JP Morgan Chase 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

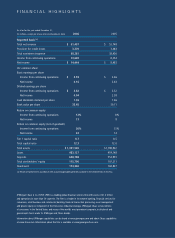

JPMorgan Chase made very good progress in 2006. We earned $13.6 billion

from continuing operations, up significantly from the year before; we grew

our major businesses – and the growth was high quality; and we positioned

ourselves extremely well for 2007 and beyond.

In this letter, I will review and assess our 2006 performance and describe key

initiatives and issues we are focusing on this year and in the future to make

our company even better. I hope, after reading this letter, that you will share

my enthusiasm about the emerging power and enormous potential of the

JPMorgan Chase franchise.

First, let’s look at 2006:

I. OUR PERFORMANCE IN 2006: PROGRESS

AND RENEWED FOCUS

At JPMorgan Chase, we analyze our performance against

a broad spectrum of measures, including growth, quality,

risk management, marketing, collaboration, operations,

controls and compliance. We continue to make significant

progress on all these fronts. Although our absolute per-

formance is not yet where it should be, the pace and level

of improvement are extremely good and make us more

confident than ever about our future.

Starting with “financial performance,” we believe there

are six key aspects of our overall 2006 performance that

illustrate the progress we have made.

Strengthened financial performance

Our earnings from continuing operations for the year

were $13.6 billion, up from $8.3 billion in 2005.

Return on equity (excluding goodwill) was 20% versus

13%. Revenue growth – almost all organic – was 14%.

These results, produced with the support of a still-favor-

able credit environment, are good, but not excellent.

And in some cases, we still trail our major competitors.

While we’re not yet top-tier in financial performance, we

feel particularly good about a number of major issues.

We essentially completed a huge, complex merger while

staying focused on business and pursuing growth; we

dramatically cut expenses and waste; and we increased

investment spending. Integration risk – the potential to

suffer major setbacks because of merger-related issues –

is always a big challenge and source of concern. But

superb execution throughout 2005 and 2006 has

enabled us to put that risk mostly behind us.

Increased management discipline and collaboration

Ultimately, we will succeed or fail based upon the talent,

dedication and diligence of our management team and

the people who work with them. On this measure, you,

our shareholders, should be extremely pleased. Your

management team regularly reviews all aspects of our

business in an open and honest way, assessing our

strengths and weaknesses, and our opportunities and

risks. The level of collaboration among business units is

higher than ever and still getting better. Our top man-

agers work well together, respect each other and take

pride in each other’s successes. As I have stressed in prior

shareholder letters, getting people to work together

across all business units is critical to our success.

DEAR FELLOW SHAREHOLDER,