Huntington National Bank 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION HUNTINGTON BANCSHARES INCORPORATED

AND RESULTS OF OPERATIONS

INTRODUCTION

Huntington Bancshares Incorporated (we or our) is a multi-state diversified financial holding company organized under Maryland

law in 1966 and headquartered in Columbus, Ohio. Through our subsidiaries, including our bank subsidiary, The Huntington

National Bank (the Bank), organized in 1866, we provide full-service commercial and consumer banking services, mortgage

banking services, automobile financing, equipment leasing, investment management, trust services, brokerage services, reinsurance

of private mortgage insurance, reinsurance of credit life and disability insurance, retail and commercial insurance-agency services,

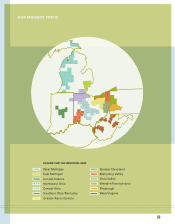

and other financial products and services. Our banking offices are located in Ohio, Michigan, Pennsylvania, Indiana, West Virginia,

and Kentucky. Selected financial service activities are also conducted in other states including: Dealer Sales offices in Arizona,

Florida, Georgia, Nevada, New Jersey, New York, North Carolina, South Carolina, and Tennessee; Private Financial and Capital

Markets Group offices in Florida; and Mortgage Banking offices in Maryland and New Jersey. Sky Insurance offers retail and

commercial insurance agency services in Ohio, Pennsylvania, and Indiana. International banking services are available through the

headquarters office in Columbus and a limited purpose office located in both the Cayman Islands and Hong Kong.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) provides you

with information we believe necessary for understanding our financial condition, changes in financial condition, results of

operations, and cash flows and should be read in conjunction with the financial statements, notes, and other information

contained in this report.

Our discussion is divided into key segments:

–INTRODUCTION — Provides overview comments on important matters including risk factors, acquisitions, and other items.

These are essential for understanding our performance and prospects.

–DISCUSSION OF RESULTS OF OPERATIONS — Reviews financial performance from a consolidated company perspective. It also

includes a Significant Items Influencing Financial Performance Comparisons section that summarizes key issues helpful for

understanding performance trends including our acquisition of Sky Financial Group, Inc. (Sky Financial) and our

relationship with Franklin Credit Management Corporation (Franklin). Key consolidated balance sheet and income

statement trends are also discussed in this section.

–RISK MANAGEMENT AND CAPITAL — Discusses credit, market, liquidity, and operational risks, including how these are

managed, as well as performance trends. It also includes a discussion of liquidity policies, how we fund ourselves, and

related performance. In addition, there is a discussion of guarantees and/or commitments made for items such as standby

letters of credit and commitments to sell loans, and a discussion that reviews the adequacy of capital, including regulatory

capital requirements.

–LINES OF BUSINESS DISCUSSION — Provides an overview of financial performance for each of our major lines of business and

provides additional discussion of trends underlying consolidated financial performance.

–RESULTS FOR THE FOURTH QUARTER — Provides a discussion of results for the 2007 fourth quarter compared with the year-ago

quarter.

A reading of each section is important to understand fully the nature of our financial performance and prospects.

Forward-Looking Statements

This report, including MD&A, contains certain forward-looking statements, including certain plans, expectations, goals, and

projections, and including statements about the benefits of our merger with Sky Financial, which are subject to numerous

assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs

and expectations, are forward-looking statements. The forward-looking statements are intended to be subject to the safe harbor

provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Actual results could differ materially from those contained or implied by such statements for a variety of factors including:

(1) deterioration in the loan portfolio could be worse than expected due to a number of factors such as the underlying value of

the collateral could prove less valuable than otherwise assumed and assumed cash flows may be worse than expected; (2) merger

benefits including expense efficiencies and revenue synergies may not be fully realized and/or within the expected timeframes;

(3) merger disruptions may make it more difficult to maintain relationships with clients, associates, or suppliers; (4) changes in

economic conditions; (5) movements in interest rates; (6) competitive pressures on product pricing and services; (7) success and

timing of other business strategies; (8) the nature, extent, and timing of governmental actions and reforms; and (9) extended

disruption of vital infrastructure. Additional factors that could cause results to differ materially from those described above can be

13