JP Morgan Chase 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

THE WAY FORWARD

Table of contents

-

Page 1

Annual Report 2008 THE WAY F O RWA R D -

Page 2

... investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase serves millions of consumers in the United States and many of the world... -

Page 3

...our best to manage and operate our company with a consistent set of business principles and core values. First and foremost, this means always trying to do the right thing. It means continuing to focus on maintaining a fortress balance sheet, strong capital ratios and strong credit ratings. It means... -

Page 4

..., and, in the process, we distinguished ourselves in our service to clients and communities. Although our financial results were weak in absolute terms (but fairly good in relative terms), reflecting terrible market conditions, I believe - and I hope you agree - that this year may have been one... -

Page 5

..., it outperformed. Several core businesses - Rates and Currencies, Commodities, Emerging Markets and Credit Trading - reported record results. We also were able to make significant progress across our IB business. At the end of May, we closed our acquisition of Bear Stearns, which I will discuss in... -

Page 6

... end of 2008, we saw a return to old-fashioned home lending standards (a maximum of 80% loan-to-value, with fully documented income). In addition, we closed down all business originated by mortgage brokers. My worst mistake of the past several years was not doing this sooner. In general, the credit... -

Page 7

...5% of loans. In 2008, Card Services increased net revenue by 8% and grew managed loans by 3% (excluding WaMu). In 2008, we added 14.9 million new credit card accounts. By investing in activities to further engage current cardmembers and attract new customers, we continued growing the business. These... -

Page 8

... it has grown consistently over time, produced good margins, and maintained great global scale and long-standing client relationships. The business maintains a leading position in holding, valuing, clearing and servicing securities and providing cash management, corporate card and liquidity prod- 6 -

Page 9

... market values. In addition, there was a large change in the mix of assets. The cash we manage for all our clients increased dramatically, with liquidity balances growing by $210 billion to reach $613 billion by year-end, as clients globally sought safety away from higher-risk investments. Equities... -

Page 10

... Banking added WaMu's Commercial and Community Lending businesses to its portfolio, representing $44.5 billion in loans. And Private Banking's record in net new asset flows showed the strength of the J.P. Morgan franchise, as high-net-worth individuals worldwide chose us to manage their investments... -

Page 11

... where we were weak, Prime Brokerage and Commodities, and it enhanced our broader equity and fixed income businesses. Ultimately, we expect the businesses we acquired to add approximately $1 billion of annual earnings to the company. The truly impressive part of the Bear Stearns deal was the human... -

Page 12

...checking accounts, as well as savings, mortgage and credit card accounts. Importantly, we did not acquire the assets or liabilities of the bank's holding company or assume the $14 billion of senior unsecured debt and subordinated debt of Washington Mutual's banks. The deal was financially compelling... -

Page 13

... JPMorgan Chase, we had large credit and operational exposures in virtually every situation mentioned above, affecting nearly every line of business. Our firm's management teams, credit officers, risk officers, and legal, finance, audit and compliance teams worked tirelessly to protect the company... -

Page 14

... Currency (OCC), the FDIC and the New York Federal Reserve Bank to agree to accept a package of capital from the government. As part of its Troubled Asset Relief Program (TARP), the U.S. government was proposing some powerful measures to help fix the collapse in the credit and lending markets. 12 -

Page 15

...billion in new credit to consumers, businesses, municipalities and not-for-profit organizations, including nearly $30 billion in home lending and $2.8 billion in auto lending. We increased loans and commitments to government units, health care companies and not-for-profits by 33% in 2008 and plan to... -

Page 16

...front of us. Money market funds, which had grown to $4 trillion of assets, directly lend to corporations by buying commercial paper (they owned $700 billion of commercial paper). Bond funds, which had grown to approximately $2 trillion, also were direct buyers of corporate credit and securitizations... -

Page 17

...: • Hedge funds, many using high leverage, grew dramatically over time. Some of that leverage was the result of global banks and investment banks lending them too much money. • Private equity firms were increasingly leveraging up their buyouts. Again, some banks and the capital markets lent them... -

Page 18

... credit that was removed from the system. Money market funds had a small structural risk, which became a critical point of failure Money market funds promise to pay back 100% to the investor on demand. Many money market funds invested in 30- to-180-day commercial paper or asset-backed securities... -

Page 19

... applied differently in different jurisdictions, allowed too much leverage, had an over-reliance on published credit ratings and failed to account for how a company was being funded (i.e., it allowed too much short-term wholesale funding). In 2004, the five independent U.S. investment banks adopted... -

Page 20

... was not the case with investment banks. In addition, a resolution process needs to be in place for large, global financial companies that operate in many jurisdictions and use many different regulatory licenses. • Although we are proponents of fair value accounting in trading books (a lot of the... -

Page 21

... war in Iraq, short-selling, high energy prices, and irrational pressure on corporations, money managers and hedge funds to show increasingly better returns. It also is clear that excessive, poorly designed and short-term oriented compensation practices added to the problem by rewarding a lot... -

Page 22

...the position to recognize the one-sided credit derivative exposures of AIG and the monoline insurers and do something about it. A systemic regulator also should be on the lookout for new or potential structural risks in our capital markets, such as the structural flaw that grew in money market funds... -

Page 23

... commercial and investment banks to buy liquid or illiquid assets and fund them short. While this practice did not appear quite so dangerous in benign times, it created huge issues for many financial institutions during the market crisis. Basel II also has relied too heavily on rating agencies... -

Page 24

... markets function or change fundamental long-term U.S. government policies should be made thoughtfully, deliberately and with broad input For example, we all believe that companies should have fully funded pension plans; i.e., the actual assets in the plan should be enough to meet a fair estimate... -

Page 25

... a matter of days rather than weeks. This would allow a company to raise capital and repair a balance sheet that might have been stretched by unanticipated market events and to do so in a manner that is fair and does not dilute the company's existing shareholder base. Loan loss reserving can easily... -

Page 26

..., 50% of mid-sized companies and thousands of other, smaller U.S. companies use derivatives to manage certain risks, including currency and interest rate risk. As such, derivatives are a large business for JPMorgan Chase and for firms around the world. It is important to note that derivatives in and... -

Page 27

...the risks, we reserve and account for them conservatively, and we manage them in conjunction with all of our other credit exposures. • As the overall amount of counterparty credit risk has grown, so has the concern that this growth has increased systemic risk. To address this issue, we support the... -

Page 28

... commercial credit exposures - some worse than others. In addition to higher charge-offs, it will require substantial additions to reserves, which we have increased from $10 billion at the end of 2007 to $24 billion at the end of 2008. We already said last year how bad we thought mortgage and home... -

Page 29

... government is trying to reduce the mortgage rate by buying mortgages, making it easier to refinance; reducing consumer payments; and aggressively pushing mortgage modification programs. We believe the recent Term Asset-Backed Securities Loan Facility, or TALF program, which allows private investors... -

Page 30

...: change-of-control agreements, special executive retirement plans, golden parachutes, special severance packages for senior executives or merger bonuses. • We have always paid a significant percentage of our incentive compensation in stock, approximately 50% for our senior management team. That... -

Page 31

... in our markets across the United States. And over the past five years, we have given more than $600 million to 13,500 organizations globally. These tremendously important investments help inner-city young adults get jobs, fund educational programs, build affordable housing and support rebuilding... -

Page 32

... Markets businesses increased 40% year-over-year: - Record performance in Rates and Currencies, Commodities and Emerging Markets. • Prime Services acquired from Bear Stearns more than doubled the number of $1 billion+ relationships from June to December. • Reduced legacy leveraged lending funded... -

Page 33

... and businesses through personal service at bank branches and through ATMs, online banking and telephone banking as well as through retail mortgage correspondents, auto dealerships and school financial aid offices. Customers can use more than 5,000 bank branches (third largest nationally) and... -

Page 34

... in risk management, customer satisfaction, and systems and infrastructure. Card Services offers customers clear and simple tools, resources and business practices designed to help customers avoid fees, maintain their best interest rates and more effectively manage their credit card accounts. 32 -

Page 35

... growth. • Acquired WaMu's Commercial Term Lending, Commercial Real Estate Lending and Community Lending & Investment businesses representing $44.5 billion in loans, and expect to complete the integration by early 2010. • Aligned the domestic middle market banking and treasury services sales... -

Page 36

... custody. We operate through two divisions: Treasury Services provides cash management, trade, wholesale card and liquidity products and services to small- and midsized companies, multinational corporations, financial institutions and government entities. Worldwide Securities Services holds, values... -

Page 37

...funds, private equity and liquidity. We provide trust and estate, banking and brokerage services to high-net-worth clients and retirement services for corporations and individuals. • J.P. Morgan Asset Management liquidity balances grew more than 50% in 2008 to $613 billion, retaining its position... -

Page 38

... mortgage modification and home foreclosure prevention efforts and ongoing lending to consumers, businesses, municipalities and not-forprofits as well as acquiring Bear Stearns and Washington Mutual. • Invested more than $450 billion in lowand moderate-income communities in the first five years... -

Page 39

... Financial Measures Business Segment Results Balance Sheet Analysis Off-Balance Sheet Arrangements and Contractual Cash Obligations Capital Management Risk Management Liquidity Risk Management Credit Risk Management 111 Market Risk Management 117 Private Equity Risk Management 117 Operational Risk... -

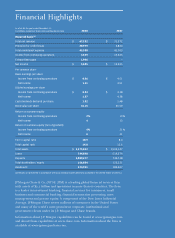

Page 40

...,653 160,968 (a) Results for 2008 and 2004 included an accounting conformity loan loss reserve provision related to the acquisition of Washington Mutual Bank's banking operations and the merger with Bank One Corporation, respectively. (b) The income tax benefit in 2008 is the result of the release... -

Page 41

...The Firm offers a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, market-making in cash securities and derivative instruments, prime... -

Page 42

...TS") provides cash management, trade, wholesale card and liquidity products and services to small and mid-sized companies, multinational corporations, financial institutions and government entities. TS partners with the Commercial Banking, Retail Financial Services and Asset Management businesses to... -

Page 43

..., credit and market risks, and the critical accounting estimates affecting the Firm and its various lines of business, this Annual Report should be read in its entirety. to the impact of the Washington Mutual transaction and the Bear Stearns merger. The business environment for financial services... -

Page 44

...areas. The Tier 1 capital ratio was 10.9% at year-end; Treasury & Securities Services and Commercial Banking each reported record revenue and net income for the second straight year; the consumer businesses opened millions of new checking and credit card accounts; Asset Management experienced record... -

Page 45

...lower market valuations of seed capital investments. Partially offsetting these revenue declines were higher deposit and loan balances, the benefit of the Bear Stearns merger, increased revenue from net asset inflows and wider deposit spreads. The provision for credit losses rose from the prior year... -

Page 46

... the net income impact of the acquisition of Washington Mutual's banking operations could be approximately $0.50 per share in 2009; the Bear Stearns merger could contribute $1 billion (after-tax) annualized after 2009; and merger-related items, which include both the Washington Mutual transaction... -

Page 47

... business, see the Corporate/Private Equity segment discussion on pages 73-75 of this Annual Report. Mortgage fees and related income increased from the prior year, driven by higher net mortgage servicing revenue, which benefited from an improvement in MSR risk management results and increased loan... -

Page 48

... following: higher trading-related net interest income in IB, the impact of the Washington Mutual transaction, wider net interest spread in Corporate/Private Equity, growth in liability and deposit balances in the wholesale and RFS businesses, higher consumer and wholesale loan balances, and wider... -

Page 49

... to certain IB structured notes to which fair value accounting was elected in connection with the adoption of SFAS 159); growth in liability and deposit balances in the wholesale and consumer businesses; a higher level of credit card loans; the impact of the Bank of New York transaction; and an... -

Page 50

...Annual Report. 2008 compared with 2007 Total noninterest expense for 2008 was $43.5 billion, up $1.8 billion, or 4%, from the prior year. The increase was driven by the additional operating costs related to the Washington Mutual transaction and Bear Stearns merger, and investments in the businesses... -

Page 51

... from exiting selected corporate trust businesses in the fourth quarter of 2006. No income from discontinued operations was recorded in 2008 or 2007. (a) On September 25, 2008, JPMorgan Chase acquired the banking operations of Washington Mutual Bank. On May 30, 2008, the Bear Stearns merger was... -

Page 52

... (a) 2008 included an accounting conformity loan loss reserve provision related to the acquisition of Washington Mutual's banking operations. (b) Based on income from continuing operations. (c) Credit card securitizations affect CS. See pages 63-65 of this Annual Report for further information. 50... -

Page 53

... their credit cards; accordingly, the customer's credit performance will affect both the securitized loans and the loans retained on the Consolidated Balance Sheets. JPMorgan Chase believes managed basis information is useful to investors, enabling them to understand both the credit risks associated... -

Page 54

... and balances (including home lending, student, auto and other loans) - Mortgage production and servicing Card Services Businesses: • Credit Card • Merchant Acquiring Commercial Banking Businesses: • Middle-Market Banking • Commercial Term Lending • Mid-Corporate Banking • Real Estate... -

Page 55

... Services Asset Management Corporate/Private Equity(c) Total (5)% 5 5 20 47 24 NM 4% (a) Represents reported results on a tax-equivalent basis and excludes the impact of credit card securitizations. (b) On September 25, 2008, JPMorgan Chase acquired the banking operations of Washington Mutual Bank... -

Page 56

...offers a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, marketmaking in cash securities and derivative instruments, prime brokerage... -

Page 57

... Fixed Income Markets revenue also decreased due to markdowns in securitized products on nonsubprime mortgages and weak credit trading performance. These lower JPMorgan Chase & Co. / 2008 Annual Report results were offset partially by record revenue in currencies and strong revenue in rates. Equity... -

Page 58

... its position to #2 in Global Long-term Debt and Global Announced M&A. The Firm maintained its #1 position in Global Syndicated Loans. According to Dealogic, the Firm was ranked #1 in Investment Banking fees generated during 2008, based upon revenue. 56 JPMorgan Chase & Co. / 2008 Annual Report -

Page 59

... specified liabilities of Washington Mutual. Washington Mutual's banking operations consisted of a retail bank network of 2,244 branches, a nationwide credit card lending business, a multi-family and commercial real estate lending business, and nationwide mortgage banking activities. The transaction... -

Page 60

...higher mortgage production and servicing expense. These increases were offset partially by the sale of the insurance business. Selected metrics Year ended December 31, (in millions, except headcount and ratios) 2008 2007 2006 Selected balance sheet data - period-end Assets $ 419,831 Loans: Loans... -

Page 61

... and investments in the retail distribution network. JPMorgan Chase & Co. / 2008 Annual Report (a) Employees acquired as part of the Bank of New York transaction are included beginning in 2007. Consumer Lending Selected income statement data Year ended December 31, (in millions, except ratio... -

Page 62

... metrics Year ended December 31, (in billions) 2008 2007 2006 Business metrics Selected ending balances Loans excluding purchased credit-impaired End-of-period loans owned Home equity $ 114.3 $ 94.8 Prime mortgage 65.2 34.0 Subprime mortgage 15.3 15.5 Option ARMs 9.0 - Student loans 15.9 11.0 Auto... -

Page 63

... the years ended December 31, 2008, 2007 and 2006, respectively. Credit data and quality statistics (in millions, except ratios) Net charge-offs excluding purchased credit-impaired(a) Home equity Prime mortgage Subprime mortgage Option ARMs Auto loans Other Total net charge-offs Net charge-off rate... -

Page 64

...) Total mortgage origination volume Home equity Student loans Auto Avg. mortgage loans held-for-sale and loans at fair value(a) Average assets Third-party mortgage loans serviced (ending) MSR net carrying value (ending) Mortgage origination channels comprise the following: 2008 2007 2006... -

Page 65

...Statements of Income and Consolidated Balance Sheets. The following discussion of CS' financial results reflects the acquisition of Washington Mutual's credit card operations, including $28.3 billion of managed credit card loans, as a result of the Washington Mutual transaction on September 25, 2008... -

Page 66

... Card Services. • Charge volume - Represents the dollar amount of cardmember purchases, balance transfers and cash advance activity. • Net accounts opened - Includes originations, purchases and sales. • Merchant acquiring business - Represents a business that processes bank card transactions... -

Page 67

... Year ended December 31, (in millions, except headcount, ratios and where otherwise noted) Financial metrics % of average managed outstandings: Net interest income Provision for credit losses Noninterest revenue Risk adjusted margin(a) Noninterest expense Pretax income (ROO)(b) Net income 2008 2007... -

Page 68

... Chase acquired the banking operations of Washington Mutual from the FDIC, adding approximately $44.5 billion in loans to the Commercial Term Lending, Real Estate Banking and Other businesses in Commercial Banking. On October 1, 2006, JPMorgan Chase completed the acquisition of The Bank of New York... -

Page 69

... by business: Middle Market Banking Commercial Term Lending(b) Mid-Corporate Banking Real Estate Banking(b) Other(b) Total Commercial Banking revenue Selected balance sheet data (period-end) Equity Selected balance sheet data (average) Total assets Loans: Loans retained Loans held-for-sale and loans... -

Page 70

... 1, 2006, selected corporate trust businesses were transferred from TSS to the Corporate/Private Equity segment and are reported in discontinued operations. Selected income statement data Year ended December 31, (in millions, except ratio data) Revenue Lending & deposit-related fees Asset management... -

Page 71

...reported in Commercial Banking Treasury Services revenue reported in other lines of business Treasury Services firmwide revenue(a) Worldwide Securities Services revenue 2008 2007 2006 Year ended December 31, (in millions, except ratio data and where otherwise noted) Firmwide business metrics Assets... -

Page 72

... include institutions, retail investors and highnet-worth individuals in every major market throughout the world. AM offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity, including money market instruments and bank deposits. AM also... -

Page 73

... Management offers high-net-worth individuals, families and business owners in the United States comprehensive wealth management solutions, including investment management, capital markets and risk management, tax and estate planning, banking and specialty-wealth advisory services. Bear Stearns... -

Page 74

...the year ended December 31, (in billions) Assets by asset class Liquidity Fixed income Equities & balanced Alternatives Total assets under management Custody/brokerage/ administration/deposits Total assets under supervision Assets by client segment Institutional Private Bank(b) Retail Private Wealth... -

Page 75

... manages capital, liquidity, interest rate and foreign exchange risk and the investment portfolio for the Firm. The corporate staff units include Central Technology and Operations, Internal Audit, Executive Office, Finance, Human Resources, Marketing & Communications, Legal & Compliance, Corporate... -

Page 76

...tax audits. (d) Includes an accounting conformity loan loss reserve provision related to the Washington Mutual transaction in 2008. 2008 also reflects items related to the Bear Stearns merger, which included Bear Stearns' losses, merger costs, Bear Stearns asset management liquidation costs and Bear... -

Page 77

... Chief Investment Office investment securities only. (c) Held-for-investment prime mortgage loans were transferred from AM to the Corporate/Private Equity segment for risk management and reporting purposes. The initial transfer in 2007 had no material impact on the financial results of Corporate... -

Page 78

Management's discussion and analysis B A L A N C E S H E E T A N A LYS I S Selected balance sheet data December 31, (in millions) Assets Cash and due from banks Deposits with banks Federal funds sold and securities purchased under resale agreements Securities borrowed Trading assets: Debt and equity... -

Page 79

... pages 198-201 of this Annual Report. Other assets The Firm's other assets consist of private equity and other investments, collateral received, corporate and bank-owned life insurance policies, premises and equipment, assets acquired in loan satisfaction (including real estate owned), and all other... -

Page 80

... awards under the Firm's employee stock-based compensation plans, the Bear Stearns merger, and net income for 2008 was more than offset by the declaration of cash dividends and net losses recorded within accumulated other comprehensive income related to AFS securities and defined benefit pension... -

Page 81

...Firm. The conduits fund their purchases and loans through the issuance of highly rated commercial paper to third-party investors. The primary source of repayment of the commercial paper is the cash flow from the pools of assets. JPMorgan Chase receives fees related to the structuring of multi-seller... -

Page 82

... $ 1,340 2008 2007 2006 Year ended December 31, 2008 (in millions) Loan modifications Other loss mitigation activities Prepayments $ 2,384 865 219 For additional discussion of the Framework, see Note 16 on page 188 of this Annual Report. Off-balance sheet lending-related financial instruments and... -

Page 83

... NA 85,262 Contractual cash obligations By remaining maturity at December 31, (in millions) Time deposits Advances from the Federal Home Loan Banks Long-term debt Trust preferred capital debt securities FIN 46R long-term beneficial interests(k) Operating leases(l) Contractual purchases and capital... -

Page 84

..., respectively, of this Annual Report. Line of business equity (in billions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate/Private Equity(a) Total common stockholders' equity Yearly Average 2008 2007 $ 26.1 19... -

Page 85

... a well-capitalized position, based upon Tier 1 and Total capital ratios at December 31, 2008 and 2007, as indicated in the tables below. For more information, see Note 30 on pages 212-213 of this Annual Report. Risk-based capital components and assets December 31, (in millions) Total Tier 1 capital... -

Page 86

... shares or common stock in connection with any employee benefit plan in the ordinary course of business consistent with past practice). Basel II The minimum risk-based capital requirements adopted by the U.S. federal banking agencies follow the Capital Accord of the Basel Committee on Banking... -

Page 87

... under the Firm's employee stock-based plans. The actual number of shares that may be repurchased is subject to various factors, including market conditions; legal considerations affecting the amount and timing of repurchase activity; the Firm's capital position (taking into account goodwill and... -

Page 88

... and Operations is responsible for building the information technology infrastructure used to monitor and manage risk. Treasury and the Chief Investment Office are responsible for measuring, monitoring, reporting and managing the Firm's liquidity, interest rate and foreign exchange risk. Legal and... -

Page 89

... Chief Investment Office (Liquidity, Interest Rate and Foreign Exchange Risk) Risk Management (Market, Credit, Operational and Private Equity Risk) Legal and Compliance (Legal and Fiduciary Risk) The Investment Committee oversees global merger and acquisition activities undertaken by JPMorgan Chase... -

Page 90

... Chase completed the merger with Bear Stearns. Due to the structure of the transaction and the de-risking of positions over time, the merger with Bear Stearns had no material impact on the Firm's liquidity. On September 25, 2008, JPMorgan Chase acquired the banking operations of Washington Mutual... -

Page 91

... federal funds purchased, certificates of deposits, time deposits, bank notes, commercial paper, longterm debt, trust preferred capital debt securities, preferred stock and common stock. Secured sources of funding include securities loaned or sold under repurchase agreements, asset securitizations... -

Page 92

... credit card, residential mortgage, auto and Cash Flows from Operating Activities JPMorgan Chase's operating assets and liabilities support the Firm's capital markets and lending activities, including the origination or purchase of loans initially designated as held-for-sale. The operating assets... -

Page 93

...-bearing deposits at TSS, AM and CB; net issuances of long-term debt and trust preferred capital debt securities primarily to fund certain illiquid assets held by the parent holding company and build liquidity, and by IB from client-driven structured notes transactions; and growth in commercial... -

Page 94

...Firm's credit ratings, financial ratios, earnings, cash flows or stock price. To the extent any IB structured notes do contain such provisions, the Firm believes that, in the event of an acceleration of payments or maturities or provision of collateral, the securities used by the Firm to risk manage... -

Page 95

..., concentrations levels and risk profile changes are reported regularly to senior credit risk management. Detailed portfolio reporting of industry, customer and geographic concentrations occurs monthly, and the appropriateness of the allowance for credit losses is reviewed by senior management at... -

Page 96

...credit card securitizations, see Card Services on pages 63-65 of this Annual Report. (c) Primarily represents margin loans to prime and retail brokerage customers included in accrued interest and accounts receivable on the Consolidated Balance Sheets. (d) Includes credit card and home equity lending... -

Page 97

...assets by line of business segment table for additional information. The following table presents net charge-offs (excluding gains from sales of nonperforming loans), for the years ended December 31, 2008 and 2007. Net charge-offs Wholesale Year ended December 31, (in millions, except ratios) Loans... -

Page 98

... the wholesale nonperforming assets by business segment as of December 31, 2008 and 2007. 2008 Assets acquired in loan satisfactions As of December 31, (in millions) Investment Bank Commercial Banking Treasury & Securities Services Asset Management Corporate/Private Equity Total Nonperforming loans... -

Page 99

...prior year due to the Washington Wholesale credit exposure - selected industry concentration December 31, 2008 (in millions, except ratios) Exposure by industry(a) Real estate Banks and finance companies Asset managers Healthcare State and municipal governments Utilities Retail and consumer services... -

Page 100

...• Asset Managers: Exposure in this industry grew from 2007 as a result of increased derivative exposure to primarily investment grade funds and the acquisition of loans and lending-related commitments to this industry due to the Bear Stearns merger. • All other: All other in the wholesale credit... -

Page 101

... rate, credit and foreign exchange derivatives, respectively. The increase in 2008 also included positions acquired in the Bear Stearns merger. The Firm also holds additional collateral delivered by clients at the initiation of transactions, and although this collateral does not reduce the balances... -

Page 102

... the credit approval process. The Firm risk manages exposure to changes in CVA by entering into credit derivative transactions, as well as interest rate, foreign exchange, equity and commodity derivative transactions. The graph below shows exposure profiles to derivatives over the next ten years as... -

Page 103

...from year-end 2007. The increase was primarily as a result of the merger with Bear Stearns, partially offset by the impact of industry efforts to reduce offsetting trade activity. Credit portfolio activities In managing its wholesale credit exposure the Firm purchases protection through single-name... -

Page 104

Management's discussion and analysis credit risk on the loans, lending-related commitments or derivative receivables. This activity does not reduce the reported level of assets on the balance sheet or the level of reported off-balance sheet commitments, though it does provide the Firm with credit ... -

Page 105

...mortgages, home equity loans, credit cards, auto loans, student loans and business banking loans, with a primary focus on serving the prime consumer credit market. The consumer credit portfolio also includes certain loans acquired in the Washington Mutual transaction, primarily mortgage, home equity... -

Page 106

... 90 days past due and still accruing 2008 2007 Net charge-offs 2008 2007 Average annual net charge-off rate(j) 2008 2007 Consumer loans - excluding purchased credit-impaired(a) Home equity $ 114,335 Prime mortgage 72,266 Subprime mortgage 15,330 Option ARMs 9,018 Auto loans(b) 42,603 Credit card... -

Page 107

... the consumer nonperforming assets by business segment as of December 31, 2008 and 2007. 2008 Assets acquired loan satisfactions As of December 31, (in millions) Retail Financial Services Card Services Corporate/Private Equity Total Nonperforming loans $ 6,548 4 19 $ 6,571 Real estate owned $ 2,183... -

Page 108

... the Consolidated Balance Sheets and those receivables sold to investors through securitization. Managed credit card receivables were $190.3 billion at December 31, 2008, an increase of $33.3 billion from year-end 2007, reflecting the acquisition of credit card loans as part of the Washington Mutual... -

Page 109

... 31, 2008 (in billions) Home equity Prime Subprime mortgage mortgage Total Option home loan ARMs portfolio Card reported Total consumer All loans- other loans reported Card securitized Total consumer loans- managed Auto Excluding purchased credit-impaired California $ 23.2 New York 16.3 Texas... -

Page 110

... or the size of the loss has not been fully determined. At least quarterly, the allowance for credit losses is reviewed by the Chief Executive Officer, the Chief Risk Officer, the Chief Financial Officer and the Controller of the Firm, and discussed with the Risk Policy and Audit Committees of the... -

Page 111

... the net charge-off rates. Includes $88.8 billion of home lending credit-impaired loans acquired in the Washington Mutual transaction and accounted for under SOP 03-3 at December 31, 2008. These loans were accounted for at fair value on the acquisition date, which reflected expected cash flows... -

Page 112

... by business segment at December 31, 2008 and 2007. December 31, (in millions) Investment Bank Commercial Banking Treasury & Securities Services Asset Management Corporate/Private Equity Total Wholesale Retail Financial Services Card Services Corporate/Private Equity Total Consumer - reported Credit... -

Page 113

...benefited from reduced balances of lending-related commitments. Year ended December 31, (in millions) Investment Bank Commercial Banking Treasury & Securities Services Asset Management Corporate/Private Equity(a)(b) Total Wholesale Retail Financial Services Card Services - reported Corporate/Private... -

Page 114

... fixed income (which includes interest rate risk and credit spread risk), foreign exchange, equities and commodities. Trading risk arises from positions in these asset classes and may lead to the potential decline in net income (i.e., economic sensitivity) due to adverse changes in market rates... -

Page 115

... VaR model, the Firm conducts daily back-testing of VaR against daily IB market risk-related revenue, which is defined as the change in value of principal transactions revenue (less Private Equity gains/losses) plus any trading-related net interest income, brokerage commissions, underwriting fees or... -

Page 116

... the VaR for these mortgage and credit products since daily time series are largely not available. In addition, the new VaR measure includes certain actively managed positions utilized as part of the Firm's risk management function within Corporate and in the Consumer Lending businesses to provide... -

Page 117

...a consolidated, corporate-wide basis. Business units transfer their interest rate risk to Treasury through a transfer-pricing system, which takes into account the elements of interest rate exposure that can be risk-managed in financial markets. These elements include asset and liability balances and... -

Page 118

... change in rates (in millions) December 31, 2008 December 31, 2007 +200bp $ 336 $ (26) +100bp $ 672 $ 55 -100bp $ NM(a) $ (308) -200bp $ NM(a) $ (664) Market risk management regularly reviews and updates risk limits. Senior management, including the Firm's Chief Executive Officer and Chief Risk... -

Page 119

..., monitoring, reporting and analysis, the Firm categorizes operational risk events as follows Client service and selection Business practices Fraud, theft and malice Execution, delivery and process management Employee disputes Disasters and public safety Technology and infrastructure failures Risk... -

Page 120

... may produce significant losses or reputational damage. The Fiduciary Risk Management function works with the relevant line-of-business risk committees with the goal of ensuring that businesses providing investment or risk management products or services that give rise to fiduciary duties to clients... -

Page 121

... downturn, as well as its potential impact on housing prices and the labor market. While the allowance for credit losses is highly sensitive to both home prices and unemployment rates, in the current market it is difficult to estimate how potential changes in one or both of these factors might... -

Page 122

... management's judgment related to uncertainties associated with current macroeconomic and political conditions, quality of underwriting standards, and other relevant internal and external factors affecting the credit quality of the portfolio. Fair value of financial instruments, MSRs and commodities... -

Page 123

... limited to yield curves, interest rates, volatilities, equity or debt prices, foreign exchange rates and credit curves. In addition to market information, models also incorporate transaction details, such as maturity. Finally, management judgment must be applied to assess the appropriate level of... -

Page 124

... the SFAS 131 operating segments. JPMorgan Chase generally determined its reporting units to be one level below the six major business segments identified in Note 37 on pages 226-227 of this Annual Report, plus Private Equity which is included in Corporate. This determination was based on how the... -

Page 125

... 1, 2008. The FSP did not have a material impact on the Firm's Consolidated Balance Sheets. Accounting for income tax benefits of dividends on sharebased payment awards In June 2007, the FASB ratified EITF 06-11, which must be applied prospectively for dividends declared in fiscal years beginning... -

Page 126

... activities, and not its Consolidated Balance Sheets, Consolidated Statements of Income or Consolidated Statements of Cash Flows. Determining whether instruments granted in share-based payment transactions are participating securities In June 2008, the FASB issued FSP EITF 03-6-1, which addresses... -

Page 127

...Balance Sheets, Consolidated Statements of Income or Consolidated Statements of Cash Flows. Employers' disclosures about postretirement benefit plan assets In December 2008, the FASB issued FSP FAS 132(R)-1, which requires more detailed disclosures about employers' plan assets, including investment... -

Page 128

... based upon internal models with significant observable market parameters. The Firm's nonexchange-traded commodity derivative contracts are primarily energy-related. The following table summarizes the changes in fair value for nonexchange-traded commodity derivative contracts for the year ended... -

Page 129

... trade, monetary and fiscal policies and laws; • securities and capital markets behavior, including changes in market liquidity and volatility; • changes in investor sentiment or consumer spending or saving behavior; • ability of the Firm to manage effectively its liquidity; • credit ratings... -

Page 130

... LLP, an independent registered public accounting firm, as stated in their report which appears herein. James Dimon Chairman and Chief Executive Officer Michael J. Cavanagh Executive Vice President and Chief Financial Officer February 27, 2009 128 JPMorgan Chase & Co. / 2008 Annual Report -

Page 131

... • NEW YORK, NY 10017 Report of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of JPMorgan Chase & Co.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, changes in stockholders' equity and... -

Page 132

Consolidated statements of income Year ended December 31, (in millions, except per share data) Revenue Investment banking fees Principal transactions Lending & deposit-related fees Asset management, administration and commissions Securities gains (losses) Mortgage fees and related income Credit card... -

Page 133

... capital debt securities Total liabilities Commitments and contingencies (see Note 31 on page 213 of this Annual Report) Stockholders' equity Preferred stock ($1 par value; authorized 200,000,000 shares at December 31, 2008 and 2007; issued 5,038,107 and 0 shares at December 31, 2008 and 2007... -

Page 134

... at end of year Capital surplus Balance at beginning of year Issuance of common stock Shares issued and commitments to issue common stock for employee stock-based compensation awards and related tax effects Net change from the Bear Stearns merger: Reissuance of treasury stock and the Share Exchange... -

Page 135

... the Bear Stearns merger. Also, in 2008 the fair values of noncash assets acquired and liabilities assumed in the Washington Mutual transaction were $260.0 billion and $259.8 billion, respectively. In 2006, the Firm exchanged selected corporate trust businesses for The Bank of New York's consumer... -

Page 136

... operating entities and usually have a limited life and no employees. The basic SPE structure involves a company selling assets to the SPE. The SPE funds the purchase of those assets by issuing securities to investors. The legal documents that govern the transaction specify how the cash earned... -

Page 137

...'s business banking, commercial banking, credit card, consumer lending and wealth management businesses. The acquisition was accounted for under the purchase method of accounting in accordance with SFAS 141. The $1.9 billion purchase price was allocated to the Washington Mutual assets acquired and... -

Page 138

...recorded in Corporate/Private Equity. The following condensed statement of net assets acquired reflects the value assigned to the Washington Mutual net assets as of September 25, 2008. (in millions) Assets Cash and due from banks Deposits with banks Federal funds sold and securities purchased under... -

Page 139

...leading global prime brokerage platform; strengthened the Firm's equities and asset management businesses; enhanced capabilities in mortgage origination, securitization and servicing; and expanded the platform of the Firm's energy business. The merger is being accounted for under the purchase method... -

Page 140

...37 per share) Fair value of employee stock awards (largely to be settled by shares held in the RSU Trust(b)) Direct acquisition costs Less: Fair value of Bear Stearns common stock held in the RSU Trust and included in the exchange of common stock Total purchase price Net assets acquired Bear Stearns... -

Page 141

... of net assets acquired The following reflects the value assigned to Bear Stearns net assets as of the merger date. (in millions) Assets Cash and due from banks Federal funds sold and securities purchased under resale agreements Securities borrowed Trading assets Loans Accrued interest and accounts... -

Page 142

..., loan agency and document management services On October 1, 2006, JPMorgan Chase completed the acquisition of The Bank of New York Company, Inc.'s ("The Bank of New York") consumer, business and middle-market banking businesses in exchange for selected corporate trust businesses plus a cash payment... -

Page 143

... businesses were transferred from the Treasury & Securities Services ("TSS") segment to the Corporate/Private Equity segment, and reported as discontinued operations. Condensed financial information of the selected corporate trust businesses follows. Selected income statements data(a) Year ended... -

Page 144

...the independent price verification group, are based upon established policies and are applied consistently over time. Any changes to the valuation methodology are reviewed by management to confirm the changes are justified. As markets and products develop and the pricing for certain products becomes... -

Page 145

.... Level 1 securities include highly liquid government bonds, mortgage products for which there are quoted prices in active markets (such as U.S. government agency or U.S. government-sponsored enterprise passthrough mortgage-backed securities) and exchange-traded equities. If quoted market prices are... -

Page 146

... of single-name stocks, and callable exotic interest rate options. Such derivatives are primarily used for risk management purposes. For certain derivative products, such as credit default swaps referenced to mortgage-backed securities, the value is based on the underlying mortgage risk. As these... -

Page 147

... purchased under the Federal Reserve's Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility ("AML Facility") for U.S. money market mutual funds is determined based on observable market information and is classified in level 2 of the valuation hierarchy. Liabilities Securities... -

Page 148

...Level 3) $ - - $ FIN 39 netting(d) - - Total carrying value in the Consolidated Balance Sheets $ 20,843 3,381 December 31, 2008 (in millions) Federal funds sold and securities purchased under resale agreements Securities borrowed Trading assets: Debt and equity instruments: U.S. government, agency... -

Page 149

...Physical commodities(a) - Total debt and equity instruments: Derivative receivables Total trading assets Available-for-sale securities Loans Mortgage servicing rights Other assets: Private equity investments All other Total other assets Total assets at fair value Deposits Federal funds purchased and... -

Page 150

... For the year ended December 31, 2008 (in millions) Assets: Trading assets: Debt and equity instruments Net derivative receivables Available-for-sale securities Loans Mortgage servicing rights Other assets: Private equity investments(a) All other Liabilities(b): Deposits Other borrowed funds Trading... -

Page 151

... For the year ended December 31, 2007 (in millions) Assets: Trading assets: Debt and equity instruments Net derivative receivables Available-for-sale securities Loans Mortgage servicing rights Other assets: Private equity investments(a) All other Liabilities(b): Deposits Other borrowed funds Trading... -

Page 152

... pricing information and a lack of market liquidity. • Transfers of $14.0 billion of AAA-rated CLOs backed by corporate loans, based upon a significant reduction in new deal issuance and price transparency; $10.5 billion of mortgage-related assets, including commercial mortgage-backed securities... -

Page 153

... to structured notes, principally due to significant volatility in the equity markets. • Net gains of $4.6 billion related to derivatives, principally due to changes in credit spreads and rate curves. The Firm risk manages level 3 financial instruments using securities and derivative positions... -

Page 154

...on the level of liquidity and activity in the markets for a particular product. Level 3 assets include residential whole loans, prime and Alt-A residential mortgage-backed securities rated below "AAA", subprime residential mortgage-backed securities and single-name CDS on ABS. Products that continue... -

Page 155

...determined based upon independent pricing services supported by relevant and observable market data for similar securities. The Firm classifies these securities in level 2 of the valuation hierarchy. JPMorgan Chase & Co. / 2008 Annual Report • $3.9 billion of commercial mortgage-backed securities... -

Page 156

... 107 provide only a partial estimate of the fair value of JPMorgan Chase. For example, the Firm has developed long-term relationships with its customers through its deposit base and credit card accounts, commonly referred to as core deposit intangibles and credit card relationships. In the opinion... -

Page 157

...issued guaranteed capital debt securities, is based upon current market rates and adjusted for JPMorgan Chase's credit quality. The majority of the Firm's unfunded lending-related commitments are not carried at fair value on a recurring basis on the Consolidated Balance Sheets nor are they actively... -

Page 158

... Annual Report. In 2008, the Firm elected the fair value option for certain loans acquired as part of the Bear Stearns merger that were included in the trading portfolio and for prime mortgages previously designated as held-for-sale by Washington Mutual as part of the Washington Mutual transaction... -

Page 159

... assets: Debt and equity instruments, excluding loans Loans reported as trading assets: Changes in instrument-specific credit risk Other changes in fair value Loans: Changes in instrument-specific credit risk Other changes in fair value Other assets Deposits(a) Federal funds purchased and securities... -

Page 160

... commodities inventories that are accounted for at the lower of cost or fair value), changes in fair value associated with financial instruments held by the Investment Bank for which the SFAS 159 fair value option was elected, and loans held-for-sale within the wholesale lines of business. For loans... -

Page 161

... paper 7,492 Debt securities issued by non-U.S. governments 38,647 Corporate debt securities 60,323 Equity securities 78,546 Loans 31,802 Mortgage-backed securities: Prime 1,725 Alt-A 787 Subprime 680 Non-U.S. residential 805 Commercial 2,816 Asset-backed securities: Credit card receivables 1,296... -

Page 162

... of credit, financial guarantees, deposit-related fees in lieu of compensating balances, cash management-related activities or transactions, deposit accounts and other loan-servicing activities. These fees are recognized over the period in which the related service is provided. Asset management... -

Page 163

... margin loans. (d) Includes brokerage customer payables. (e) Includes accounting conformity loan loss reserve provision related to the acquisition of Washington Mutual's banking operations. Note 9 - Pension and other postretirement employee benefit plans The Firm's defined benefit pension plans... -

Page 164

... of potential 2009 contributions to the United Kingdom ("U.K.") defined benefit plans is not reasonably estimable at this time. JPMorgan Chase also has a number of defined benefit pension plans not subject to Title IV of the Employee Retirement Income Security Act. The most significant of these... -

Page 165

... assets, beginning of year Actual return on plan assets Firm contributions Employee contributions Assets of newly material plans Benefits paid Settlements Foreign exchange impact and other Fair value of plan assets, end of year Funded (unfunded) status(a)(b) U.S. 2008 $ (7,556) (278) (488) - - - NA... -

Page 166

... Chase's expected long-term rate of return for U.S. defined benefit pension and OPEB plan assets is a blended average of the investment advisor's projected long-term (10 years or more) returns for the various asset classes, weighted by the asset allocation. Returns on asset classes are developed... -

Page 167

... of return on U.K. plan assets is an average of projected long-term returns for each asset class. The return on equities has been selected by reference to the yield on long-term U.K. government bonds plus an equity risk premium above the risk-free rate. The return on "AA"-rated long-term corporate... -

Page 168

... U.S. large and small capitalization and international equities), fixed income (including corporate and government bonds, Treasury inflation-indexed and high-yield securities), real estate, cash equivalents and alternative investments. Non-U.S. defined benefit pension plan assets are held in various... -

Page 169

... merger exchange ratio of 0.21753. The RSU Trust was established to hold common stock underlying awards granted to selected employees and key executives under certain Bear Stearns employee stock plans. The RSU Trust was consolidated on JPMorgan Chase's Consolidated Balance Sheets as of June 30, 2008... -

Page 170

... award. RSU activity Compensation expense for RSUs is measured based upon the number of shares granted multiplied by the stock price at the grant date and is recognized in net income as previously described. The following table summarizes JPMorgan Chase's RSU activity for 2008. Year ended December... -

Page 171

... any compensation cost related to share-based compensation awards to employees. Cash flows and tax benefits The total income tax benefit related to stock-based incentive arrangements recognized in the Firm's Consolidated Statements of Income for the years ended December 31, 2008, 2007 and 2006, was... -

Page 172

... The 2007 and 2006 activity reflect the 2004 merger with Bank One Corporation and the Bank of New York transaction. The table below shows the change in the merger reserve balance related to the costs associated with the transactions. 2008 Year ended December 31, (in millions) Merger reserve balance... -

Page 173

...Certificates of deposit 17,226 Debt securities issued by non-U.S. governments 8,173 Corporate debt securities 9,358 Equity securities 3,073 Mortgage-backed securities: Prime 7,762 Subprime 213 Alt-A 1,064 Non-U.S. residential 2,233 Commercial 4,623 Asset-backed securities: Credit card receivables 13... -

Page 174

... of deposit Debt securities issued by non-U.S. governments Corporate debt securities Equity securities Mortgage-backed securities: Prime Subprime Alt-A Non-U.S. residential Commercial Asset-backed securities: Credit card receivables Other consumer loans Commercial and industrial loans Other... -

Page 175

... of deposit Debt securities issued by non-U.S. governments Corporate debt securities Equity securities Mortgage-backed securities: Prime Subprime Alt-A Non-U.S. residential Commercial Asset-backed securities: Credit card receivables Other consumer loans Commercial and industrial loans Other... -

Page 176

Notes to consolidated financial statements card-related asset-backed securities, mortgage-backed securities issued by private issuers and commercial and industrial asset-backed securities. Of the $2.0 billion of unrealized losses related to credit card-related asset-backed securities, $1.7 billion ... -

Page 177

... Annual Report for further information on loans carried at fair value and classified as trading assets. For loans held for investment, other than purchased credit-impaired loans, interest income is recognized using the interest method or on a basis approximating a level rate of return over the term... -

Page 178

... loans:(a)(b) Commercial and industrial Real estate(c) Financial institutions Government agencies Other Loans held-for-sale and at fair value(d) Total wholesale loans Total consumer loans:(e) Home equity Prime mortgage Subprime mortgage Option ARMs Auto loans Credit card(f) Other Loans held-for-sale... -

Page 179

... cash flows expected to be collected arising from changes in estimates after acquisition. Accordingly, none of the credit-impaired loans acquired in the Washington Mutual transaction are reported in the following tables. Interest income on impaired loans is recognized based on the Firm's policy... -

Page 180

...would be measured based on the present value of expected cash flows discounted at the loan's (or pool's) effective interest rate. For additional information on purchased credit-impaired loans, see Note 14 on pages 175-178 of this Annual Report. JPMorgan Chase & Co. / 2008 Annual Report $ 896 1,211... -

Page 181

... Annual Report. (b) Relates to the Washington Mutual transaction in 2008. (c) The 2008 amount represents foreign-exchange translation. The 2007 amount represents assets acquired of $5 million and $5 million of foreign-exchange translation. The 2006 amount represents the Bank of New York transaction... -

Page 182

... Washington Mutual transaction. (b) The 2006 amount represents the Bank of New York transaction. Note 16 - Loan securitizations JPMorgan Chase securitizes and sells a variety of loans, including residential mortgage, credit card, automobile, student, and commercial loans (primarily related to real... -

Page 183

... heritage Bear Stearns and heritage Washington Mutual at December 31, 2008. (e) Includes credit card loans, accrued interest and fees, and cash amounts on deposit. (f) Excludes retained servicing (for a discussion of MSRs, see Note 18 on pages 199-200 of this Annual Report). (g) Excludes senior and... -

Page 184

... number of loan sales, the Firm is obligated to share up to 100% of the credit risk associated with the sold loans with the purchaser. See Note 33 on page 221 of this Annual Report for additional information on loans sold with recourse. Credit Card Securitizations The Card Services ("CS") business... -

Page 185

... noted) Credit card Principal securitized Pretax gains All cash flows during the period: Proceeds from new securitizations Servicing fees collected Other cash flows received(a) Proceeds from collections reinvested in revolving securitizations Purchases of previously transferred financial assets... -

Page 186

Notes to consolidated financial statements Year ended December 31, 2007 (in millions, except for ratios and where otherwise noted) Credit card Principal securitized Pretax gains All cash flows during the period: Proceeds from new securitizations Servicing fees collected Other cash flows received(a) ... -

Page 187

... interests, which are carried at fair value, were risk rated "A" or better. Ratings profile of retained interests(c)(d) 2008 December 31, (in billions) Asset types: Credit card(a) Residential mortgage: Prime(b) Subprime Option ARMs Commercial and other Student loans Auto Total Investment Grade... -

Page 188

Notes to consolidated financial statements December 31, 2007 (in millions, except rates and where otherwise noted) Credit card Retained interests Weighted-average life (in years) Prepayment rates(a) Impact of 10% adverse change Impact of 20% adverse change Loss assumptions Impact of 10% adverse ... -

Page 189

... of reported and securitized financial assets at December 31, 2008 and 2007. Total Loans December 31, (in millions) Home Equity Prime mortgage(a) Subprime mortgage Option ARMs Auto loans Credit card All other loans Loans held-for-sale(b) Total consumer loans - excluding purchased credit-impaired... -

Page 190

... which JPMorgan Chase is the servicer, in the amount of $3.5 billion and $637 million at December 31, 2008 and 2007, respectively. The growth in real estate owned in 2008 is attributable to the Washington Mutual transaction and increased foreclosures resulting from current housing market conditions... -

Page 191

...debt securities. See Note 23 on page 203 for further information. The Private Equity business, also included in Corporate, may be involved with entities that could be deemed VIEs. Private equity activities are accounted for in accordance with the AICPA Audit and Accounting Guide Investment Companies... -

Page 192

... include credit card receivables, auto loans, trade receivables, student loans, commercial loans, residential mortgages, capital commitments (e.g., loans to private equity, mezzanine and real estate opportunity funds secured by capital commitments of highly rated institutional investors), and... -

Page 193

... at December 31, 2008 and 2007, was 27 days and 26 days, respectively, and the average yield on the commercial paper at December 31, 2008 and 2007, was 0.6% and 5.7%, respectively. In the normal course of business, JPMorgan Chase trades and invests in commercial paper, including paper issued by the... -

Page 194

...level of outstanding variable interests (credit support, liquidity facilities, etc); • Modifications of asset purchase agreements; and • Sales of interests held by the primary beneficiary. From an operational perspective, the Firm does not run its Monte Carlo-based expected loss model every time... -

Page 195

...-term investors with qualifying tax-exempt investments, and that allow investors in tax-exempt securities to finance their investments at short-term tax-exempt rates. In a typical transaction, the vehicle purchases fixed-rate longer-term highly rated municipal bonds and funds the purchase by issuing... -

Page 196

.... (f) The ratings scale is based upon the Firm's internal risk ratings and presented on an S&P equivalent basis. Credit-linked note vehicles The Firm structures transactions with credit-linked note ("CLN") vehicles in which the VIE purchases highly rated assets, such as assetbacked securities, and... -

Page 197

... the asset swap vehicles. As a derivative counterparty, the Firm has a senior claim on the collateral of the VIE and reports such derivatives on its balance sheet at fair value. Substantially all of the assets purchased by such VIEs are investment-grade. JPMorgan Chase & Co. / 2008 Annual Report... -

Page 198

... hold some of the CDO vehicles' securities, including equity interests, as a secondary market-maker or as a principal investor, or it may be a derivative counterparty to the vehicles. At December 31, 2008 and 2007, these amounts were not significant. 196 JPMorgan Chase & Co. / 2008 Annual Report -

Page 199

...met by asset managers. (b) The aggregate of the fair value of loan exposure and any unfunded, contractually committed financing. (c) The ratings scale is based upon JPMorgan Chase's internal risk ratings and presented on an S&P equivalent basis. VIEs sponsored by third parties Investment in a third... -

Page 200

... related to VIEs that are consolidated by the Firm. Consolidated VIEs Assets December 31, 2008 (in billions) VIE program type Municipal bond vehicles Credit-linked notes CDO warehouses(a) Student loans Employee funds Energy investments Other Total Trading debt and equity Total assets(c) December... -

Page 201

... impairment during 2008 and 2007. Goodwill attributed to the business segments was as follows. December 31, (in millions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate/Private Equity Total goodwill 2008 $ 4,765 16... -

Page 202

... impact of cash settlements per the SFAS 157 disclosure for fair value measurement using significant unobservable inputs (level 3). (c) Includes MSRs acquired as a result of the Washington Mutual transaction (of which, $59 million related to commercial real estate) and the Bear Stearns merger. For... -

Page 203

... related to servicing assets on securitized automobile loans, which is recorded in lending & deposit-related fees, of $5 million and $9 million for the years ended December 31, 2008 and 2007, respectively. Amortization expense The following table presents amortization expense related to credit card... -

Page 204

... must use the loan proceeds to finance their purchases of eligible high-quality ABCP investments from MMMFs, which are pledged to secure nonrecourse advances from the FRBB. Participating banking organizations do not bear any credit or market risk related to the ABCP investments they hold under this... -

Page 205

...the line item of the host contract on the Consolidated Balance Sheets; changes in fair value are recorded in principal transactions revenue in the Consolidated Statements of Income. (b) The interest rates shown are the range of contractual rates in effect at year-end, including non U.S. dollar fixed... -

Page 206

... issued to the trusts includes the impact of hedging and purchase accounting fair value adjustments that were recorded on the Firm's Consolidated Financial Statements. (c) Subject to Series K Preferred Stock restrictions, which are discussed in Note 24 below. 204 JPMorgan Chase & Co. / 2008 Annual... -

Page 207

... value of $1 per share. On April 23, 2008, the Firm issued 600,000 shares of Fixed to Floating Rate Noncumulative Perpetual Preferred Stock, Series I ("Series I"). On July 15, 2008, each series of Bear Stearns preferred stock then issued and outstanding was exchanged into a series of JPMorgan Chase... -

Page 208

... 2008 2007 3,657.8 2006 3,618.2 Issued - balance at January 1 3,657.7 Newly issued: Common stock: Open market issuance 283.9 Bear Stearns Share Exchange Agreement 20.7 Employee benefits and compensation plans - Employee stock purchase plans - Total newly issued Canceled shares Total issued - balance... -

Page 209

...$ $ $ (a) Options issued under employee benefit plans and, in 2008, the warrant issued under the U.S. Treasury's Capital Purchase Program to purchase an aggregate 209 million, 129 million and 150 million shares of common stock were outstanding for the years ended December 31, 2008, 2007 and 2006... -

Page 210

... in interest rates. The net change during 2008 was due primarily to spread widening in credit card asset-backed securities, non-agency mortgage-backed securities and collateralized loan obligations. For further discussion of SFAS 158, see Note 9 on pages 161-167 of this Annual Report. The following... -

Page 211

.... Year ended December 31, Statutory U.S. federal tax rate Increase (decrease) in tax rate resulting from: U.S. state and local income taxes, net of federal income tax benefit Tax-exempt income Non-U.S. subsidiary earnings Business tax credits Bear Stearns equity losses Other, net Effective tax rate... -

Page 212

... tax benefits for the years 2008 and 2007. Unrecognized tax benefits Year ended December 31, (in millions) 2008 2007 $ 4,677 434 (241) - 903 (791) (158) (13) $ 4,811 JPMorgan Chase has recorded deferred tax assets of $1.4 billion in connection with net operating loss and business tax credit... -

Page 213

...). Year ended December 31, (in millions) U.S. Non-U.S.(a) Income from continuing operations before income tax expense (benefit) 2008 2007 2006 $ (2,094) $ 13,720 $12,934 4,867 9,085 6,952 Note 29 - Restrictions on cash and intercompany funds transfers The business of JPMorgan Chase Bank, National... -

Page 214

... a well-capitalized bank holding company. (f) The minimum Tier 1 leverage ratio for bank holding companies and banks is 3% or 4% depending on factors specified in regulations issued by the Federal Reserve and OCC. Note: Rating agencies allow measures of capital to be adjusted upward for deferred tax... -

Page 215

.... See Note 17 on pages 189-198 of this Annual Report for additional information on assets and liabilities of consolidated VIEs. The Firm has resolved with the IRS issues related to compliance with reporting and withholding requirements for certain accounts transferred to The Bank of New York Mellon... -

Page 216

...as equity, foreign exchange, credit, commodity or interest rate prices or indices. JPMorgan Chase makes markets in derivatives for customers and also is an end-user of derivatives in order to hedge or manage risks of market exposures, modify the interest rate characteristics of related balance sheet... -

Page 217

... did not issue short-term fixed rate Canadian dollar denominated notes due to the weak credit market for Canadian short-term debt. Over the next 12 months, it is expected that $348 million (after-tax) of net losses recorded in accumulated other comprehensive income (loss) at December 31, 2008, will... -

Page 218

...funded credit derivative where the issuer of the CLN purchases credit protection on a referenced entity from the note investor. Under the contract, the investor pays the issuer par value of the note at the inception of the transaction, and in return, the issuer pays periodic payments to the investor... -

Page 219

... scale is based upon the Firm's internal ratings, which generally correspond to ratings defined by S&P and Moody's. (c) Amounts are shown on a gross basis, before the benefit of legally enforceable master netting agreements and cash collateral held by the Firm. JPMorgan Chase & Co. / 2008 Annual... -

Page 220

...lending collateral comprises primarily cash, securities issued by governments that are members of the Organisation for Economic Co-operation and Development and U.S. government agencies. (j) Represents notional amounts of derivatives qualifying as guarantees. 218 JPMorgan Chase & Co. / 2008 Annual... -

Page 221

... may hold cash or other highly liquid collateral to support these guarantees. The carrying value of standby letters of credit of $673 million and $590 million at December 31, 2008 and 2007, respectively, which is classified in accounts payable and other liabilities in the Consolidated Balance Sheets... -

Page 222

...a purchaser and seller of credit protection in the credit derivatives market. For a further discussion of credit derivatives, see Note 32 on pages 214-217 of this Annual Report. Securities lending indemnification Through the Firm's securities lending program, customers' securities, via custodial and... -

Page 223

... advances of funds (i.e., normal servicing advances). In recourse servicing, the servicer agrees to share credit risk with the owner of the mortgage loans, such as the Federal National Mortgage Association or the Federal Home Loan Mortgage Corporation or a private investor, insurer or guarantor... -

Page 224

... experience, management expects the risk of loss to be remote. Residual value guarantee In connection with the Bear Stearns merger, the Firm succeeded to an operating lease arrangement for the building located at 383 Madison Avenue in New York City (the "Synthetic Lease"). Under the terms of the... -

Page 225

... Securities firms & exchanges Oil & gas Insurance Technology Media Central government Metals/mining All other wholesale Loans held-for-sale and loans at fair value Receivables from customers(a) Total wholesale-related Consumer-related: Home equity Prime mortgage Subprime mortgage Option ARMs Auto... -

Page 226

... Report. The Firm's long-lived assets for the periods presented are not considered by management to be significant in relation to total assets. The majority of the Firm's long-lived assets are located in the United States. Income (loss) from continuing operations before income tax expense (benefit... -

Page 227

... Income tax benefit(b) Equity in undistributed net income of subsidiaries(b) 3,155 Net income Parent company - balance sheets December 31, (in millions) $ 5,605 $ 15,365 $14,444 2008 $ 2007 110 52,972 9,563 43 1,423 28,705 52,895 128,711 25,710 850 13,241 $ 314,223 Assets Cash and due from banks... -

Page 228

...reported in the Corporate/Private Equity segment. Merger costs attributed to the business segments for 2008, 2007 and 2006 were as follows. Year ended December 31, (in millions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management... -

Page 229

... of the new Basel II capital rules. In addition, equity allocated to RFS, CS and CB was increased as a result of the Washington Mutual transaction. Discontinued operations As a result of the transaction with The Bank of New York, selected corporate trust businesses have been transferred from TSS... -

Page 230

... Stock Exchange. The high, low and closing prices of JPMorgan Chase's common stock are from The New York Stock Exchange Composite Transaction Tape. Excludes purchased wholesale loans held-for-sale. During the second quarter of 2008, the policy for classifying subprime mortgage and home equity loans... -

Page 231

...Stock Exchange. The high, low and closing prices of JPMorgan Chase's common stock are from The New York Stock Exchange Composite Transaction Tape. (f) Excludes purchased wholesale loans held-for-sale. (g) During the second quarter of 2008, the policy for classifying subprime mortgage and home equity... -

Page 232

...Accounting for Income Tax Benefits of Dividends on Share-Based Payment Awards." EITF Issue 02-3: "Issues Involved in Accounting for Derivative Contracts Held for Trading Purposes and Contracts Involved in Energy Trading and Risk Management Activities." 230 JPMorgan Chase & Co. / 2008 Annual Report -

Page 233

...between two currencies, which is either added to or subtracted from the current exchange rate (i.e., "spot rate") to determine the forward exchange rate. FSP: FASB Staff Position. FSP FAS 123(R)-3: "Transition Election Related to Accounting for the Tax Effects of Share-Based Payment Awards." FSP FAS... -

Page 234

... margin loans to prime and retail brokerage customers which are included in accrued interest and accounts receivable on the Consolidated Balance Sheets for the wholesale lines of business. REMIC: Investment vehicles that hold commercial and residential mortgages in trust and issues securities... -

Page 235

... for Income Taxes." SFAS 114: "Accounting by Creditors for Impairment of a Loan - an amendment of FASB Statements No. 5 and 15." SFAS 115: "Accounting for Certain Investments in Debt and Equity Securities." SFAS 123: "Accounting for Stock-Based Compensation." SFAS 123R: "Share-Based Payment." SFAS... -

Page 236

... Chief Executive Officer Hills & Company Washington, D.C. Walter A. Gubert Vice Chairman JPMorgan Chase & Co. Chairman JPMorgan Chase EMEA London, United Kingdom Ratan Naval Tata Chairman Tata Sons Limited Mumbai, India The Hon. Bill Bradley Former U.S. Senator Allen & Company, LLC New York, New... -

Page 237

...Chief Financial Officer Albany International Corp. Fred Wilpon Chairman Sterling Equities, Inc. Emil Duda Senior Executive Vice President and Chief Financial Officer Lifetime Healthcare Company / Excellus Health Plan Inc. Richard B. Leventhal Chairman and Chief Executive Officer Fedway Associates... -

Page 238

...and Chief Executive Officer (*denotes member of Operating Committee) Guy Chiarello Technology Carlos M. Hernandez Investment Bank Scott E. Powell Consumer Banking Andrew D. Crockett JPMorgan Chase International John J. Hogan Investment Bank/Risk Management Louis Rauchenberger Controller Gaby... -

Page 239

... Relations site of www.jpmorganchase.com. Additional questions should be addressed to: Investor Relations JPMorgan Chase & Co. 270 Park Avenue New York, NY 10017 Telephone: 212-270-6000 Directors To contact any of the Board members or committee chairs, the Presiding Director or the non-management... -

Page 240

www.jpmorganchase.com