ING Direct 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

ING and the financial environment

Key points

> Global economy recovering after

steep downturn

> Transactions with the Dutch State amidst

market turmoil

> Back to Basics programme has reduced

complexity and increased focus

> Restructuring Plan approved by European

Commission

> First repayment to Dutch State following

rights issue

After the unprecedented shockwave that hit financial markets

in 2008, we initiated transactions with the Dutch State to

strengthen our capital base and reduce our risk exposure, while

redefining our strategic course. Hence, it was clear from the

beginning that 2009 would be a difficult year for ING. Throughout

the year, market conditions remained challenging, but the second

half of 2009 also brought the first signs of recovery. ING’s first

priorities were to stabilise the Company, restore credibility and regain

trust. We thus introduced Back to Basics, a change programme

comprising a series of measures to decrease costs, reduce risk and

capital exposures, and deleverage the balance sheet, with the

ultimate objective of increasing focus on the essence of financial

services and creating a more coherent set of activities. We

simplified the governance structure by operationally separating the

Bank and the Insurer under the umbrella of the Group, and carried

out a portfolio review, which led to a number of divestments.

Meanwhile, we managed to turn around our commercial

performance. Above anything, however, 2009 will be remembered

as the year in which we took the most far-reaching decisions in

the history of the Company. First of all, we set a clear course for the

future by announcing an independent future for our Bank and our

Insurer. In addition, we closed an early repayment agreement with

the Dutch State on 50% of the capital provided in October 2008.

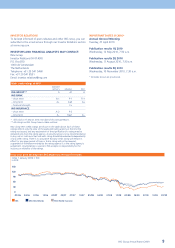

GLOBAL ECONOMY SHOWING SIGNS OF RECOVERY

AFTER STEEP DOWNTURN

From September 2008 onwards, especially after the collapse of

Lehman Brothers, market conditions rapidly worsened. Due to

the impact of the financial crisis, macro-economic prospects at the

beginning of 2009 were very bleak. The steep economic downturn

was reflected in a sharp decline in world trade, asset prices and

industrial production and a tightening availability of credit. As a

consequence, even a repetition of the Great Depression was

considered a plausible scenario. In contrast to the 1930s, however,

policy makers around the world acted swiftly and firmly, by

providing significant economic stimuli and loosening monetary

conditions. Governments took exceptional measures to reinvigorate

financial institutions and stabilise the financial system. As a result,

an increasing number of countries were able to report positive

economic growth in the second half of the year.

World trade seems to have picked up firmly and in many countries

the rise in unemployment seems to have a less adverse impact on

the economy than expected. Nevertheless, the recovery of

the global economy remains fragile. Companies have rebuilt

inventories despite a strengthening consumer and investor demand.

However, as a result of the market interventions to cushion the

impact of the crisis, public finances have been thrown off-balance.

Our Economics Department’s forecasts for 2010 and 2011 indicate

that the global economy will return to growth, albeit at a slower

pace than before the crisis.

Notwithstanding the negative impact of the financial crisis on

the overall economic climate, which clearly weakens the growth

prospects for the financial services industry, the crisis also offers

new opportunities for financial institutions. The substantial

reduction in asset values during the financial crisis has reinforced

customer demand for wealth accumulation and raised consumer

awareness of the need for financial protection.

Back to Basics

1.2 Report of the Executive Board

ING Group Annual Report 2009

10