Hasbro 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

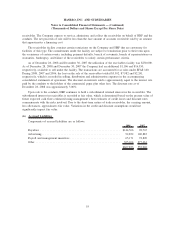

exercised. The holder of the warrants elected to settle the warrants through a non-cash net share settlement,

resulting in the issuance of 779 shares. If the holder had not elected net share settlement, the Company would

have received cash proceeds from the exercise totaling $28,888 and would have been required to issue

1,700 shares.

In addition, during 2007 the Company exercised its call option to repurchase warrants which allowed for

the purchase of an aggregate of 15,750 shares of the Company’s common stock. The Company had a warrant

amendment agreement with Lucasfilm Ltd. and Lucas Licensing Ltd. (together “Lucas”) that provided the

Company with a call option through October 13, 2016 to purchase the warrants from Lucas for a price to be

paid at the Company’s election of either $200,000 in cash or the equivalent of $220,000 in shares of the

Company’s common stock, such stock being valued at the time of the exercise of the option. Also, the warrant

amendment agreement provided Lucas with a put option through January 2008 to sell all of these warrants to

the Company for a price to be paid at the Company’s election of either $100,000 in cash or the equivalent of

$110,000 in shares of the Company’s common stock, such stock being valued at the time of the exercise of the

option. In May 2007 the Company exercised its call option to repurchase all of the outstanding warrants for

the Company’s common stock held by Lucas and paid $200,000 in cash and repurchased the warrants.

Prior to exercising the call option, the Company adjusted these warrants to their fair value through

earnings at the end of each reporting period. During 2007 and 2006, the Company recorded other expense of

$44,370 and $31,770, respectively to adjust the warrants to their fair value. These amounts are included in

other (income) expense, net in the consolidated statements of operations. There was no tax benefit or expense

associated with these fair value adjustments.

(12) Pension, Postretirement and Postemployment Benefits

Pension and Postretirement Benefits

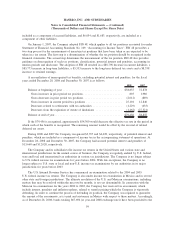

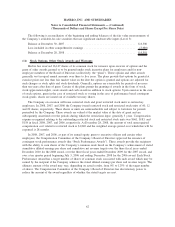

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, “Employer’s

Accounting for Defined Benefit Pension and Other Postretirement Plans”, (“SFAS No. 158”) which amends

Statements of Financial Accounting Standards No. 87, 88, 106 and 132R. Under SFAS No. 158, the Company

is required to recognize on its balance sheet actuarial gains and losses and prior service costs that have not yet

been included in income as an adjustment of equity through other comprehensive earnings with a correspond-

ing adjustment to prepaid pension expense or the accrued pension liability. In addition, within two years of

adoption, the measurement date for plan assets and liabilities would be required to be the Company’s fiscal

year-end.

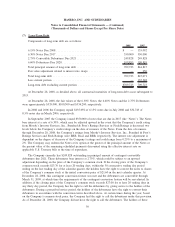

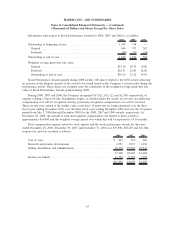

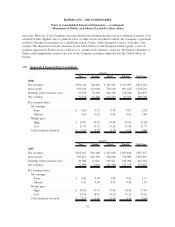

In accordance with SFAS No. 158, effective January 1, 2007, the Company elected to change the

measurement date of certain of its defined benefit pension plans and the Company’s other postretirement plan

from September 30 to the Company’s fiscal year-end date, which was December 30, 2007. As a result of this

election, the assets and liabilities of these plans were remeasured as of December 31, 2006. The remeasure-

ment of the assets and liabilities resulted in an increase in the projected benefit obligation of $536 and an

increase in the fair value of plan assets of $10,872. The impact of this accounting change was a reduction of

retained earnings of $2,143, an increase to accumulated other comprehensive earnings of $7,779, a decrease in

long-term accrued pension expense of $3,619, an increase in prepaid pension expense of $5,482, and a

decrease in long-term deferred tax assets of $3,465.

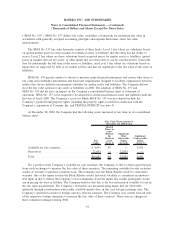

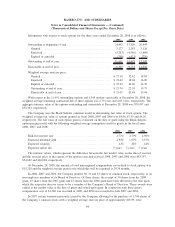

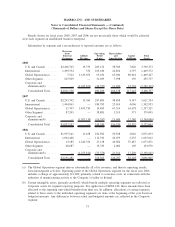

Expense related to the Company’s defined benefit and defined contribution plans for 2008, 2007 and

2006 were approximately $33,400, $25,900, and $31,100, respectively. Of these amounts, $32,400, $13,400

and $15,400 related to defined contribution plans in the United States and certain international affiliates. The

remainder of the expense relates to defined benefit plans discussed below.

65

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)