Hasbro 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

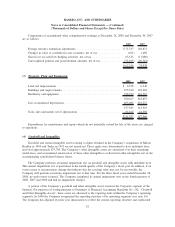

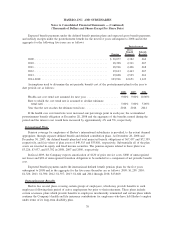

Mexican government related to the 2000 to 2002 assessments, allowing the Company to defend its positions.

The Company will be required to either post an additional bond or pay a deposit of $25,688 (at year-end 2008

exchange rates) related to the 2003 assessment. The Company expects to be successful in sustaining its

position with respect to these assessments as well as similar positions that may be taken by the Mexican tax

authorities for periods subsequent to 2003.

Upon the settlements of other examinations in various tax jurisdictions and the expiration of several

statutes of limitation, the Company believes that it is reasonably possible that the related unrecognized tax

benefits and accrued interest may decrease income tax expense by up to approximately $3,000 in the next

12 months.

The cumulative amount of undistributed earnings of Hasbro’s international subsidiaries held for reinvestment

is approximately $718,000 at December 28, 2008. In the event that all international undistributed earnings were

remitted to the United States, the amount of incremental taxes would be approximately $167,000.

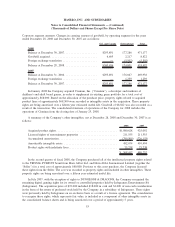

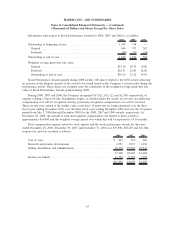

(9) Capital Stock

Preference Share Purchase Rights

Hasbro maintains a Preference Share Purchase Rights Plan (the “Rights Plan”). Under the terms of the

Rights Plan, each share of common stock is accompanied by a Preference Share Purchase Right (“Right”).

Each Right is only exercisable under certain circumstances and, until exercisable, the Rights are not

transferable apart from Hasbro’s common stock. When exercisable, each Right will entitle its holder to

purchase until June 30, 2009, in certain merger or other business combination or recapitalization transactions,

at the Right’s then current exercise price, a number of the acquiring company’s or Hasbro’s, as the case may

be, common shares having a market value at that time of twice the Right’s exercise price. Under certain

circumstances, the Company may substitute cash, other assets, equity securities or debt securities for the

common stock. At the option of the Board of Directors of Hasbro (“the Board”), the rightholder may, under

certain circumstances, receive shares of Hasbro’s common stock in exchange for Rights.

Prior to the acquisition by a person or group of beneficial ownership of a certain percentage of Hasbro’s

common stock, the Rights are redeemable for $0.01 per Right. The Rights Plan contains certain exceptions

with respect to the Hassenfeld family and related entities.

Common Stock

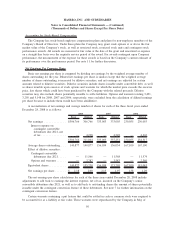

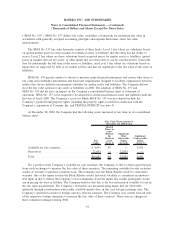

In February 2008 the Company’s Board of Directors authorized the repurchase of up to $500,000 in

common stock after three previous authorizations dated May 2005, July 2006 and August 2007 with a

cumulative authorized repurchase amount of $1,200,000 were fully utilized. Purchases of the Company’s

common stock may be made from time to time, subject to market conditions, and may be made in the open

market or through privately negotiated transactions. The Company has no obligation to repurchase shares

under the authorization and the timing, actual number, and the value of the shares which are repurchased will

depend on a number of factors, including the price of the Company’s common stock. This authorization

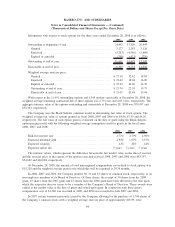

replaced all prior authorizations. In 2008, the Company repurchased 11,736 shares at an average price of

$30.44. The total cost of these repurchases, including transaction costs, was $357,589. At December 28, 2008,

$252,364 remained under this authorization.

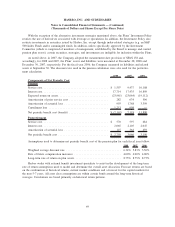

(10) Fair Value of Financial Instruments

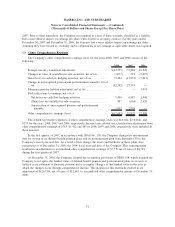

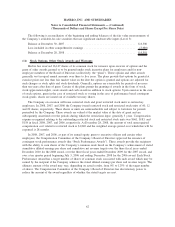

On December 31, 2007, the first day of fiscal 2008, the Company adopted Statement of Financial

Accounting Standards No. 157, “Fair Value Measurements” (“SFAS No. 157”), for financial assets and

liabilities and No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities”

60

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)