Hasbro 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

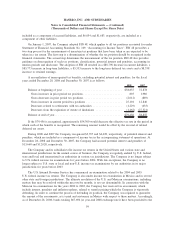

2007. Prior to their repurchase, the Company was required to assess if these warrants, classified as a liability,

had a more dilutive impact on earnings per share when treated as an equity contract. For the years ended

December 30, 2007 and December 31, 2006, the warrants had a more dilutive impact on earnings per share

assuming they were treated as a liability and no adjustments to net earnings or equivalent shares was required.

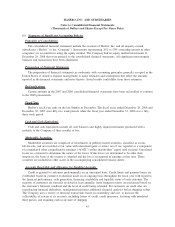

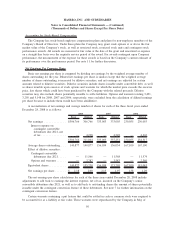

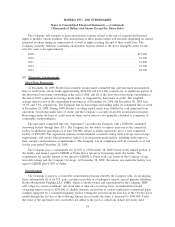

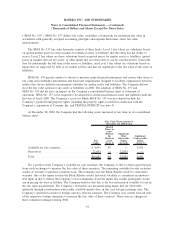

(2) Other Comprehensive Earnings

The Company’s other comprehensive earnings (loss) for the years 2008, 2007 and 2006 consist of the

following:

2008 2007 2006

Foreign currency translation adjustments . . . .................. $(33,555) 35,888 26,429

Changes in value of available-for-sale securities, net of tax ....... (3,037) 221 (2,497)

Gain (loss) on cash flow hedging activities, net of tax ........... 73,184 (15,851) (7,412)

Change in unrecognized pension and postretirement amounts, net of

tax............................................... (52,582) 27,393 —

Minimum pension liability adjustment, net of tax ............... — — 1,991

Reclassifications to earnings, net of tax:

Net losses on cash flow hedging activities .................. 1,409 6,887 1,448

(Gain) loss on available-for-sale securities .................. 897 (664) 2,629

Amortization of unrecognized pension and postretirement

amounts ......................................... 1,002 2,099 —

Other comprehensive earnings (loss) ........................ $(12,682) 55,973 22,588

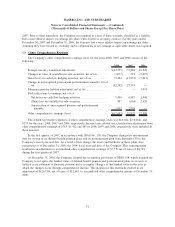

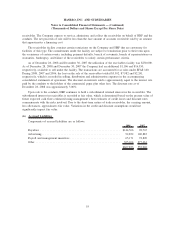

The related tax benefit (expense) of other comprehensive earnings items was $16,022, $(16,064), and

$273 for the years 2008, 2007 and 2006, respectively. Income taxes related to reclassification adjustments from

other comprehensive earnings of $763, $1,412 and $85 in 2008, 2007 and 2006, respectively, were included in

these amounts.

In the first quarter of 2007, in accordance with SFAS No. 158, the Company changed its measurement

date for certain of its defined benefit pension plans and its postretirement plan from September 30 to the

Company’s fiscal year-end date. As a result of this change, the assets and liabilities of these plans were

remeasured as of December 31, 2006, the 2006 fiscal year-end date of the Company. This remeasurement

resulted in an adjustment to accumulated other comprehensive earnings of $7,779 net of taxes of $4,765,

during the first quarter of 2007.

At December 31, 2006, the Company adopted the recognition provisions of SFAS 158, which required the

Company to recognize the funded status of defined benefit pension and postretirement plans as an asset or

liability in its statement of financial position and to recognize changes in that funded status in the year in

which the changes occur through comprehensive income. The adoption of this statement resulted in an

adjustment of $(26,750), net of taxes of $12,645, to accumulated other comprehensive income at December 31,

2006.

51

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)