Huntington National Bank 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

When I was appointed CEO in 2001, I said I would keep you updated on the financial performance

and prospects of your company and advise you of all the positives and negatives as they unfold. Through my

quarterly shareholder letters and other communications, you know that one of the most significant challenges

we faced last year was the continuation of the SEC formal investigation that began in 2003 and continued

throughout 2004. You will recall this was an investigation into certain financial accounting matters relating

to fiscal years 2002 and earlier and certain related disclosure matters.

We continue to have ongoing discussions with the staff of the SEC, and as previously announced, it is

anticipated that a settlement of this matter, which is subject to approval by the SEC, will involve the entry of

an order by the SEC requiring Huntington to comply with various provisions of the Securities Exchange Act

of 1934 and the Securities Act of 1933, along with the imposition of a civil money penalty. At year end, we had

reserves related to the expectation of the imposition of a civil money penalty, which we viewed as sufficient

given negotiations with the SEC. However, no assurances can be made that any assessed penalty may not

exceed this amount.

On March 1, 2005, we announced that Huntington entered into formal written agreements with its

banking regulators, the Federal Reserve Bank of Cleveland and the Office of the Comptroller of the Currency.

These agreements provide for a comprehensive action plan designed to enhance our corporate governance,

internal audit, risk management, accounting policies and procedures, and financial and regulatory reporting.

They call for independent third-party reviews, as well as the submission of written plans and progress reports

by management. They remain in effect until terminated by the banking regulators.

Entering into these formal written agreements is consistent with our expectations announced last

November and in line with steps that we have been taking to ensure that our corporate governance and controls

are best in class. We have been working extensively with our banking regulators over the past several months.

While there is work yet to be done, we have devoted significant resources in order to address the issues raised.

We are confident that we are on the right path to address fully and comprehensively all of their concerns in a

timely manner. We also believe that the changes we have made, and are in the process of making, are positive

for our organization and will position us to be a stronger company in the future.

In November 2004, we withdrew our application with our banking regulators to acquire Unizan

Financial Corp. and intend to resubmit the application once the regulators are fully satisfied that we have

addressed all of their concerns. How soon that may happen, we cannot say. We have extended the merger

agreement to January 2006, and we intend to move forward on this acquisition as soon as possible.

The board of directors and your management team are strongly committed to assuring that the highest

of ethical standards are followed. We are also fully committed to full, fair, and transparent financial disclosure

and to assuring that our policies and practices in these areas meet all best-in-class standards. We fell short of

that mark for which I, and your management team, accept responsibility. We will not be satisfied simply with

compliance; we must excel.

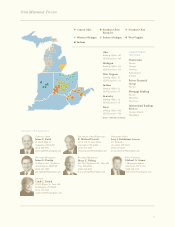

Three and a half years ago, we began the transformation of Huntington into the “local bank with

national resources.” This model places decision-making in our local markets, close to customers. Regional

presidents have accountability and responsibility for commercial and retail businesses within their markets.

This is where we believe we have developed a competitive advantage. We have invested in systems, staffing,

and training and will continue to do so. And the financial performance results in 2004 clearly indicate that

our business model is working.

SEC Formal Investigation and

Formal Regulatory Supervisory Agreements

Where We Are