INTL FCStone 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Current Drivers of Our Strategy

The rapidly changing regulatory environment and customers’

desire to transact with well-capitalized counterparties has

made the nancial sector more capital-intensive and has

increased costs. This has resulted in industry consolidation, as

smaller players are driven out of the market and larger banks

are forced to deal with increased regulatory and capital

requirements to the detriment of smaller customers. We

believe we are uniquely placed to take advantage of these

industry trends.

We have developed a broad product capability, and the

regulatory status and global footprint to allow us to maximize

the opportunity to consolidate our strength as a mid-sized

industry player. This, in turn, allows us to take advantage of

both the consolidation of the lower end of the market and the

re-positioning of banks.

We are a leading independent clearing FCM (Futures

Commission Merchant), one of the few non-bank Swap

Dealers (registered under the recent Dodd-Frank legislation)

and a registered broker-dealer in the U.S. We have regulatory

authorizations for virtually all nancial services except

deposit-taking in the UK and Ireland, and have regulated

afliates in Brazil, Argentina, Dubai, Australia and Singapore.

Each of our businesses is volatile and their nancial

performance can change due to a variety of factors that

are both outside of management’s control and not readily

predictable. To address this volatility, we have diversied into

a number of uncorrelated products and businesses as well as

geographically.

Customers

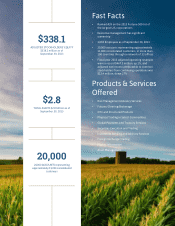

We have more than 20,000 accounts representing

approximately 11,000 separate customers, located in more

than 100 countries, including producers, processors and

end-users of nearly all widely traded physical commodities;

commercial counterparties who are end-users of our

products and services; governmental and non-governmental

organizations; and commercial banks, brokers, institutional

investors and major investment banks. All of these customers

seek to mitigate nancial price-risk embedded in their

business processes, requiring efcient access to the capital

markets.

Over the last three years we have aggressively invested in

new growth markets in Asia, Europe, Australia, Latin America

and Canada, where we see opportunities to deliver our

services to mid-market customers that are not well-served

by local players. The opportunities for us vary from a need

by mid-sized commercial entities for more sophisticated

risk management as exposure to markets increases, to

emerging markets looking for more comprehensive access to

international futures and securities exchanges. Our customer-

centric approach tends to lead to long-term customer

relationships and annuity-like revenue for the Company.

Overview

INTL FCStone is an independent nancial services

rm employing nearly 1,100 professionals in eleven

countries. We focus on providing our commercial and

institutional customers with efcient access to the global

markets, enabling them to mitigate or gain from their market

exposures, efciently access liquidity, buy or sell physical

commodities and make global payments.

We execute and clear futures, options on futures, swaps,

securities, and foreign exchange in most global nancial

marketplaces, buy and sell physical commodities, and provide

a wide variety of services, including risk and corporate nance

advisory services and global payments. We act as an execution

broker and clearer, and in certain markets we may act as

a liquidity provider or offer customized risk-management

structures not available in the traded marketplace.

We are a customer-centric organization and tailor our

services to our customers’ requirements. These services

range from high-touch risk management advisory services,

including detailed proprietary market data and analytics, to

low-touch electronic and direct market access, including a

full range of post-trade support services.

Strategy

We focus on niche products and/or customer segments that

are generally overlooked or under-served by the larger

players in our industry, while offering a broad range of services

and capabilities in almost all markets and asset classes. This

strategy focuses on higher-margin activities, allowing us to

earn an appropriate return and attain a discernible franchise

status in these niche areas with an opportunity to leverage

these relationships into a broader product offering. We aim to

be recognized as a successful mid-size nancial services rm,

providing a wide range of nancial services to a high quality,

predominantly mid-market commercial and institutional

customer base.

We use a centralized and disciplined process for capital

allocation, risk management and cost control, while

delegating the execution of strategic objectives and day-

to-day management to experienced individuals. This

requires high-quality managers, a clear communication of

performance objectives and strong nancial and compliance

controls. We believe this strategy will enable us to build a

scalable and signicantly larger organization that embraces

an entrepreneurial approach to business, supported and

underpinned by strong central controls.

I

3 2013 INTL FCStone Annual Report

Overview of Business

and Strategy