ING Direct 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

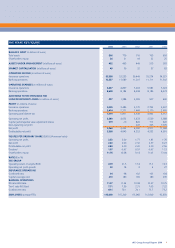

FINANCIAL HIGHLIGHTS

(continued)

1.2

OUR PERFORMANCE

12 ING Group Annual Report 2004

DIVIDEND

Net profit per share rose 40.0% to EUR 2.80, compared with

EUR 2.00 in 2003. The increase in earnings per share lagged

growth in total net profit due to an increase in the average

number of shares outstanding as a result of ING’s dividend

policy, which allowed investors to receive the dividend in cash

or stock. Dilution of earnings per share was limited in 2004

because ING stopped issuing shares to fund the cash portion

of the dividend payment, starting with the interim dividend

2004. Moreover, ING decided to return to full cash dividend

as from the final 2004 dividend.

At the Annual General Meeting of Shareholders on 26 April

2005, ING will propose a total dividend for 2004 of EUR 1.07

per (depositary receipt for an) ordinary share, up from

EUR 0.97 per (depositary receipt for an) ordinary share in

2003. Taking into account the interim dividend of EUR 0.49

made payable in September 2004, the final dividend will

amount to EUR 0.58 per (depositary receipt for an) ordinary

share, to be paid fully in cash. ING’s shares will be quoted

ex-dividend as of 28 April 2005 and the dividend will be

made payable on 4 May 2005.

Following the introduction of International Financial

Reporting Standards (IFRS) – which is expected to increase

volatility in net profit – ING intends to pay dividends in

relation to the longer-term underlying development of profit.

BUSINESS PORTFOLIO PROGRAMME

In 2004, ING conducted a number of divestments, the sale of

ING BHF-Bank, ING Re individual life and Life of Georgia being

the largest. The divestments completed in 2004 resulted in a

release of EUR 1.5 billion in regulatory capital. These proceeds

have been used to reduce ING’s debt/equity ratio and to invest

in the growth of businesses such as ING Direct, the activities in

developing markets such as Asia and Central Europe and the

retirement services business such as in the United States.

CAPITAL POSITION

The debt/equity ratio of ING Groep N.V. improved to 9.9%

from 14.4% at the end of 2003 and over 20% at the end

of 2001. The improvement was caused by a EUR 4.9 billion

increase in the Group capital base, excluding third-party

interests, due to retained earnings and the issue of hybrid

securities in June 2004 as well as a EUR 1.0 billion decrease

in core debt.

The capital coverage ratio for ING’s insurance operations

increased to an industry-wide very high level of 210% of

regulatory requirements at the end of 2004, compared with

180% at year-end 2003.

The Tier-1 ratio of ING Bank N.V. stood at 7.71% on

31 December 2004, up from 7.59% at the end of 2003 and

thus comfortably above the 7.3% target. Also the Bank’s

solvency ratio (BIS ratio) was above the 11% target and

improved to 11.47% from 11.34% at the end of 2003.

Compared with year-end 2003, total risk-weighted assets

rose by EUR 22.8 billion, or 9.1%, to EUR 274.1 billion,

almost fully caused by the growth of ING Direct.

INSURANCE OPERATIONS

Operating net profit from insurance rose 19.0% to EUR 2,985

million, driven by a strong increase in results from non-life

insurance, due to a favourable claims experience as well as

gains on the sale of ING’s non-life insurance joint venture in

Australia and the initial public offering of the Canadian non-

life insurance business. Net profit from insurance increased

42.7% to EUR 3,564 million in 2004.

Total premium income increased 5.9% to EUR 43,617 million,

as strong growth, particularly from the life insurance

businesses in the United States and Asia, was offset in part

by the impact of divestments and currency effects. Excluding

these effects, total premium income increased 13.6%. Total

life insurance premiums increased 9.1% to EUR 36,975 million.

Total non-life premiums declined 8.9% to EUR 6,642 million,

mainly as a result of the sales of the Australian non-life joint

venture and the Dutch health insurance business.

Operating expenses from the insurance operations declined

1.2% to EUR 4,837 million. However, excluding the impact

of divestments and currency effects, operating expenses

increased 6.1%, mainly due to higher costs in the Netherlands,

Belgium, the rest of Europe and Australia. Excluding one-offs,

currency effects and expenses at Nationale-Nederlanden,

expense growth in insurance totalled 3.5%.

Investment losses amounted to EUR 32 million, or just

2 basis points of total fixed-interest securities, which is low

in historical perspective. In 2003 investment losses were

EUR 163 million, or 13 basis points of total fixed-interest

securities.

The value of new life insurance business written in 2004

increased to EUR 632 million, up 43.6% from EUR 440 million

in 2003. The increase is due to improved pricing margins,

higher sales and investment in new business. Insurance

Asia/Pacific generated more than half of the total value of

new business created by ING Group, indicating the strong

future earnings potential of the business in the region.

The overall internal rate of return on the new business

written is 12.1% (compared with 10.9% in 2003), which is

above ING’s target of 12%.