ING Direct 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

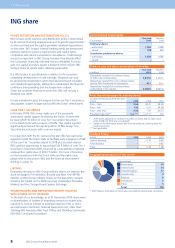

result of the agreement, ING was able to repurchase EUR 5 billion

of the core Tier 1 securities at the issue price (EUR 10 per security).

The total payment amounted to EUR 5,605 million and consisted

of a repayment of the EUR 5 billion principal amount plus accrued

coupon from 12 May 2009 to 20 December 2009 of EUR 259

million and a premium of EUR 346 million.

Furthermore, in order to obtain approval from the EC on our

restructuring plan, additional payments will be made to the Dutch

State for the IABF, corresponding to a reduction of 50 basis points

on the funding fee monthly received by ING and an increase of

82.6 basis points on the guarantee fee annually paid by ING. In

total, these annual extra payments amounted to a net present

value of EUR 1.3 billion, which was booked as a one-time pre-tax

charge in the fourth quarter of 2009. Under the agreement,

the IABF as announced in January 2009, including the transfer

price of the securities of 90%, will remain unaltered.

In order to finance the repayment of the core Tier 1 securities and

to mitigate the EUR 1.3 billion pre-tax capital impact of the

additional payments for the IABF, ING launched a EUR 7.5 billion

rights issue. ING aims to finance any further repayments of

core Tier 1 securities from internal resources, including proceeds

from the divestment of the insurance operations.

FINANCIAL HIGHLIGHTS ING GROUP 2009

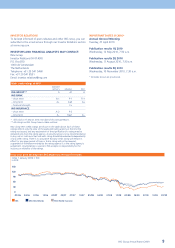

Notwithstanding the challenging environment in 2009, ING

significantly improved its operating performance, successfully

reduced expenses and returned to profit on an underlying basis.

Total net result of the Group decreased by EUR 206 million to

EUR –935 million. This net loss reflects a one-time after tax charge

due to an accrual of additional future payments to the Dutch state

of EUR 930 million after tax for the IABF as part of the agreement

with the EC announced in October 2009. On an underlying basis,

ING posted a positive net result of EUR 748 million for the full-year

2009, compared with a loss of EUR 304 million in 2008, as financial

markets began to stabilise and operating conditions improved.

As a result of our Back to Basics programme, operating expenses,

included in underlying result, were reduced by 6.9%, or EUR 987

million (pre-tax).

Underlying net result is derived from total net result by excluding

the impact from divestments and special items. Special items were

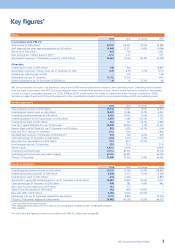

ING results 2009*

Group Banking Insurance

EUR million 2009 2008 2009 2008 2009 2008

Underlying result before tax, excluding market impact,

risk costs and VA assumption changes 8,767 7,023 7,393 5,263 1,374 1,760

Subprime RMBS –350 –120 –160 –81 –190 –39

Alt-A RMBS –1,405 –2,063 –1,245 –1,823 –160 –240

Prime RMBS –47 0–47 0 0 0

Other ABS –37 –4 –37 –4 0 0

CDO/CLO 133 –394 –1 –122 134 –272

CMBS –25 000–25 0

Monoliners –58 –9 –58 –9 0 0

Other debt securities –174 –809 0–255 –174 –554

Impairments / fair value changes debt securities –1,963 –3,399 –1,548 –2,294 –415 –1,105

Equity securities impairments –302 –1,454 –49 –331 –253 –1,123

Capital gains on equity securities 426 754 24 30 402 724

Hedges on direct equity exposure –312 482 0 0 –312 482

Hedges on indirect equity exposure –417 –49 0 0 – 417 -49

DAC unlocking –351 –1,094 0 0 –351 –1,094

Equity related impact –957 –1,361 –25 –302 –932 –1,059

Real Estate revaluations / impairments –2,156 –1,173 –1,687 –732 –469 – 441

Private equity revaluations 56 –413 0 0 56 –413

Real Estate / Private equity –2,10 0 –1,587 –1,687 –732 –413 –855

Capital gains on debt securities 33 –106 –19 052 –106

Other market impact 244 –220 –241 –206 485 –14

Other 278 –325 260 –206 –538 –119

Total market impacts –4,742 –6,674 –3,520 –3,534 –1,222 –3,140

Loan loss provisions Bank –2,973 –1,280 –2,973 –1,280 0 0

Variable annuity assumption changes –343 000–343 0

Total market volatility, risk costs and variable

annuity assumption changes –8,058 –7,954 –6,493 –4,814 –1,565 –3,140

Underlying result before tax 709 –931 900 449 –191 –1,380

Tax and third party interests –38 –627 – 61 –273 23 –354

Underlying net result 748 –304 961 722 –214 –1,026

Divestments and special items –1,683 –425 –1,261 –267 –422 –158

Total net result –935 –729 –299 454 –636 –1,183

* Numbers may not add up due to rounding.

ING Group Annual Report 2009 13