INTL FCStone 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exchanges, including the Chicago Mercantile

Exchange and its divisions, the Chicago Board of

Trade, the New York Mercantile Exchange and

COMEX; ICE Futures U.S., formerly known as the

New York Board of Trade; and the Minneapolis

Grain Exchange (“MGEX”). FCStone, LLC is one of the

largest independent FCMs in the U.S., as measured by

required customer segregated assets, not afliated

with a major nancial institution or commodity

intermediary, end-user or producer. As of September

30, 2013, FCStone, LLC had approximately $1.7

billion in required customer segregated assets.

Revenues in our clearing activities are derived from

clearing fees, commissions and interest earned on

customer balances. The exact amount of interest

retained is negotiated with each customer. We also

charge a variety of fees for services and technology.

Key costs for this business are employment costs

and the costs of technology to provide the clearing

service to our customers.

The commodities business was acquired when

we merged with FCStone in 2009. At the time of

the acquisition, this business was re-structured

to eliminate high-risk customers that accounted

for the majority of the transaction volume. In line

with our corporate strategy, we have focused on

niche customers where we believe we can earn an

appropriate risk-adjusted return, including oor

traders and “locals” as well as mid-sized trading

rms, CTAs and funds. We also look to leverage

our capabilities and capacity by offering facilities

management or outsourcing solutions to other FCMs

that may not have the necessary scale to self-clear.

The futures clearing business is a low margin,

low-touch business that is highly competitive

and characterized by surplus capacity, which has

driven down returns. The industry has suffered

from a number of well-publicized failures, which

has led to increased regulation and a resultant

increase in costs, as well as potentially more

capital being required to support customer activity.

This industry has generally been unprotable

due to low interest rates, which are a signicant

driver of clearing revenues. We have already seen

meaningful consolidation in the industry, which is

likely to continue until surplus capacity is removed,

and capital committed to the industry earns an

appropriate return. This is a scale business with high

xed costs and marginally incremental variable

costs, which tends to force pricing down to the

marginal cost point. Our response to this has been

to maintain our margins and seek out customers

that value our higher service levels and the fact

that we are well-capitalized and one of the larger

independent FCMs.

Financial Results

Management believes that the best way to assess

our nancial performance is on a fully marked-

to-market basis. Our Form 10-K, included in this

Annual Report, provides a detailed reconciliation of

these numbers to the audited numbers. We will be

reviewing our segment presentation in light of the

growth of certain of our businesses.

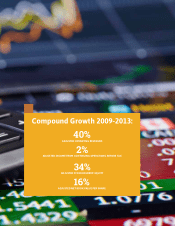

For the 2013 scal year net adjusted earnings were

$12.4 million (2012-$17.0 million, as restated). This

equated to an ROE of 4% -- signicantly below our

stated long-term target of 15%.

Fiscal 2013 highlights:

• Record adjusted operating revenues of $467.3

million.

• Completed expansion and renewal of a three-

year syndicated committed loan facility for

$140.0 million.

• Completed our rst debt offering with a $45.5

million offering of Senior Notes due in July

2020.

• Successfully registered INTL FCStone Markets,

LLC as a swap dealer.

• Increased capacity of global payments business

with a successful migration to a new technology

platform.

• Successfully transferred the accounts and

integrated the operations of Tradewire

Securities, LLC.

• Reached an agreement to transfer the accounts

of First American Capital and Trading Corp., a

transaction which closed in the rst quarter

of scal 2014, adding correspondent clearing

service capabilities to our Securities segment.

We experienced growth in adjusted operating

revenues during scal 2013 compared to scal 2012.

Net operating revenues, which represent operating

revenues net of transaction-based clearing expenses,

introducing broker commissions and interest

expense, declined $8.8 million, primarily resulting

from an increase in transaction-based expenses in

the Securities and Clearing and Execution Services

(“CES”) segments.

All of our segments, with the exception of the

Commodity and Risk Management Services (“C&RM”)

segment, experienced operating revenue growth

over the prior year. The decrease in our core C&RM