ING Direct 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company, we also worked closely with the Dutch authorities and

the European Commission (EC) to identify steps which would

enable ING to get the EC’s approval for the support received from

the Dutch State. This process was finalised in the second half of

2009 and is further explained below.

RESTRUCTURING PLAN SUBMITTED TO THE

EUROPEAN COMMISSION

Under European rules, state-supported companies need to

demonstrate their long-term viability and take actions to prevent

undue distortions of competition. As a result, parallel to the

introduction and implementation of the first phases of the Back

to Basics programme, we were required to develop and submit

a restructuring plan to the EC. Against this backdrop we had to

devise a plan that would not only enable us to pay back the Dutch

State and address the EC’s requirements, but also return our focus

to the business and our customers. This was a challenging exercise,

especially since the relevant EC guidelines were only published

in July 2009, which postdated ING’s transactions with the

Dutch State.

Our negotiations with the EC were finalised in October 2009. On

18 November, the EC formally approved the restructuring plan,

which ING had submitted. With this decision the EC also gave final

clearance for the issuance of the core Tier 1 securities to the Dutch

State and for the IABF. On 25 November 2009, the extraordinary

General Meeting approved the resulting strategic shift of the

Company, as well as the proposed rights issue of EUR 7.5 billion to

facilitate an early repayment of the Dutch State. The Restructuring

Plan’s strategic implications for ING are explained below.

As already explained, a key goal of the Back to Basics programme

was to reduce ING’s complexity by operating the Bank and Insurer

separately under the one Group umbrella. The negotiations with

the EC on the Restructuring Plan have thus acted as a catalyst to

accelerate this process, by completely separating our banking and

insurance operations, and ultimately eliminating our double

leverage. The backgrounds and objectives of this strategic shift are

further explained in the Strategy section (page 15).

ING has had to accept a number of commitments to obtain the

EC’s approval for the transactions with the Dutch State. One of

these involves the divestment of ING Direct US. It is anticipated that

this divestment will take several years and be completed before the

end of 2013. In the meantime, we will ensure that we continue to

grow the value of the business and invest in a superior customer

experience. We regard ING Direct US as a very strong franchise and

the US market clearly offers potential for growth. The concession

regarding ING Direct US has no impact on ING Direct in other

countries. We remain committed to the ING Direct franchise as a

strong contributor to our growth. Its unique customer proposition,

simple transparent products and market-leading efficiency are core

elements of our banking strategy.

Also as part of the Restructuring Plan, a new company will be

created in the Dutch retail market out of part of our current

operations, by combining the Interadvies banking division

(including WestlandUtrecht Hypotheekbank and the mortgage

activities of Nationale-Nederlanden) and the existing consumer

lending portfolio of ING Retail. This business, once separated, will

be divested. The combined business will be the number 5 financial

institution in the Netherlands. It is profitable and currently has a

balance sheet of EUR 37 billion, with around 200,000 mortgage

contracts, 320,000 consumer lending accounts, 500,000 savings

accounts and 76,000 securities contracts. The business has a

mortgage portfolio amounting to approximately EUR 34 billion,

which equates to a market share of around 6%.

Furthermore, ING must refrain from being a price leader within

the EU for certain retail and SME banking products, and must

refrain from acquisitions of financial institutions that might slow

down the repayment of the core Tier 1 securities. These restrictions

will apply for the shorter period of three years or until the core

Tier 1 securities have been repaid in full to the Dutch State.

ING had submitted the Restructuring Plan on the condition that the

EC guarantees equal treatment of all state-supported financial

institutions and safeguards the level playing field in the EU internal

market. In January 2010, ING lodged an appeal with the General

Court of the European Union against specific elements of the EC’s

decision of 18 November 2009. The first element involves ING and

the Dutch State’s agreement upon a reduction of the repayment

premium for the first EUR 5 billion tranche of core Tier 1 securities.

This agreement provided the Dutch State with an early repayment

and at an attractive return. The Commission views this reduction as

additional state aid of approximately EUR 2 billion. Both ING and

the Dutch State contest this element of the decision, as it could

hamper discussions between ING and the State on repayment

terms of the remaining core Tier 1 securities.

ING also seeks a ruling on the price leadership restrictions and the

proportionality of the restructuring requirements demanded by the

EC. ING believes it is in the interest of all its stakeholders to use the

opportunities provided by law to let the General Court review these

elements of the EC’s decision. The appeal does not alter ING’s

commitment to execute its Restructuring Plan as announced on

26 October 2009. ING stands firmly behind its strategic decision

to separate Banking and Insurance operations and divest the latter.

These processes are on track and will continue as planned.

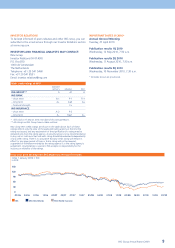

The restructuring measures, including steps already taken as part

of our Back to Basics programme, are expected to result in a pro

forma balance sheet reduction of around EUR 600 billion by 2013,

approximately the equivalent of 45% of the balance sheet at

30 September 2008. This will be achieved through divestments

mentioned above and further deleveraging of the bank balance

sheet. Including estimated organic growth, it is expected that by

the end of 2013 our balance sheet will be approximately 30%

smaller than at 30 September 2008. The proceeds from divesting

the insurance operations will be used to eliminate double leverage

and further repay the Dutch State.

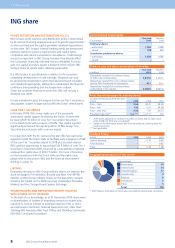

RIGHTS ISSUE AND ADDITIONAL AGREEMENTS

WITH THE DUTCH STATE

In conjunction with the Restructuring Plan submitted to the EC,

we also reached an agreement with the Dutch State to modify the

repayment terms of the core Tier 1 securities in order to facilitate

early repayment, bringing the terms in line with Dutch peers. We

thereby made use of an early repayment option to repurchase half

of the core Tier 1 securities before the end of January 2010. As a

ING and the financial environment (continued)

1.2 Report of the Executive Board

ING Group Annual Report 2009

12