INTL FCStone 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

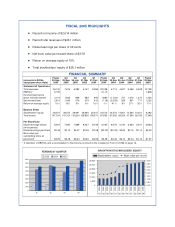

During fiscal 2005, we encountered a relatively difficult market environment, with revenues from

securities trading activities declining 24% compared to 2004. Fortunately this decline was more than

offset by the increased revenues (up 353%) from the foreign exchange business as well as a better

performance from the commodities and asset management businesses. Total revenues for 2005

increased by 19% to $26.1 million.

Total costs excluding interest and taxation increased by 22% largely due to the increased overhead

associated with the foreign exchange business. This was partially offset by lower variable costs (mainly

incentive compensation) for the securities businesses. Our overall cost to income ratio for fiscal 2005

was 84% against 80% in the prior year (excluding the effect of the beneficial conversion feature

interest charge) with our costs in fiscal 2005 being roughly equally split between fixed and variable

costs (a slightly higher ratio of fixed costs than for 2004). We have put in considerable effort to develop

a flexible cost structure that helps to shield earnings from market volatility.

During the 2005 fiscal year, management concluded that we had not properly accounted for a

beneficial conversion feature in the subordinated notes issued in March 2004. This feature arose

because the market price of our common stock at the time of the issuance of the notes was greater

than the conversion price of the notes. In May 2005 the Company restated its financial statements to

account for this beneficial conversion feature and for a related tax item and a minor lease adjustment.

These were not cash items and stockholders’ equity at September 30, 2004 was reduced from $24.749

million to $24.573 million.

In 2005, the Company recorded earnings of $2.6 million compared to a loss of $118,000 in 2004 after

the restatement. The 2005 effective tax rate of 36% is not comparable with the 2004 rate due to the

effect of the restatement.

Fully diluted earnings per share for 2005 were $0.33 compared to a loss of $0.02 in 2004.

Review of Our Businesses

The Company currently divides its business into four segments. In fiscal 2006 we will separate our

commodities trading from foreign exchange trading to create a fifth segment. The Company is

continuously evaluating additional business segments and may expand into these segments in the

future when suitable opportunities arise.

International Equities Market-Making: INTL Trading provides execution and liquidity to national

and regional broker-dealers and institutions. We make markets in approximately 350 over-the-counter

(“OTC”) American Depository Receipts (“ADRs”), including those of some of the world’s largest multi-

national corporations, and foreign ordinary shares; and in approximately 1,100 OTC bulletin board

stocks. In addition, we will on request make prices in more than 8,000 ADRs and foreign ordinary

shares and select OTC bulletin board stocks.

Equity market-making revenues for 2005 were $12.1 million (2004 — $16.7 million), down 28%. This

decline was due to tighter spreads arising from difficult market conditions, and offset the positive

impact of slightly increased volumes. We recently expanded our capabilities into the OTC bulletin

board market, where we make markets in select stocks. We continue to expand our diverse wholesale

customer relationships through our dedication to service as well as our ability to commit capital to

provide liquidity.

International Debt Capital Markets: INTL Trading provides execution and liquidity to a large

number of banks, brokers and institutional investors located around the world. We can provide

execution in over 500 international fixed income instruments including both investment grade and

higher yielding emerging market bonds. We focus on smaller issues including emerging market