Huntington National Bank 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

restructuring of the relationship on December 28, we believe the actual pre-tax charge to earnings of $424 million

represents our best estimate of the inherent loss within this credit relationship. This has been a deeply disappointing

and painful experience.

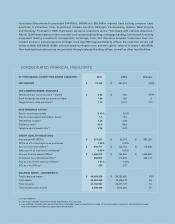

Including the Franklin impact, reported 2007 earnings were $75.2 million, or $0.25 per common share. This was

sharply lower than the level of $461.2 million, or $1.92 per share, we achieved in 2006.

Reflecting the impact of the merger, as well as our 2007 financial performance, capital ratios declined. At December

31, 2007, our tangible equity ratio was 5.08%, below our 6.00%-6.25% targeted level. Regulatory Tier 1 and total

risk-based capital ratios declined to 7.51% and 10.85%, respectively, but remained well above the “well-capitalized”

regulatory minimums.

Though credit performance clearly was the dominant story of 2007, there were many financial successes which bode

well for the future. Non-real estate, non-merger-related commercial loan growth was a strong 7%, and average total

core deposits rose 2% in spite of continued fierce competition. In the first half of 2007, prior to the intense merger

integration period, we opened a record number of checking accounts. Fee-based income increased nicely, especially

in the areas of deposit and other service charges and revenue from the sale of retail securities, insurance, and trust

services. And non-interest expenses were well-controlled.

There were many other operating highlights. The Huntington Funds, our family of mutual funds, continued the

strong, impressive performance of recent years. Our indirect auto business withstood weak retail auto sales as a

result of our strong, long-term dealer relationships and our new, unique Huntington Plus program by which we

generate fees. Through this program we electronically send to a third party certain loan applications for funding.

The customer gets quick and convenient loan approval. We get a fee and a higher flow of other applications from the

dealer as we are viewed as a full spectrum lender. Service to small businesses continued to be important to Huntington,

and we are proud to have been ranked #1 in Ohio and West Virginia in SBA lending, with Greenwich recognizing us

for our “excellence” in overall small business customer satisfaction, cash management services, online banking, and

branch services. Our retail online banking offering continues to win awards with one nationally recognized group

ranking us #8 in the country.

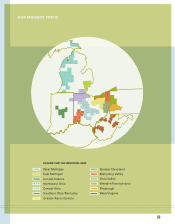

As a result of the merger, we welcomed over 3,500 associates to Huntington. We now have a stronger, more talented

team. Seven regional presidents from the former Sky Financial regions were named: Frank Hierro, Mahoning Valley;

Rick Hull, Greater Akron/Canton; Vincent Locher, Pittsburgh; Michael Newbold, Central Indiana; Stephen Sant,

Western Pennsylvania; Sharon Speyer, Northwest Ohio; and Jayson Zatta, Ohio Valley. In addition, during 2007

Rebecca Smith and Clayton Rice became presidents of our East Michigan and West Virginia regions, respectively.

And in January 2008, Mark Reitzes was named president of the Southern Ohio/Kentucky region. Two other key

leadership opportunities reflect our enduring commitment to important core values – Neeli Bendapudi as Chief

Customer Officer and Anne Carter as Director of Diversity.

LETTER TO SHAREHOLDERS 3