Huntington National Bank 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Huntington began to feel the effects of the housing collapse in the second quarter, and we announced a significant

increase in charge-offs and loan loss reserves related to two major homebuilders in southeast Michigan. Credit quality

continued to deteriorate throughout the second half of 2007, predominantly with residential developers. Accord-

ingly, we substantially increased the allowance for credit losses. As we entered 2008, our primary concerns were with

single family home builders headquartered in southeast Michigan and northern Ohio regions.

By far the most significant event for Huntington during 2007 was the acquisition of Sky Financial, which was

effective on July 1, 2007. We completed the conversion of over 400,000 retail and over 50,000 business customers in

late September. The merger integration was challenging, and some customers encountered bumps along the way.

By year-end the transition was behind us, and we are pleased to have achieved a very high rate of customer retention,

exceeding our expectations. We are grateful for the hard work and dedication of many Huntington and former

Sky Financial associates in making the integration a success.

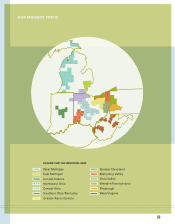

With $55 billion in assets, $40 billion in total loans and leases, and $38 billion in deposits, Huntington is now the

22nd largest U.S.-based banking company. We have achieved our goal of increasing market density, now ranking a

strong #3 in deposits in Ohio and #4 in the attractive Indianapolis market. Based on the most recent FDIC data,

40% of our deposits are now in markets where we rank #1, including the Ohio MSAs of Columbus, Toledo, Canton,

and Youngstown. We are also very pleased to enter Western Pennsylvania, including the Pittsburgh area. Huntington

now has over 600 banking offices and approximately 1,400 ATMs to serve the needs of our customers.

In December 2006, when we announced the agreement to acquire Sky Financial, we estimated that we would achieve

cost savings of $115 million. As of the 2007 fourth quarter, we had achieved 90% of these targeted expense efficien-

cies; we will capture the remainder in the first half of 2008. Though we did not initially estimate revenue synergies

from the merger, we now expect to realize almost $90 million of incremental revenues over the next 3-5 years, includ-

ing over $30 million in 2008. Much of this additional revenue will come from the sale of new or more sophisticated

capital markets and money management services to the former Sky Financial customer base and from consistent

achievement of Huntington sales penetration levels of retail securities and core banking services. We will also benefit

from the sale of insurance agency products distributed by the former Sky Insurance team to Huntington clients.

By far the biggest disappointment of 2007 occurred with the $424 million pre-tax earnings charge we took in the

fourth quarter associated with our credit exposure to Franklin Credit Management Corporation. Sky Financial had

a successful 17-year relationship with Franklin, which was in the business of acquiring/originating, servicing, and

collecting so called “scratch and dent” and subprime first mortgage and second mortgage loans throughout the U.S.

By the time of the merger in mid-year, the relationship had grown to $1.6 billion. Unfortunately, as a result of the

freeze in the mortgage markets, we were unable to sell-off as much of the credit exposure as we had intended to do.

The performance of Franklin’s more than 30,000 borrowers deteriorated in the fall, resulting in the November 16

announcement of our intention to take a pre-tax charge to earnings of up to $450 million. With the successful

LETTER TO SHAREHOLDERS

2