JP Morgan Chase 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

8

Aside from Private Equity, our Corporate sector,

excluding merger-related items, produced $1.5 billion

in net income. This includes unallocated corporate

expense of approximately $500 million, which we

expect to continue at approximately the same level

in 2009, as well as a myriad of other items that are

disclosed in detail in our financial statements.

B. Strong strategic positions of all our businesses

One important and critical point to highlight is that

each of our businesses now ranks as one of the top

three players in its respective industry. As ever, our

goal is to be the best, not necessarily the biggest. That

said, we know that size matters in businesses where

economies of scale – in areas such as systems, opera-

tions, innovation, branding and risk diversification –

can be critical to success. The only reason to get

bigger and gain economies of scale is when doing so

enables you to do a better job for your clients; i.e., by

giving them more, better and faster at a lower cost.

Ultimately, this is also the only real reason to do a

merger – the client gets something better. If this isn’t

the case, big can be bad. If bureaucracy, hubris, lack of

attention to detail – or other ailments of large corpora-

tions – overwhelm the benefits of size, then failure will

ultimately result.

We are also keenly aware of the value added at more

detailed levels in our businesses. For example, in

Retail Financial Services, we gained share with small

businesses as we expanded our brand footprint. Our

Investment Bank has become a top player in both

Prime Brokerage and Energy, previously two of our

weak spots. Commercial Banking added WaMu’s

Commercial and Community Lending businesses

to its portfolio, representing $44.5 billion in loans.

And Private Banking’s record in net new asset flows

showed the strength of the J.P. Morgan franchise, as

high-net-worth individuals worldwide chose us to man-

age their investments. We also continue to upgrade

our infrastructure by improving systems, data centers,

products and services.

Suffice it to say, we like our market position and

believe that each business is strong and getting

stronger. Even in tough years like 2008 and 2009,

we did not – and will not – stop doing all the things

that make our businesses better.

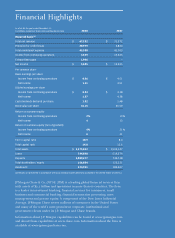

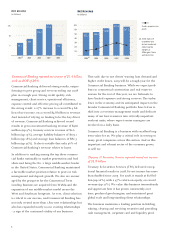

Managed

Net Revenue(a)

by Line of

Business

(in millions)

Commercial Banking

$4,777

Investment Bank

$12,214

Retail

Financial

Services

$23,520

Asset Management

$7,584

Card Services

$16,474

Treasury & Securities Services

$8,134

17%

32%

23%

7%

11%

10%

Ass

Corporate

$69

(a) For a discussion

of managed basis

presentation and

a reconciliation

to reported net

revenue, see

pages 50-51 of

this Annual Report.