INTL FCStone 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

International Assets

Holding Corporation

(Nasdaq Symbol “IAAC”)

ANNUAL REPORT

FOR FISCAL YEAR ENDED SEPTEMBER 30, 2005

Table of contents

-

Page 1

International Assets Holding Corporation (Nasdaq Symbol "IAAC") ANNUAL REPORT FOR FISCAL YEAR ENDED SEPTEMBER 30, 2005 -

Page 2

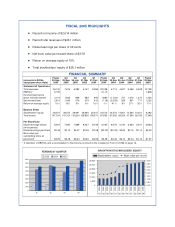

... million FINANCIAL SUMMARY (amounts in $000s, except per share data) Statement of Operations Total revenues EBITDA* Income/(loss) before taxes, minority interest... period end Fiscal 30-Sep 2005 26,140 5,139 4,119 2,614 10% Q4 Q3 Q2 Q1 30-Sep 30-Jun 31-Mar 31-Dec 2005 2005 2005 2004 7,615 6,282 6,157... -

Page 3

...international equities marketmaking, international debt capital markets, foreign exchange/commodities trading and asset management. Through offices in New York, London and Florida, the Company provides competitive execution... profitable presence in London. We now have a solid foundation from which to ... -

Page 4

CHIEF EXECUTIVE'S REPORT - 2005 REVIEW Building our Capability Three years ago the new management team laid out a strategic plan to leverage the existing equity market-making activities into other niche international markets. Based on this plan, during 2003 and 2004, we added four new business areas... -

Page 5

... commit capital to provide liquidity. International Debt Capital Markets: INTL Trading provides execution and liquidity to a large number of banks, brokers and institutional investors located around the world. We can provide execution in over 500 international fixed income instruments including both... -

Page 6

.... During 2005, we added a new debt capital markets team based in Florida, New York and London to expand our capital markets origination, structuring and distribution capability. This team focuses on private debt placements for financial institutions based in Eastern Europe, Latin America and the... -

Page 7

... in our chosen markets in order to provide a value-added execution capability to our customers. During the fiscal year we added 14 new members to our staff, which now numbers 67 in total. We believe that we have further strengthened human capital both on the production and support side of our... -

Page 8

... 2005 was a difficult year for us with tough market conditions, financial restatement and having to re-engineer parts of our infrastructure. Despite this, we believe we have made progress in further growing and diversifying our business as well as laying the foundation for future growth. A number... -

Page 9

...ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2005 Commission File Number 000-23554 INTERNATIONAL ASSETS HOLDING CORPORATION..., Florida 32701 (Address of principal executive offices) (407) 741-5300 (Issuer's telephone number) ... -

Page 10

INTERNATIONAL ASSETS HOLDING CORPORATION 2005 FORM 10-KSB TABLE OF ...Information ...PART III Item 9. Item 10. Item 11. Item 12. Item 13. Item 14. Directors and Executive Officers of the Registrant ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management And Related... -

Page 11

...Form 8-K, statements of changes in beneficial ownership and press releases are available in the Investor Relations section of this website. The Company's website also includes the Company's Code of Ethics, which governs the Company's directors, officers and employees, and other information regarding... -

Page 12

... board stocks. The Company conducts these activities through INTL Trading, which provides execution services and liquidity to national broker-dealers, regional broker-dealers and institutional investors. The Company focuses on those international equities in which the Company can use its expertise... -

Page 13

... debt capital markets team based in London and Florida, thereby adding a structuring capability and expanding the Company's origination and distribution capability. This team focuses on private debt placements for financial institutions based in Eastern Europe, Latin America and the Caribbean... -

Page 14

... with the U.S. Securities and Exchange Commission ("SEC"). In July 2004, INTL Consilium launched the Emerging Market Absolute Return Fund, which had over $55 million in assets under management on September 30, 2004 and over $117 million on September 30, 2005. The Company's strategy is to build the... -

Page 15

... of New York. On December 1, 2005, INTL Trading began clearing through Broadcort, a division of Merrill Lynch, Pierce, Fenner & Smith, Inc. INTL Trading does not hold customer funds or directly clear or settle securities transactions. The Company's administrative staff manages the Company's internal... -

Page 16

... loans to any stockholder, employee or affiliate, if such ...2005 fiscal year, INTL Trading maintained net capital which exceeded the minimum levels required by SEC...by numerous national and international factors that are beyond... and volatility of interest rates legislative and regulatory changes currency... -

Page 17

... to a number of risks... order execution the ...manage its inventory risk successfully. Accordingly, the Company may experience significant losses, which could materially adversely affect its business, financial condition and operating results. Unexpected losses due to counterparty failures and credit... -

Page 18

.... The Company competes primarily on the basis of its expertise and quality of service. A number of the Company's competitors have significantly greater financial, technical, marketing and other resources than the Company has. Some of them may offer alternative forms of financial intermediation as... -

Page 19

.... The Company and certain of its officers and employees, have, in the past, been subject.... New or revised legislation or regulations imposed by the SEC, other...adverse resolution of any future lawsuits or claims against the Company...trading business, active since October 2005, may be subject to potential... -

Page 20

..., as well as other related costs. The Company seeks to...management's assessment of the Company's business, the Company believes that a small number...Management The Company seeks to mitigate the market and credit risks arising from its financial trading activities through an active risk management... -

Page 21

... 3,900 square feet of office space in London on November 24, 2005. Occupation of the new premises will be in January 2006. The lease expires on December 20, 2012. During the 2004 fiscal year the Company leased approximately 310 square feet of office space in Miami, Florida. This lease commenced on... -

Page 22

...FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ...of high and low sales prices for the common stock as reported by NASDAQ. These prices do not include retail mark-ups,...Information The following table presents information regarding the Company's equity compensation plans at September 30, 2005: Number... -

Page 23

...new management and raised approximately $3,400,000 in additional capital. In the second quarter of fiscal 2003, the Company began trading and related activities in international...quarter of fiscal 2005 the Company expanded its debt capital markets team in London and Florida, introducing structuring ... -

Page 24

.... The Company's activities are currently divided into international equities market-making, international debt capital markets, foreign exchange/commodities trading and asset management. In fiscal 2006, the commodities trading business will be reported as a separate segment. The Company is focused... -

Page 25

...2005 and fiscal year 2004. Fiscal Year 2005 Percentage of Total 2005 Fiscal Year 2004 Percentage of Total 2004 Percentage Change in Expense 2004-2005 Compensation and benefits ...$10,483,000 Clearing and related... because it believes that it permits investors to make a more meaningful comparison ... -

Page 26

... into equity in August 2004. In May 2005 the Company restated its financial statements for fiscal 2004 to account for the beneficial conversion feature, a related tax item and a minor lease adjustment. As a result of the restatement, previously reported net income for 2004 was reduced from $2,525... -

Page 27

... and clearing related charges and variable trader compensation, as more fully described below. Net contribution is one of the key measures used by management to assess the performance of each segment and for decisions regarding the allocation of the Company's resources. International Equity Market... -

Page 28

...Company's compensation and benefit expense increased 23% from $8,490,000 in 2004 to $10,483,000 in 2005. The increase was a result of both higher staff levels and higher performance based compensation due to increased revenues and profitability. The average number of employees during the first three... -

Page 29

...due to increased office rental following the acquisition of INTL Global Currencies in London and the lease of additional space in New York. The Company also had additional expense for equipment rental, primarily information services, required for the Company's additional employees. Professional Fees... -

Page 30

..., amounting to approximately $2,060,000 at September 30, 2005, in the United Kingdom. INTL Trading is subject to the net capital requirements of the SEC and the NASD relating to liquidity and net capital levels. At September 30, 2005, INTL Trading had regulatory net capital of $4,521,000, which... -

Page 31

...statements of operations of the Company as of September 30, 2005. The Company's assets and liabilities may vary significantly from period to period because of changes relating...calculated at 10% of revenues exceeding $10,000,000 in the annual period ending June 30, 2006, and 10% of revenue exceeding ... -

Page 32

...reported in the consolidated financial statements. Due to their nature, estimates involve judgment based upon available information...transactions completed during each reporting period, the foreign exchange rate in effect at the... stated at market value with related changes in unrealized appreciation or... -

Page 33

... financial statements at September 30, 2005 at fair value of the related financial ...COMEX division of the New York Mercantile Exchange. The ...part of its firm-wide risk management policies. Effects of Inflation Because the...such as compensation and benefits, clearing and related expenses, occupancy and ... -

Page 34

... a dealer, to satisfy customer needs and mitigate risk. The Company manages risks from both derivatives and non-derivative cash instruments on a consolidated ...but in aggregate with the Company's other trading activities. Management believes that the volatility of revenues is a key indicator of the ... -

Page 35

..., acquired additional resources regarding financial reporting and adopted policies regarding the review of complex financial transactions. In connection with the filing of this Form 10-KSB, the Company's management, including the Chief Executive Officer and Chief Financial Officer, evaluated the... -

Page 36

...likely to materially affect the Company's internal control over financial reporting during the fiscal year ended September 30, 2005. It should be noted that ...of our Chief Executive Officer and Chief Financial Officer are made at the "reasonable assurance" level. ITEM 8B OTHER INFORMATION Not ... -

Page 37

... 10. EXECUTIVE COMPENSATION Information with respect to this item will be contained in the Proxy Statement for the 2006 Annual Meeting of Shareholders, which is incorporated herein by reference. ITEM 11. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS... -

Page 38

...Company and Royal & Sun Alliance Insurance plc for the lease of office premises in London (incorporated by reference from Form 8-K, as filed with the SEC on December 1, 2005). International Assets Holding Corporation Code of Ethics (incorporated by reference from the Company's Form 10-KSB filed with... -

Page 39

... Accounting Policies, or the Notes to the Consolidated Financial Statements. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES Information with respect to this item will be contained in the Proxy Statement for the 2006 Annual Meeting of Shareholders, which is incorporated herein by reference... -

Page 40

... behalf by the undersigned, thereunto duly authorized. INTERNATIONAL ASSETS HOLDING CORPORATION By: /s/ SEAN M. O'CONNOR Sean M. O'Connor, Chief Executive Officer Dated: December 21, 2005 In accordance with the Securities and Exchange Act of 1934, this report has been signed below by the following... -

Page 41

... We have audited the accompanying consolidated balance sheet of International Assets Holding Corporation, Inc. and subsidiaries (the "Company") as of September 30, 2005, and the related consolidated statements of operations, changes in stockholders' equity and cash flows for the year then ended... -

Page 42

... principles generally accepted in the United States of America. As discussed in Note 2 of the consolidated financial statements, the consolidated financial statements for the year ended September 30, 2004 have been restated. KPMG LLP Tampa, Florida December 12, 2004, except as to Note 2, which... -

Page 43

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Consolidated Balance Sheets September 30, 2005 and 2004 2005 2004 as restated... Investment in asset management joint venture ...676,660 Investment in INTL Consilium sponsored fund...Accrued compensation and benefits ...2,059,189 ...statements. F-3 -

Page 44

... CORPORATION AND SUBSIDIARIES Consolidated Statements of Operations Years ended September 30, 2005 and 2004 2005 2004 as restated Revenues: Net dealer inventory and investment gains ...Commissions, net ...Interest income ...Dividend expense, net ...Equity in income (loss) from asset management... -

Page 45

... Statements of Changes in Stockholders' Equity Years ended September 30, 2005 and 2004 Preferred Common stock stock Additional paid-in capital Accumulated deficit Treasury stock, at cost Total stockholders' equity Balances at October 1, 2003, as previously reported ...Effect of restatement... -

Page 46

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Consolidated Statements of Cash Flows Years Ended September 30, 2005 and 2004 2005 2004 as restated Cash flows from operating activities: Net income (loss) ...Adjustments to reconcile net income (loss) to net cash provided by (used in) ... -

Page 47

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Consolidated Statements of Cash Flows Years Ended September 30, 2005 and 2004 2005 2004 as restated Supplemental disclosure of cash flow information: Cash paid for interest ...Income taxes paid ...Supplemental disclosure of noncash investing... -

Page 48

... (see Notes 1(l) and 4 for more information). (b) Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and... -

Page 49

... value, with related unrealized gains or...government, provincial and corporate...interest rate spread...2005 has been recorded at fair value, determined by management, of $36,662. Pricing information is not publicly available so management has utilized financial statements and other financial information... -

Page 50

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 The Company has made an investment in a hedge fund sponsored by INTL...tax rates ...management, is more likely than not to be realized. (i) Stock-Based Employee... -

Page 51

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 If the...convertible notes. 2005 2004 as restated Diluted earnings (loss) per share Numerator: Net income (loss) ...Denominator: Weighted average number of: ... -

Page 52

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (k) Effects of Recently Issued Accounting Standards Share-Based Payments - In December 2004, the FASB issued SFAS No. 123 (revised 2004), Share-Based ... -

Page 53

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (n) Reclassification Certain amounts in the 2004 financial statements have been reclassified to conform with the 2005 presentation. (2) Restatement In May ... -

Page 54

... 30, 2004 and financial information for the year ended September 30, 2005 is presented for comparative purposes: Year Ended Sept. 30, 2004 previously reported Year Ended Sept. 30, 2004 adjustment restatement Year Ended Sept. 30, 2004 as restated Year Ended Sept. 30, 2005 (All figures below are... -

Page 55

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (3) Issuance of Convertible Subordinated Notes, Conversion of Subordinated Notes into Common Shares and related Debt Issuance Costs On March 12, 2004, the ... -

Page 56

... and condensed balance sheet of INTL Consilium. INTL Consilium, LLC Condensed Statement of Operations For the year ended September 30, 2005 and For the period from inception May 11, 2004 through September 30, 2004 (Unaudited) 2005 2004 Revenues: Management and investment advisory fees ...Interest... -

Page 57

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 INTL Consilium, LLC Condensed Balance Sheet September 30, 2005 and 2004 (Unaudited) 2005 2004 Assets Cash ...$ 213,863 Management and investment advisory ... -

Page 58

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005...paid $67,047 for legal and accounting related fees. The Company is obligated to ...human resources, including trading staff, operations, administration and management... -

Page 59

... of the additional goodwill accrual of $2,352,700 is reported as deferred acquisition consideration payable in the consolidated balance sheets. The goodwill related to the INTL Global Currencies acquisition is as follows: September 30, 2005 September 30, 2004 Cash premium paid to sellers ...Cash... -

Page 60

...'s executive officers and directors. See note 3 for additional information regarding the issuance and conversion of the Notes. One of the Company's principal shareholders has made an investment, valued at approximately $95,000,000 as of September 30, 2005, in a hedge fund managed by INTL Consilium... -

Page 61

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (10) Financial Instruments Owned and Financial Instruments Sold, Not Yet Purchased, at Fair Value Financial instruments owned and financial instruments ... -

Page 62

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Listed below is the fair value of trading-related derivatives as of September 30, 2005 and September 30, 2004. Assets represent net unrealized gains and ... -

Page 63

... Financial Statements-(Continued) September 30, 2005 and 2004 (12) Trust Certificates and Total Return Swap During the quarter ended December 31, 2004, the Company entered into a series of financial transactions (the "Transactions") with an unaffiliated financial institution in Latin America for... -

Page 64

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 received but not yet recognized as revenue, amounting to $166,556, appear as a liability on the Consolidated Balance Sheets as at September 30, 2005...related... -

Page 65

... facilities range from 1.25% to 2.75% over the London Interbank Offered Rates ('LIBOR') (approximately 3.9% at September 30, 2005), or are at the U.S. broker loan rate (approximately 4.3% at September 30, 2005). At September 30, 2004, INTL Global Currencies had a multi-currency on-demand overdraft... -

Page 66

...Statements-(Continued) September 30, 2005 and 2004 currencies. Amounts borrowed bore interest at LIBOR for each currency plus 2%. The overdraft facility was guaranteed by International Assets Holding Corporation. At September 30, 2004, the net borrowings of INTL Global Currencies exceeded its credit... -

Page 67

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 At September 30, 2005 and 2004, the U.S. dollar equivalents of the components of the net borrowing payable to banks were as follows: 2005...of credit ...Total... -

Page 68

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (18) Capital and Cash Reserve Requirements INTL Trading is a member of the NASD and is subject to the SEC Uniform Net Capital Rule 15c3-1. This Rule ... -

Page 69

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (20) Income Taxes Income tax expense (benefit) for the years ended September 30, 2005 and 2004 consisted of: Current Deferred Total 2005: United States ... -

Page 70

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Deferred income taxes as of September 30, 2005 and 2004 reflect the impact of "temporary differences" between amounts of assets and liabilities for ... -

Page 71

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (21) Employee Benefit Plan Effective January 1, 2003, the Company implemented a Savings Incentive Match Plan for Employees IRA (SIMPLE IRA). All employees ... -

Page 72

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 2005 where the exercise price was greater than the market price on the grant date was $4.37. No options were granted during 2004 where the exercise ... -

Page 73

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Incentive Stock Options As of September 30, 2005, options outstanding under qualified incentive stock options, including their grant date, exercise price ... -

Page 74

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Nonqualified Stock Options As of September 30, 2005...($6.00 strike price, 3 year life, risk free interest rate 2.27%) for the 200,000 warrants issued to the ... -

Page 75

... termination fee would be the reasonable and documentable deconversion-related expenses. The Company has entered into individual employment agreements with its Chief Executive Officer and President that initially matured on October 21, 2005. The agreements automatically renew for one additional year... -

Page 76

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (25) Quarterly Financial Information (Unaudited) The Company has set forth below certain unaudited financial data for all eight quarters in the fiscal ... -

Page 77

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Quarter Ended June 30, 2004 previously reported Quarter Ended June 30, 2004 restatement adjustment Quarter Ended June 30, 2004 as restated...average number of... -

Page 78

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Quarter Ended Dec. 31, 2004 previously reported Quarter Ended Dec. 31, 2004 restatement adjustment Quarter Ended Dec. 31, 2004 as restated Quarter Ended ... -

Page 79

... the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 trades and invests in international bonds, including both investment grade and higher yielding emerging market bonds. The Company generally focuses on smaller issues, such as emerging market sovereign, corporate and bank... -

Page 80

... HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 Information concerning operations in these segments of business is approximately shown in accordance with SFAS No. 131 as follows: 2005 2004 Revenues: International equities... -

Page 81

INTERNATIONAL ASSETS HOLDING CORPORATION AND SUBSIDIARIES Notes to the Consolidated Financial Statements-(Continued) September 30, 2005 and 2004 (27) Subsequent Events On November 24, 2005 INTL Global Currencies entered into a new office lease for approximately 3,900 square feet for its London ... -

Page 82

... Assets, Inc. Florida, USA IAHC 100% INTL Consilium LLC Florida, USA IAHC 50.1% IAHC Bermuda Limited INTL Holding (UK) Ltd. Bermuda UK IAHC IAHC 100% 100% INTL Global Currencies Ltd. UK INTL Holding (UK) Ltd. 100% This Annual Report contains "forward-looking statements" within the... -

Page 83

... is an important aspect of this system of internal controls and management has established a Risk Committee to establish and monitor conformance with risk policies. Investor Relations The Company seeks to provide accurate and timely information to shareholders and other stakeholders to facilitate... -

Page 84

... COMMITTEE EXECUTIVE OFFICERS BRIAN T. SEPHTON CHIEF FINANCIAL OFFICER AND TREASURER JONATHAN C. HINZ GROUP CONTROLLER NANCEY MCMURTRY SECRETARY AND COMPLIANCE OFFICER OFFICES 220 E. CENTRAL PARKWAY ALTAMONTE SPRINGS, FL 32701 TEL: (305) 407-5300 FAX: (305) 470-0808 708 THIRD AVENUE NEW YORK, NY... -

Page 85

220 E. CENTRAL PARKWAY ALTAMONTE SPRINGS, FLORIDA 32701