price collapse all might have played out differ-

ently – either more benignly or more violently.

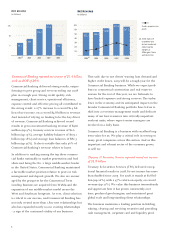

It is critical to understand that the capital markets

today are fundamentally different than they were after

World War II. This is not your grandfather’s economy.

The role of banks in the capital markets has changed

considerably. And this change is not well-understood – in

fact, it is fraught with misconceptions. Traditional banks

now provide only 20% of total lending in the economy

(approximately $14 trillion of the total credit provided

by all financial intermediaries). Right after World War II,

that number was almost 60%. The other lending has

been provided by what many call the “shadow banking”

system. “Shadow” implies nefarious and in the dark, but

only part of this shadow banking system was in the dark

(i.e., SIVs and conduits) – the rest was right in front of us.

Money market funds, which had grown to $4 trillion of

assets, directly lend to corporations by buying commercial

paper (they owned $700 billion of commercial paper).

Bond funds, which had grown to approximately $2 tril-

lion, also were direct buyers of corporate credit and secu-

ritizations. Securitizations, which came in many forms

(including CDOs, collateralized loan obligations and