ING Direct 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING GROUP

ANNUAL REPORT

LAYING THE FOUNDATIONS FOR

PROFITABLE GROWTH

2004

Table of contents

-

Page 1

2004 ING GROUP ANNUAL REPORT LAYING THE FOUNDATIONS FOR PROFITABLE GROWTH -

Page 2

-

Page 3

... THE CONSOLIDATED BALANCE SHEET AND PROFIT AND LOSS ACCOUNT PAGE 62 63 64 65 66 76 77 94 107 117 130 131 132 133 134 1.2 OUR PERFORMANCE REPORT OF THE EXECUTIVE BOARD Financial highlights Insurance Europe Insurance Americas Insurance Asia/Pacific Wholesale Banking Retail Banking ING Direct Asset... -

Page 4

... 00 01 02 03 04 EMPLOYEES average FTEs 120,000 110,000 100,000 90,000 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 95 96 97 98 99 00 01 02 03 04 Operating profit before tax Operating net profit International Netherlan ds Netherlands International 2 ING Group Annual Report 2004 -

Page 5

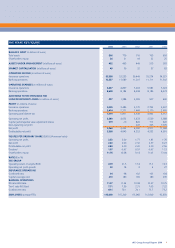

FIVE YEARS' KEY FIGURES 2004 2003 2002 2001 2000 BALANCE SHEET (in billions of euros) Total assets Shareholders' equity ASSETS UNDER MANAGEMENT (in billions of euros) MARKET CAPITALISATION (in billions of euros) OPERATING INCOME (in millions of euros) Insurance operations Banking operations ... -

Page 6

... a wide array of banking, insurance and asset management services in over 50 countries. Our 113,000 employees work daily to satisfy a broad customer base: individuals, families, small businesses, large corporations, institutions and governments. Based on market capitalisation, ING is one of the... -

Page 7

... in Australia, Canada, France, Germany (including Austria), Italy, Spain, United Kingdom and the United States. Main products offered are savings and mortgages. A separate activity is ING Card, which manages a credit-card portfolio within the Benelux. OPERATING PROFIT BEFORE TAX* ING DIRECT 2004... -

Page 8

...a strong home market position in the Benelux, which has a high level of wealth accumulation. Our large presence in the United States puts us in the world's biggest savings market. In Asia and Central Europe we have a portfolio of successful life insurance companies. In mature markets, ING Direct has... -

Page 9

...example the Benelux countries and the United States. Furthermore, we have good businesses with clear growth potential. The first is ING Direct. The second is pension products and services. The third is life insurance business in developing markets. In pursuing this strategy, we want to add value for... -

Page 10

... ING Bank in the Netherlands, ING Belgium and the wealth management and pension business in the United States all form part of ING's businesses in mature markets. ING Direct, the life insurance operations in developing markets and pension activities are ING's main growth businesses. It is key in ING... -

Page 11

...in Canada we completed an initial public offering of a part of our non-life business. ING also sold Delta Asset Management in the United States and CenE Bankiers in the Netherlands (a subsidiary specialising in commercial and private banking). This was followed by the sale of the German unit ING BHF... -

Page 12

... the core of ING's strategy. Good execution, a focus on the customer and active business portfolio management led the way to improved results. But ING's strategy does not focus on one year. ING wants to offer continuity to its investors, providing them with better returns on their investment in the... -

Page 13

... life insurance activities in Asia/Pacific and the core businesses in the United States, and continued strong non-life results in Canada. Given EUR 579 million in realised capital gains on shares in 2004, net profit amounted to EUR 5,968 million, an increase of 48% compared to 2003. The high level... -

Page 14

... to reduce ING's debt/equity ratio and to invest in the growth of businesses such as ING Direct, the activities in developing markets such as Asia and Central Europe and the retirement services business such as in the United States. CAPITAL POSITION The debt/equity ratio of ING Groep N.V. improved... -

Page 15

... of most currencies against the euro (-EUR 16.1 billion). The net inflow of EUR 26.5 billion was mainly realised as a result of good sales of money-market funds and structured products at KB Asset Management in Korea, and good life premium growth in Taiwan and Korea. The portfolio of ING Real Estate... -

Page 16

...of the Dutch insurance unit Nationale-Nederlanden began to bear fruit, with the company succeeding in improving customer satisfaction levels and increasing the value of new life insurance business. In Belgium, our insurance activities showed a strong sales performance. In Central Europe, we continue... -

Page 17

... new life insurance business written by Insurance Europe was EUR 138 million, an increase of 46.8% compared with 2003. The overall internal rate of return (IRR) on these sales was 12.4%, up from 10.9% a year earlier. This rise can largely be accounted for by the Netherlands, where the IRR increased... -

Page 18

...back-offices. The merger of three insurance business units and the rebranding to ING Insurance in 2001 resulted in cost reduction and a stronger market position. In 2004, the Belgian government opened the market for individual life insurance for self-employed (fiscally stimulated retirement products... -

Page 19

...the United States, the sale of non-core businesses allows for increased focus on business units with better growth potential and lower risk. In Canada, ING strengthened its number-one position in non-life insurance by purchasing a large portion of the non-life activities of Allianz Canada. FINANCIAL... -

Page 20

... United States increased 3.6% to EUR 18,450 million, with the strongest growth coming from fixed and variable annuities. Investment losses dropped to 7 basis points of average fixed-interest securities in 2004, down from 21 basis points the year before. In Canada, where ING offers non-life insurance... -

Page 21

... yields. ING IM also generated significant private equity gains on its portfolio. In Canada and Latin America, we applied the same global standards for the investment process, controls, risk management and compliance. Good opportunities for pensions The US retirement services business made a strong... -

Page 22

... business, positive 2004 performance variances and an upward revision to assumed investment returns. These embedded-value gains were partially offset by higher cost of capital resulting from a change to ING's internal capital model. KEY FIGURES 2004 Value of new life business (in millions of euros... -

Page 23

... objectives has been successfully aligned across all business units in the region. The product mix in particular has undergone various structural changes. Unit-linked products and other investment-linked products account for an increasing part of total sales. ING has also been actively building new... -

Page 24

.... The mix of the investment management business across proprietary, mutual fund and institutional client groups means it has a diversified growth base and together with ING's life insurance businesses, the aim is to achieve significant market share in each market. 22 ING Group Annual Report 2004 -

Page 25

... millions of euros Netherlands Belgium Germany Rest of world Asset management* Other Total * mainly ING Real Estate and Baring Asset Management 937 690 -243 278 348 -78 1,932 Wholesale Banking's results were strongly supported by its Financial Markets business, which showed very good results. From... -

Page 26

... ING BHF's asset management, private banking, financial markets and core corporate banking businesses. The London Branch of ING BHF-Bank was sold to Deutsche Postbank AG, while HVB Group agreed to buy part of ING BHF-Bank's corporate lending portfolio. Following these transactions, ING retains ING... -

Page 27

... financial markets products (such as foreign exchange, integrated products and disintermediation, cash & derivatives products). Wholesale Banking also continues to improve its cross selling of ING's asset management and insurance products (especially employee benefits), and the services of ING Real... -

Page 28

... fourth quarter. * Comparable change = excluding foreign exchange differences, acquisitions and divestments, and one-offs. KEY FIGURES 2004 After-tax RAROC Economic capital (in billions of euros) 29.1% 2.7 2003 29.3% 2.5 OPERATING PROFIT BEFORE TAX in millions of euros Retail Banking Rest of ING... -

Page 29

... • Good year for Retail Banking, distinct revenue increase in home markets • Postbank increased sales of mortgage products rapidly; customers rate Postbank first of major banks in the Netherlands for its service • Private Banking continued rapid growth, particularly in Belgium, the Netherlands... -

Page 30

... markets. Our focus remains on increasing customer satisfaction, cost leadership and profitable growth. In the Netherlands, there is room for Postbank to increase sales of mortgages and mutual funds while maintaining its high customer satisfaction levels. At ING Bank, we aim to increase customer... -

Page 31

... strong profit growth in 2004, contributing increasingly to overall Group profit. Business continued to grow strongly, in new customers worldwide, in funds entrusted and in retail mortgage lending, ING Direct's second core product. ING Direct's cost base was one of the lowest in the market. Brand... -

Page 32

... This compared with total retail client funds entrusted to ING Direct of EUR 145.4 billion worldwide at year-end, next to EUR 5.7 billion off-balance in mutual funds and pension plans. All countries, except for France and the United Kingdom, sold mortgages in 2004. Strong growth in customer base The... -

Page 33

... 6.9 7.6 12.8 7.6 38.1 11.5 99.4 * year in which business started ** including Austria OPERATING PROFIT BEFORE TAX in millions of euros 2004 2003 change Canada Spain Australia France United States Italy Germany* United Kingdom Subtotal ING Direct ING Card Total * including Austria 66 32 60 5 173... -

Page 34

... of the publicly listed Rodamco Asia real-estate fund added EUR 800 million. The functional operating profit before tax from asset management (derived from figures included in the insurance and banking results) increased 14% to EUR 484 million in 2004. Asset management activities accounted for 7% of... -

Page 35

... and the United States were sold. In an environment of strong competition, ING Real Estate maintained its leading position in the Dutch financing market. A noteworthy finance deal in 2004 was the refinancing of the Vendex KBB realestate portfolio in close cooperation with ING Bank. CONCLUSIONS AND... -

Page 36

... and cultural change strategy to enable the business to achieve its objectives. Executive coaching in Australia now focuses on key performance behaviour and all managers have access to online toolkits to assist them in developing team performance and change management. ING Bank Netherlands has... -

Page 37

... to support the new management structure • Change management and performance management at the centre of attention • Building talent and succession planning a continuing process CONCLUSIONS AND AMBITIONS Group HR has established a Leadership and Change function to support the business lines in... -

Page 38

...at fair prices supported by good execution, exemplary service and proper accessibility. In other words: good value for money. Satisfied and motivated employees deliver better customer service and drive our success as a business. We provide competitive terms of employment, safe working conditions and... -

Page 39

...finance transactions in developing markets. During 2004, ING has further embedded the Equator Principles in its credit approval process. Sometimes different parts of ING interact with customers in different roles. For example, the possibility exists that an insurance unit is an investor in a company... -

Page 40

... States. Other major topics of discussion at the various meetings were management development, corporate governance, the remuneration policy of the Executive Board, the policy in relation to the communication of profit expectations and the progress of the projected divestments. The growth of ING... -

Page 41

... annual report, three new members were appointed to the Executive Board following the General Meeting of Shareholders. With effect from 28 April 2004 the three new members are Eric Boyer de la Giroday, Eli Leenaars and Hans Verkoren, who are responsible for Wholesale Banking, Retail Banking and ING... -

Page 42

...the corporate-governance structure is approved by the General Meeting of Shareholders, ING will be considered to be in full compliance with the Code. Changes in 2004 As the Executive Board and Supervisory Board decided to implement the Dutch Corporate Governance Code expeditiously, the best-practice... -

Page 43

... are used solely for funding purposes. The shares, which are all registered shares, are not listed on a stock exchange. Depositary receipts Over 99% of the issued ordinary and preference shares are held by the ING Trust Office ("Trust Office"). The Trust Office issues bearer depositary receipts in... -

Page 44

...option rights granted to them, together with information on the policy behind such decisions, are provided in a separate chapter, starting on page 50 of this report. Members of the Executive Board are permitted to hold shares and depositary receipts for shares in the company for long-term investment... -

Page 45

...management positions, including chairman of ING Poland and of ING Latin America. He was appointed a member of the Executive Board of ING Group in April 2004. His main responsibilities are ING's Retail Banking and Private Banking activities, in particular ING Bank, Postbank and RVS in the Netherlands... -

Page 46

... to hold shares and depositary receipts for shares in the company for long-term investment purposes. Details are given on page 60. If any members of the Supervisory Board were granted ING option rights during their previous membership of the Executive Board (see page 60), these option rights will... -

Page 47

... Governance Committee. Former member of the Board of Directors of ReliaStar Financial Corp. Other business activities: Member of the Supervisory Board of each of TCF Financial Corporation, Hormel Foods Corporation, Communications Systems Inc. and Hector Communications Corporation (listed companies... -

Page 48

... rotation of other partners of Ernst & Young Accountants and KPMG Accountants N.V. involved with the audit of the financial statements of ING are subject to applicable independence legislation. The external auditors may be questioned at the Annual General Meeting of Shareholders in relation to their... -

Page 49

... paid to in particular principle IV.2 of the Dutch Corporate Governance Code and the current state of affairs regarding proxy voting in order to achieve larger shareholder participation at the Shareholders' meeting. The Board has decided it will establish its own website before the Annual General... -

Page 50

..., several other advisory offices); Paul Frentrop, (Director Deminor Nederland B.V., in that capacity advisor of Dutch and foreign institutional investors with regard to corporate governance issues); Tom Regtuijt (former Executive Board Member of Nederlandse Spoorwegen (Netherlands Railways), several... -

Page 51

... the members of the Board of Stichting Continuïteit ING contained in Annex X of the Listing and Issuing Rules of Euronext Amsterdam N.V., Amsterdam, have been complied with. Amsterdam, 7 March 2005 Board of Stichting Continuïteit ING Executive Board of ING Groep N.V. ING Group Annual Report 2004... -

Page 52

... to the Executive and Supervisory Board members as well as ING Group shares held by members of both boards. GENERAL POLICY SENIOR-MANAGEMENT REMUNERATION Background In 2002, an external consultancy firm was hired to report on the market competitiveness of ING's remuneration levels and mix. Based on... -

Page 53

... from last year because of ING's internal reorganisation that eliminated one reporting level between the Executive Board and the top senior management. Long-term incentive plan In the overall evaluation of the remuneration components, the Supervisory Board conducted a cost/benefit analysis of... -

Page 54

... (all other situations). For the Executive Board members appointed before 2004, the exit clause has been set at three years base salary. The term of notice for new and existing Executive Board members is three months for the employee and six months for the employer. 52 ING Group Annual Report 2004 -

Page 55

...Board members was on average 179%. ING's external auditor has reviewed to which extent the objectives, both the group and the individual, have been met. Long-term incentive Executive Board 2004 Under the long-term incentive plan (LTIP) for the Executive Board, two instruments are used: stock options... -

Page 56

... compensation in US dollars. For each year the compensation in US dollars has been translated to euros at the average exchange rate for that year. (3) Ewald Kist retired as of 1 June 2004. Salary reflects payments made up to retirement. The short-term performance-related bonus reflects compensation... -

Page 57

... was recognised in 2003. In 2004, in relation to 2003 performance, a new long-term incentive plan was approved by the AGM, pursuant to which the Executive Board members was granted in 2004 a combination of stock options (41,250) and provisional performance shares (13,750), based on a 50/50 split in... -

Page 58

... Board members. Fred Hubbell's pension costs have been translated from US dollars to euros at the average exchange rate for that year. The 2004 amount reflects the cost of the normal pension build-up to age 65, which has to be taken in the year of retirement, in accordance with IAS 19 accounting... -

Page 59

... expiry date. Eric Boyer de la Giroday, Eli Leenaars and Hans Verkoren were appointed to the Executive Board on 28 April 2004. In their capacity of Executive Board member no options were granted to them in 2004 nor did they exercise any rights over past option grants. ING Group Annual Report 2004 57 -

Page 60

...the case in 2004, the total LTI value in stock options and provisional performance shares to be granted to the Executive Board members will be determined by the Supervisory Board at the end of 2005, based on the achievement of the three pre-defined financial objectives set out in the 2005 short-term... -

Page 61

... Berghe Jan Berghuis Jan Kamminga Johan Stekelenburg Hans Tietmeyer 23 14 39 13 89 508 521 68 41 55 51 39 39 293 637 (1) (2) Member as of 28 April 2004. Including a compensation payment to match his former remuneration as a member of the BBL Supervisory Board. ING Group Annual Report 2004 59 -

Page 62

... hold ING Group shares. As at 31 December 2004, two members of the Supervisory Board held option rights that were granted in earlier years when they were members of the Executive Board, specified in the table below INFORMATION ON THE OPTIONS OUTSTANDING AND THE MOVEMENTS DURING THE FINANCIAL YEAR... -

Page 63

... advises the Executive Board regarding strategic, social and policy issues or developments that are relevant to ING. Gerlach Cerfontaine, chairman, chairman Executive Board Schiphol Group, the Netherlands Yuan Chen, President State Development Bank, China Hans Eggerstedt, former member Executive... -

Page 64

... OF ING GROUP CONSOLIDATED BALANCE SHEET OF ING GROUP AS AT 31 DECEMBER before profit appropriation amounts in millions of euros 2004 2003 ASSETS Tangible fixed assets 1 Participating interests 2 Investments 3 Lending 4 Banks 5 Cash 6 Other assets 7 Accrued assets 8 Total EQUITY AND LIABILITIES... -

Page 65

...ANNUAL ACCOUNTS CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP FOR THE YEARS ENDED 31 DECEMBER amounts in millions of euros 2004 2003 2002 Premium income 18 Income from investments of the insurance operations 19 Interest result from the banking... -

Page 66

2.1 ANNUAL ACCOUNTS CONSOLIDATED STATEMENT OF COMPREHENSIVE NET PROFIT OF ING GROUP CONSOLIDATED STATEMENT OF COMPREHENSIVE NET PROFIT OF ING GROUP FOR THE YEARS ENDED 31 DECEMBER amounts in millions of euros 2004 2003 2002 Net profit for the period Other components of comprehensive net profit: -... -

Page 67

... Net cash flow from financing activities Net cash flow Cash at beginning of year Exchange differences Cash at year-end Cash comprises the following items: Short-dated government paper Bank deposits available on demand Cash and bank balances and call money of the insurance operations Cash at year-end... -

Page 68

... death benefits with variable annuities, so the impact for ING mainly relates to the timing of the profit recognition in universal life contracts in the US. This accounting change resulted in an EUR 91 million after-tax reduction in Shareholders' equity. CHANGES IN PRESENTATION Guaranteed Investment... -

Page 69

... million and is added to Shareholders' equity. In 2004, ING Group sold its Asian cash equities business to Macquarie Bank. The cash equities business comprises sales, trading, research and equity capital markets operations. In 2004, ING Group sold its non-life insurance business in Australia to QBE... -

Page 70

... gross profits ING assumes the short-term and longterm separate account growth rate assumption to be the same. The growth rate assumption is currently 8.5% gross (7.5% net). Higher/lower expected profits - e.g. reflecting stock market performance and a changed level of assets under management - may... -

Page 71

... to general market fluctuations and due to issuer-specific developments. The impairment review focuses on issuer specific developments regarding financial condition and future prospects, taking into account the intent and ability to hold the securities under the Group's long-term investment strategy... -

Page 72

...estimates. Foreign currencies General The euro is the reporting currency of ING Group. Assets and liabilities in foreign currencies are translated at the spot mid-rates (Amsterdam exchange rates) prevailing on the balance sheet date. Non-monetary items which are expressed in terms of historical cost... -

Page 73

... intent of benefiting from actual or expected short-term price movements or to lock in arbitrage profits, and positions held through matched principal broking and market making. If, due to a change in management's intent, transfers are made between investment and trading portfolios, these assets are... -

Page 74

...principles are generally applied as those pertaining to the valuation of investments held for the group's own risk. However, fixed-interest securities directly linked to life policy liabilities are stated at fair value plus accrued interest where relevant. Life insurance products In the case of life... -

Page 75

... value, which generally means quoted prices. Changes in the fair value, both realised and unrealised, on these assets are included in the profit and loss account. Fixed-interest securities in the trading portfolio repurchased after issue by group companies and equity participations are stated at the... -

Page 76

... expected retirement date and the market yields at the balance sheet date on high quality corporate bonds. In order to distribute expenses for pensions and other staff-related expenses evenly over the years, these expenses are calculated using the expected rate of return on plan assets. Differences... -

Page 77

... investment and trading securities and amortisation of accrued discounts and premiums and yield differences. Commission Fees and commissions from banking and asset management services are recognised in the profit and loss account over the period in which the related services are performed. Fees... -

Page 78

... between cash flows from operating, investing and financing activities. Cash flows in foreign currencies are translated at the average exchange rates for the year. Where the balance of items in the cash flow statement does not correspond to the movements in the relevant balance sheet items... -

Page 79

2.1 ANNUAL ACCOUNTS NOTES TO THE CONSOLIDATED BALANCE SHEET OF ING GROUP amounts in millions of euros, unless otherwise stated ASSETS 1 TANGIBLE FIXED ASSETS TANGIBLE FIXED ASSETS 2004 2003 Data-processing equipment Other movable fixed assets Opening balance Additions Changes in the composition ... -

Page 80

... FOR OTHER INVESTMENTS) Land and buildings 2003 Shares and convertible debentures 2003 Fixed-interest interests 2003 Investments for risk of policyholders 2003 2004 2004 2004 2004 Opening balance Additions and advances Changes in the composition of the group Transfer from other assets Yield... -

Page 81

... OF LAND AND BUILDINGS DURING THE LAST FIVE YEARS in percentages Years of appraisal 2004 2003 2002 2001 2000 70 13 2 4 11 100 SHARES AND CONVERTIBLE DEBENTURES BY INSURANCE AND BANKING OPERATIONS 2004 Insurance operations 2003 2004 Banking operations 2003 2004 Total 2003 Listed Unlisted 8,960... -

Page 82

... CONSOLIDATED BALANCE SHEET OF ING GROUP (continued) FIXED-INTEREST SECURITIES BY INSURANCE AND BANKING OPERATIONS 2004 Balance sheet value 2003 2004 Estimated fair value 2003 INSURANCE OPERATIONS Debentures and fixed-interest securities Private loans Mortgage loans Other fixed-interest securities... -

Page 83

... credit exposure. LENDING ANALYSED BY SECURITY Netherlands International Total 2004 Netherlands International Total 2003 Loans to or guaranteed by public authorities Loans secured by mortgages Loans guaranteed by credit institutions Other private lending Other corporate loans Provision for loan... -

Page 84

... International Total 2004 Netherlands International Total 2003 Loans secured by public authorities Loans secured by mortgages Loans guaranteed by credit institutions Other private lending Other corporate loans and guarantees Allocated to Lending Allocated to Banks Allocated to other assets 199 181... -

Page 85

...7 OTHER ASSETS OTHER ASSETS 2004 2003 Trading portfolio Equity participations Property Deferred tax assets Receivables on account of direct insurance from: - policyholders - intermediaries Reinsurance receivables Income tax receivables Pension assets and other staff-related assets Other receivables... -

Page 86

...settled after more than one year from balance sheet date. DEFERRED ACQUISITION COSTS OF INSURANCE BUSINESS BY GEOGRAPHICAL AREA 2004 Life insurance 2003 2004 Non-life insurance 2003 2004 Total 2003 Netherlands Belgium Rest of Europe North America Latin America Asia Australia Other 443 47 209 5,923... -

Page 87

... Year of issue Liquidation preference per share (in USD) 2004 Balance sheet value 2003 1.5 10 20 8.439 9.2 7.7 2000 2000 1999 1,000 25 25 1,100 183 1,283 1,189 198 396 1,783 These Trust Preferred Securities have been issued to raise Tier-1 capital for ING Bank N.V. ING Group Annual Report... -

Page 88

... bonds have been issued to raise hybrid capital for ING Verzekeringen N.V. and Tier-1 capital for ING Bank N.V. SUBORDINATED LOANS National amount Interest rate Year of issue First call date 2004 Balance sheet value 2003 EUR USD EUR USD USD EUR 1,000 500 750 1,100 800 600 Variable 6.2 Variable... -

Page 89

... are paid to the funds at a rate necessary to adequately finance the accrued liabilities of the plans calculated in accordance with local legal requirements. Plans in other countries comply with applicable local regulations concerning investments and funding levels. ING Group Annual Report 2004 87 -

Page 90

... invested in securities issued by the employer and related parties, including shares of ING Groep N.V. Because the balance of Pension liabilities and other staff-related liabilities at 31 December 2004 is an asset, the amount is included in the balance sheet under Other assets. 88 ING Group Annual... -

Page 91

...AREA Insurance provisions for policies for which the policyholders bear the investment risk 2004 2003 Provision for life policy liabilities 2004 2003 2004 Claims provision 2003 2004 Other 2003 2004 Total 2003 Netherlands Belgium Rest of Europe North America Latin America Asia Australia Other... -

Page 92

...). Savings accounts Savings accounts relates to the balances on savings accounts, savings books, savings deposits and time deposits of personal customers. The interest payable on Savings accounts, which is contractually added to the accounts, is also included. 90 ING Group Annual Report 2004 -

Page 93

... ENTRUSTED BY TYPE 2004 2003 Private loans Mortgage loans Corporate time deposits Credit balances on customer accounts 1,539 68 43,020 99,413 144,040 1,729 50 42,832 92,673 137,284 Funds entrusted to the banking operations Funds entrusted to the banking operations relates to non-subordinated... -

Page 94

...TO THE CONSOLIDATED BALANCE SHEET OF ING GROUP (continued) OTHER LIABILITIES BY REMAINING TERM Up to 1 year 1 to 5 years Over 5 years 2004 Up to 1 year 1 to 5 years Over 5 years 2003 Subordinated loans of group companies Debenture loans Loans contracted Loans from credit institutions Deposits from... -

Page 95

... an asset amounting to EUR 229 million, the amount is included in the balance sheet under Accrued assets. As at 31 December 2004, an amount of EUR 1,148 million (2003: EUR 616 million) was expected to be settled after more than one year from the balance sheet date. ING Group Annual Report 2004 93 -

Page 96

...TO THE CONSOLIDATED BALANCE SHEET OF ING GROUP amounts in millions of euros, unless stated otherwise ANALYSIS OF CERTAIN ASSETS AND LIABILITIES BY MATURITY On demand 2004 Up to three months Three months to one year One year to five years Over five years Total ASSETS Lending Banks LIABILITIES Funds... -

Page 97

... financial statements. In response to the needs of its customers, ING Group offers financial products related to loans. These products include traditional off-balance sheet credit-related financial instruments. CONTINGENT LIABILITIES 2004 2003 INSURANCE OPERATIONS Commitments concerning investments... -

Page 98

2.1 ANNUAL ACCOUNTS ADDITIONAL INFORMATION RELATING TO THE CONSOLIDATED BALANCE SHEET OF ING GROUP (continued) ING Group supports the commercial paper programs by providing the SPE with short-term stand-by liquidity facilities. Primarily these liquidity facilities are meant to cover temporarily ... -

Page 99

...to time in response to changing market conditions as well as changes in the mix of the related assets and liabilities. Trading activities ING Group trades derivative financial instruments on behalf of clients and for its own account. Derivative financial instruments used for risk-management purposes... -

Page 100

... Written options give the issuer the obligation to buy or sell within a limited period of time a financial instrument or currency at a contracted price that may also be settled in cash. This subjects ING Group to market risk, but not to credit risk, since the counterparties have already performed in... -

Page 101

... Weighted credit equivalent 2004 Notional amount Positive fair value Unweighted credit equivalent Weighted credit equivalent 2003 INTEREST-RATE CONTRACTS Over-the-counter: - swaps - forwards - options purchased - options written Listed: - options purchased - options written - futures CURRENCY... -

Page 102

2.1 ANNUAL ACCOUNTS ADDITIONAL INFORMATION RELATING TO THE CONSOLIDATED BALANCE SHEET OF ING GROUP (continued) OPEN CONTRACTS BY REMAINING TERM, BASED ON THE NOTIONAL AMOUNTS, AS AT 31 DECEMBER Up to 1 year 2004 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years Over 5 years Total INTEREST-RATE ... -

Page 103

... are not included in the table as they do not comply with the definition of a financial asset or liability. The aggregation of the fair values presented hereunder does not represent, and should not be construed as representing, the underlying value of ING Group. ING Group Annual Report 2004 101 -

Page 104

... AND LIABILITIES Estimated fair value Balance sheet value 2004 Estimated fair value Balance sheet value 2003 FINANCIAL ASSETS Participating interests Investments - shares and convertible debentures - fixed-interest securities Lending(1) Banks(1) Cash Other assets(2) - trading portfolio - equity... -

Page 105

...account current cash flow assumptions and the counterparties' credit standings. The fair values of derivatives held for non-trading purposes generally reflect the estimated amounts that ING Group would receive or pay to terminate the contracts at the balance sheet date. ING Group Annual Report 2004... -

Page 106

...value for these instruments. CAPITAL BASE BREAKDOWN CAPITAL BASE Group Insurance Bank 2004 Group Insurance Bank 2003 Shareholders' equity Preference shares of group companies Subordinated loans Capital base ING Group Core debt (debt raised to finance subsidiaries) Third party interests Subordinated... -

Page 107

...including off-balance sheet items and market risk associated with trading portfolios. CAPITAL POSITION OF ING BANK 2004 2003 Shareholders' equity (1) Third-party interests Capital and reserves of Stichting Regio Bank Subordinated loans qualifying as Tier-1 capital (2) Fund for general banking risks... -

Page 108

...capital for the insurance activities. For regulatory purposes certain (external) subordinated loans of ING Bank N.V. and ING Verzekeringen N.V. are included. REGULATORY REQUIRED CAPITAL ING GROUP 2004 2003 Shareholders' equity Preference shares of group companies Subordinated loans Capital base ING... -

Page 109

... THE INSURANCE OPERATIONS 2004 2003 2002 Income from disposal of group companies Income from land and buildings Income from investments in shares and convertible debentures Income from investments in fixed-interest securities: - debentures - private loans - mortgage loans - policy loans - deposits... -

Page 110

... Net interest income on loans/deposits Origination fees and loan-servicing fees Interest income on investment securities Interest income on trading portfolio Other interest income Total interest income Interest expenses on deposits by banks Interest expenses on funds entrusted Interest expenses on... -

Page 111

... 14 211 32 152 409 182 126 50 -1 357 RESULTS FROM FINANCIAL TRANSACTIONS 2004 2003 Insurance operations 2002 2004 2003 Banking operations 2002 2004 2003 Total 2002 Results from securities trading portfolio Results from currency trading portfolio Other 1 30 -6 365 566 -335 596 226 46 290 562... -

Page 112

...ANNUAL ACCOUNTS NOTES TO THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP (continued) EXPENDITURE 23 UNDERWRITING EXPENDITURE UNDERWRITING EXPENDITURE 2004 2003 2002 EXPENDITURE FROM LIFE UNDERWRITING Reinsurance and retrocession premiums Benefits for own account Movements in other insurance... -

Page 113

... annual accounts. Stock option and share plans ING Group has granted option rights on ING Group shares and conditional rights on depositary receipts for ING shares to a number of senior executives (members of the Executive Board, general managers and other officers nominated by the Executive Board... -

Page 114

... the ING Group Executive Board will take a decision as to whether the option and share schemes are to be continued and, if so, to what extent. NUMBER OF OPTIONS OUTSTANDING AND EXERCISABLE, ANALYSED IN ACCORDANCE WITH YEAR OF ISSUE AND EXERCISE PRICE Financial year Original nummer of options Options... -

Page 115

...ING Group does not intentionally create a position and occurring positions are closed as soon as possible. If option rights expire, the results on the (sale of) shares which were bought to hedge these option rights are either debited or credited to Shareholders' equity. ING Group Annual Report 2004... -

Page 116

...THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP (continued) PRO FORMA RESULT IF STOCK OPTIONS WOULD HAVE BEEN RECOGNISED IN THE PROFIT AND LOSS ACCOUNT(1) As reported Pro forma 2004 As reported Pro forma 2003 As reported Pro forma 2002 Net profit (in millions of euros) Basic profit per share... -

Page 117

... the average market price in the financial year. The net increase in the number of shares resulting from the exercise of warrants and stock options is added to the average number of shares used for the calculation of diluted net profit per share. NET PROFIT PER SHARE Net profit (in millions of euros... -

Page 118

... paid (in million of euros) 2004 (1) 2003 2002 (1) 1.07 0.97 0.97 2,359 2,024 1,930 The Executive Board, with the approval of the Supervisory Board, has proposed, subject to the ratification by the General Meeting of Shareholders, a dividend of EUR 1.07 per share for the year 2004. Following... -

Page 119

... RELATING TO THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP amounts in millions of euros, unless stated otherwise RESULT FROM INVESTMENTS IN SHARES AND CONVERTIBLE DEBENTURES AND LAND AND BUILDINGS Realised and unrealised Operating Direct revaluations and investment and exchange management... -

Page 120

... used by other companies and may change over time. RECONCILIATION OF NET PROFIT TO OPERATING NET PROFIT 2004 2003 Insurance operations 2002 2004 2003 Banking operations 2002 2004 2003 Total 2002 Net profit Taxation Third parties Profit before tax Realised capital gains (losses) on shares Gain on... -

Page 121

...449 Underwriting expenditure Other interest expenses Salaries, pension and social security costs Additions to the provision for loan losses Additions to the provision for investment losses Other expenses Total expenditure Operating profit before tax Taxation Operating profit after tax 45,384 1,140... -

Page 122

2.1 ANNUAL ACCOUNTS ADDITIONAL INFORMATION RELATING TO THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP (continued) SEGMENTED OPERATING NET PROFIT OF THE INSURANCE OPERATIONS 2004 2003 2002 OPERATING RESULT FROM LIFE UNDERWRITING Premiums for own account: - gross premiums - outward ... -

Page 123

.... GEOGRAPHICAL ANALYSIS OF CLAIMS RATIO, COST RATIO AND COMBINED RATIO FOR NON-LIFE INSURANCE POLICIES 2004 2003 Claims ratio 2002 2004 2003 Cost ratio 2002 2004 2003 Combined ratio 2002 Netherlands Belgium Rest of Europe North America Latin America Asia Australia Other Total 60.6 71.1 46.1 61... -

Page 124

... RELATING TO THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP (continued) PREMIUM INCOME ON LIFE INSURANCE POLICIES Gross Reinsurers' share Own account 2004 Gross Reinsurers' share Own account 2003 Gross Reinsurers' share Own account 2002 Policies for which the insurer bears the investment... -

Page 125

...FROM DIRECT LIFE BUSINESS Policies for which the insurer bears the investment risk Gross 2003 Reinsurers' share Own account Policies for which the policyholder bears the investment risk Gross Reinsurers' share Own account PERIODIC PREMIUMS Individual policies: - without profit sharing - with profit... -

Page 126

2.1 ANNUAL ACCOUNTS ADDITIONAL INFORMATION RELATING TO THE CONSOLIDATED PROFIT AND LOSS ACCOUNT OF ING GROUP (continued) PREMIUMS WRITTEN FROM DIRECT LIFE BUSINESS Policies for which the insurer bears the investment risk Gross 2002 Reinsurers' share Own account Policies for which the policyholder ... -

Page 127

...ON NON-LIFE INSURANCE POLICIES BY CLASS OF BUSINESS Gross premium written 2004 Gross premium Gross claims expenses earned(2) Acquisition costs/other underwriting Operating expenexpenses diture(3) Net reinsurance income/ expenses Operating result Health Accident(1) Third-party liability motor Other... -

Page 128

... Committees and Management Committees no longer exist. The Executive Board sets the performance targets and approves and monitors the budgets prepared by the business lines. The strategic, commercial and financial policy of the business lines are set by key executives at the business line level in... -

Page 129

... page 118. The average numbers of employees of joint ventures are included proportionally. INTEREST INCOME (EXTERNAL) AND INTEREST EXPENSE (EXTERNAL) BREAKDOWN PER BUSINESS LINES Insurance Europe Insurance Americas Insurance Asia/Pacific Wholesale banking Retail banking ING Direct Other Total Group... -

Page 130

... ceded between group companies in different geographical areas. OPERATING PROFIT BEFORE TAX BY GEOGRAPHICAL AREA 2004 Insurance operations 2003 2002 2004 Banking operations 2003 2002 2004 2003 Total 2002 Netherlands Belgium Rest of Europe North America Latin America Asia Australia Other 1,423 128... -

Page 131

OPERATING PROFIT BEFORE TAX FROM THE INSURANCE OPERATIONS BY GEOGRAPHICAL AREA 2004 2003 Life 2002 2004 2003 Non-life 2002 2004 2003 Total 2002 Netherlands Belgium Rest of Europe North America Latin America Asia Australia Other 1,139 111 171 652 108 311 162 -258 2,396 1,192 86 221 781 137 236 101... -

Page 132

... assets LIABILITIES Insurance provisions Funds entrusted to and debt securities of the banking operations Miscellaneous other liabilities 2004 Real Estate 2004 Non-life insurance 2002 Direct banking 0.4 0.2 0.1 0.6 0.8 0.6 0.2 7.7 0.1 0.6 0.4 0.1 6.4 1.2 130 ING Group Annual Report 2004 -

Page 133

... COMPANY BALANCE SHEET OF ING GROUP AS AT 31 DECEMBER before profit appropriation amounts in millions of euros PARENT COMPANY BALANCE SHEET OF ING GROUP AS AT 31 DECEMBER 2004 2003 ASSETS Participating interests 1 Other assets 2 Total EQUITY AND LIABILITIES Shareholders' equity 3 Share capital... -

Page 134

... in millions of euros PARENT COMPANY PROFIT AND LOSS ACCOUNT OF ING GROUP FOR THE YEARS ENDED 31 DECEMBER 2004 2003 2002 Result of group companies after tax Other results after taxation Net profit for the period 5,978 -10 5,968 4,064 -21 4,043 4,521 -21 4,500 132 ING Group Annual Report 2004 -

Page 135

... with ING Group accounting principles, are included in the profit and loss account. Other changes in the balance sheet value of these Participating interests, other than those due to changes in share capital, are included in Other reserves, which forms part of Shareholders' equity. A statutory... -

Page 136

... ANNUAL ACCOUNTS NOTES TO THE PARENT COMPANY BALANCE SHEET OF ING GROUP amounts in millions of euros, unless stated otherwise ASSETS 1 PARTICIPATING INTERESTS PARTICIPATING INTERESTS Name of investee Ownership (%) Balance sheet value 2004 Ownership (%) Balance sheet value 2003 ING Bank N.V. ING... -

Page 137

... All shares are in registered form. No share certificates will be issued. Shares may be transferred by means of a deed of transfer, subject to the approval of the Executive Board of ING Group. Ordinary shares The par value of the ordinary shares is currently EUR 0.24. ING Group Annual Report 2004... -

Page 138

... may be increased or decreased by not more than a half percentage point, depending on the market conditions then prevailing, as the Executive Board may decide with the approval of the Supervisory Board. The dividend on the "A" preference shares has been EUR 0.2405 per year until 1 January 2004. On... -

Page 139

... its subsidiaries. These were purchased to hedge option rights granted to the Executive Board members and other employees. In 2004, ING Group sold 1,587,627 and purchased 2,948,601 depositary reciepts for own shares in connection with these option plans with an average price of EUR 15.59 and EUR 19... -

Page 140

2.1 ANNUAL ACCOUNTS NOTES TO THE PARENT COMPANY BALANCE SHEET OF ING GROUP amounts in millions of euros, unless stated otherwise 3. ING Group issues ordinary shares to existing holders thereof by way of paying a dividend at a price lower than the average price over the 20 business days preceding ... -

Page 141

... revaluations after tax Exchange differences Net profit not recognised in the profit and loss account Write-off of goodwill Profit appropriation previous year 2003 final dividend and 2004 interim dividend (3) Issue of shares Changes in ING Groep N.V. shares held by group companies Balance as at 31... -

Page 142

... bonds have been issued to raise hybrid capital for ING Verzekeringen N.V. and Tier 1 capital for ING Bank N.V. SUBORDINATED LOANS Notional amount Interest rate Year of issue First call date 2004 Balance sheet value 2003 EUR USD EUR USD USD EUR 1,000 500 750 1,100 800 600 Variable 6.2 Variable... -

Page 143

5 OTHER LIABILITIES OTHER LIABILITIES BY TYPE 2004 2003 Debenture loans Amounts owed to group companies Other amounts owed and accrued liabilities 5,178 606 157 5,941 5,704 655 210 6,569 DEBENTURE LOANS Interest rate Year of issue Due date 2004 Balance sheet value 2003 5 6.125 6 5.5 5.5 7.125 ... -

Page 144

... of the financial position of the company as at 31 December 2004 and of the result for the year then ended in accordance with accounting principles generally accepted in the Netherlands and comply with the financial reporting requirements included in Part 9 of Book 2, of the Netherlands Civil Code... -

Page 145

...the General Meeting of Shareholders): 1. i) for a total of 210,000,000 ordinary shares; plus ii)for a total of 210,000,000 ordinary shares, only if these shares are issued in connection with the take over of a business or company; 2. for 200,000,000 preference shares B. ING Group Annual Report 2004... -

Page 146

... net profit under IFRS may differ significantly from those under current ING Group accounting principles. The transition impact of implementing IFRS will be reported in shareholders' equity. Restated 2004 comparatives under IFRS will be presented together with the publication of the IFRS financial... -

Page 147

... Land and buildings Valuation of Fixed-interest securities Realised gains/losses on disposal of Fixed-interest securities Valuation of equity securities Derivatives Deferred acquisition costs of new insurance business Pension liabilities and other staff-related liabilities Provision for life policy... -

Page 148

... factors, including the period of time and the extent to which the unrealised loss has existed and general market conditions, but is primarily based on the financial condition of the issuer in the long-term; ING has the intention and ability to maintain a long-term investment strategy. Under US GAAP... -

Page 149

... are insured with separate pension funds. In accordance with ING Group accounting principles, as from 1 January 1998, retroactive as from 1 January 1997, the pension expenses are based on a specific method of actuarial valuation of plan assets and related projected liabilities for accrued service... -

Page 150

... equity investments are more stringent US GAAP. As a result, profit on sale is not always recognised in the same accounting period. Restructuring provision Under ING Group accounting principles, certain restructuring costs relating to employee terminations are recognised when a restructuring plan... -

Page 151

... economic risks created by the activities employed and at the company's desired level of comfort. The Economic capital is based on detailed calculations for credit, transfer, market, operational and business risk and includes diversification benefit within the bank. ING uses a one-sided confidence... -

Page 152

... compared to the 2003 level of EUR 440 million. This 44% increase is primarily due to further investment in new business, improved pricing margins and higher sales. During 2004 ING invested EUR 1,607 million to write new life insurance business. The overall rate of return expected on this investment... -

Page 153

... financial options and guarantees was explicitly reflected. In the Netherlands, assumptions were revised to reflect higher expense levels and lapse assumptions were increased to reflect recent experience. The divestment of ING of the individual reinsurance business in the United States and currency... -

Page 154

...America pension funds. Independent opinion Watson Wyatt, an international actuarial consultancy firm, has reviewed the methodology and assumptions used by ING in the calculation of the embedded value of the life insurance business at 31 December 2004 and the value of new business written during 2004... -

Page 155

... for the likelihood of timely and complete repayment of interest and instalment of fixed-income securities as assigned by rating agencies. MAIN CREDIT RATINGS OF ING(1) Standard & Poor's Moody's ING GROUP ING INSURANCE - short term - long term ING BANK - short term - long term - financial strength... -

Page 156

...ING Bank's non-trading market risk that occurs in its Wholesale Banking, Retail Banking and ING Direct activities. ALCO Bank defines the policy regarding funding, liquidity, interest rate mismatch and solvency of ING Bank. ALCO Bank meets on a monthly basis. Asset & Liability Committee ING Insurance... -

Page 157

...-house objective risk rating and loss-given default models for use in the credit approval process, risk reporting, performance monitoring and portfolio management. Simultaneously, ING is refining its credit risk management governance and practices to conform to industry best practices and regulatory... -

Page 158

... levels. ING Bank identifies as impaired loans those loans for which it is probable, based on current information and events, that the principal and interest amounts contractually due will not be collected in accordance with the contractual terms of the loan agreements. In 2004, ING added... -

Page 159

... year-end 2004 compared with 2003. The significant growth in Germany, USA, Spain and Italy are largely the result of the growth in investment activities generated by ING Direct. LARGEST ECONOMIC EXPOSURES: ING BANK LENDING PORTFOLIO, BY COUNTRY(1) amounts in billions of euros 2004 2003 Netherlands... -

Page 160

... commercial banking activities; - ING Retail Banking: ING identifies non-trading residual market risk that results from banking products of which future cash flows depend on client behaviour like current accounts, saving accounts and mortgages; - ING Direct: Within ING Direct no trading positions... -

Page 161

...taken place. Based on ING Bank's one-sided 99% confidence level an occurrence is expected, on average, once in every 100 business days. In 2004, there has been no occurrence where a daily trading loss exceeded the daily consolidated VAR of ING Wholesale banking. DISTRIBUTION OF DAILY TRADING P&L ING... -

Page 162

... interest-rate mismatch positions is performed within the Treasury function. The commercial business units bear responsibility for the remaining interest-rate risks that result from banking products of which future cash flows depend on client behaviour, like saving accounts and mortgages. Within ING... -

Page 163

... and cash flows. Currency exposures in the non-trading books are largely transferred by way of internal transactions to Financial Markets Treasury, which performs the day-to-day management of all foreign-currency positions. The most material foreign-exchange risk in the non-trading books relates to... -

Page 164

...diversified funding mix in terms of instrument types, fund providers, geographic markets and currencies. Sources of liquidity are widely distributed over the entire ING Bank. ING has a broad base of core retail funding, which mainly consists of current accounts, savings and retail deposits. Although... -

Page 165

... the euro zone. A framework is implemented that sets limits on the overall weekly and monthly liquidity risk positions. OPERATIONAL RISK GENERAL The aim for the Group and local operational risk management departments is to support general management of the business lines, which is responsible for... -

Page 166

...our target debt rating (AA/Aa2 long term) - and a one year time horizon. Economic capital should be available to absorb all future unexpected losses and is calculated for credit, transfer, market, operational and business risk. In 2004, economic capital was calculated for ING Bank in total. ECONOMIC... -

Page 167

...support of insurance liabilities and capital. As with other risk types, the proper balance between risk and return must be managed. ALCO Insurance sets the constraints for the overall asset allocation of the insurance activities including credit risk. These limits are set by rating class and average... -

Page 168

2.3 ADDITIONAL FINANCIAL INFORMATION RISK MANAGEMENT (continued) FIXED-INCOME INVESTMENT PORTFOLIO BY INSTRUMENTS in percentages 2004 2003 Public & private corporate ABS, MBS structured Governments Commercial mortgages Residential mortgages Cash & Money Market Policy loans Preferred shares 36.9%... -

Page 169

... annually, and increased the internal capital allocation for this business. ALM risk - Equity risk ING's insurance operations are exposed to movements in equity markets on two levels: 1) those business units that have direct equity holdings in their general accounts; and 2) those products where... -

Page 170

...12 months resulting from an instantaneous increase/decrease in real estate markets of 10%. In addition, ING has estimated the impact to the 31 December shareholders equity of ING Insurance from such a change in real estate markets. REAL ESTATE SENSITIVITY Effect on ING Insurance Net profit 2004 2003... -

Page 171

... Management process is measured on an annual basis by a set of 5 scorecards assessing the ORM-framework activities. In March 2004 the 2003 scorecard panels were evaluated based on supporting evidence. These scorecards have been translated in capital reductions only on a pilot basis for ING Insurance... -

Page 172

... of cash earnings following the introduction of International Financial Reporting Standards (IFRS), which is expected to increase volatility in net profit. Rating agencies In 2004 there were frequent contacts between ING and the credit rating agencies. Rating changes did not occur in this year, but... -

Page 173

...Exchange, in euros 2004 2003 2002 2001 2000 Price - high Price - low Price - year-end Price/earnings ratio* 22.28 16.73 22.26 8.8 19.06 8.70 18.49 9.3 31.20 13.29 16.14 9.1 43.97 22.80 28.64 15.7 42.76 24.26 42.54 24.2 * Based on the share price at the end of December and operating net profit... -

Page 174

2.4 GENERAL INFORMATION INFORMATION FOR SHAREHOLDERS (continued) GEOGRAPHICAL DISTRIBUTION OF ING SHARES in percentages United Kingdom United States and Canada Netherlands Belgium Luxembourg Switzerland France Germany Other 27% 23% 17% 9% 7% 6% 5% 3% 3% PRICES DEPOSITARY RECEIPTS FOR ORDINARY ... -

Page 175

... other ING news, you can subscribe to the e-mail service on www.ing.com. For more information, please contact: ING Group Investor Relations Department (IH 07.432) P.O. Box 810 1000 AV Amsterdam The Netherlands telephone +31 20 5415571 fax +31 20 5418551 www.ing.com ING Group Annual Report 2004 173 -

Page 176

... weighted average number of ordinary shares in issue: - own shares held by group companies are deducted from the total number of ordinary shares in issue; - the computation is based on daily averages; - in the case of exercised warrants, the day of exercise is taken into consideration. BIS The Bank... -

Page 177

... shares against the average market price in the financial year. The net increase in the number of shares resulting from the exercise of warrants and stock options is added to the average number of shares used for the calculation of diluted net profit per share. DISCOUNTED BILLS Bills that are sold... -

Page 178

... a financial asset or a liability for which a time-proportionate compensation is paid or received, in relation to a notional amount. INTEREST-RATE ARBITRAGE Taking advantage of interest-rate differences between separate markets. INTEREST-RATE REBATES Profit sharing for group life insurance business... -

Page 179

..., the right, but not the obligation, to buy or sell within a limited period of time a financial instrument or currency at a contracted price that may also be settled in cash. Written options subject ING Group to market risk, but not to credit risk, since the counterparties have already performed in... -

Page 180

... and paid-up on issued share capital. STOCK OPTION PLAN Option rights granted to a number of senior executives, to all ING Group staff in the Netherlands and to a considerable number of employees outside the Netherlands to purchase ING Group shares. SUBORDINATED LOAN A credit or a liability where... -

Page 181

... other positions in the trading portfolio. TREASURY BILLS Generally short-term debt certificates issued by a central government. Dutch Treasury Certificates are regarded as Dutch Treasury bills. UNWEIGHTED CREDIT EQUIVALENT The unweighted credit equivalent is the maximum loss that ING Group would... -

Page 182

... exchange rates, (viii) general competitive factors, (ix) changes in laws and regulations, and (x) changes in the policies of governments and/or regulatory authorities. ING assumes no obligation to update any forward-looking information contained in this document. 180 ING Group Annual Report 2004 -

Page 183

www.ing.com 220187