Hasbro 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27.6% in 2006 primarily reflects the decision to provide for the repatriation of a portion of 2007 international

earnings to the U.S.

Liquidity and Capital Resources

The Company has historically generated a significant amount of cash from operations. In 2008, the

Company funded its operations and liquidity needs primarily through cash flows from operations, and, when

needed, using borrowings under its available lines of credit and proceeds from its accounts receivable

securitization program. During 2009, the Company expects to continue to fund its working capital needs

primarily through cash flows from operations and, when needed, using borrowings under its available lines of

credit and proceeds from its accounts receivable securitization program. The Company believes that the funds

available to it, including cash expected to be generated from operations and funds available through its

available lines of credit and accounts receivable securitization program are adequate to meet its working

capital needs for 2009, however, unexpected events or circumstances such as material operating losses or

increased capital or other expenditures may reduce or eliminate the availability of external financial resources.

In addition, significant disruptions to credit markets may also reduce or eliminate the availability of external

financial resources. Although we believe the risk of nonperformance by the counterparties to our financial

facilities is not significant, in times of severe economic downturn in the credit markets it is possible that one

or more sources of external financing may be unable or unwilling to provide funding to us.

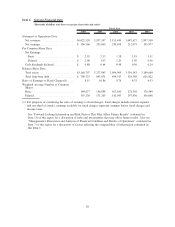

At December 28, 2008, cash and cash equivalents, net of short-term borrowings were $622,804 compared

to $764,257 and $704,818 at December 30, 2007 and December 31, 2006, respectively. Hasbro generated

$593,185, $601,794, and $320,647 of cash from its operating activities in 2008, 2007 and 2006, respectively.

In 2007 and 2006 operating cash flows were impacted by royalty advances paid of $70,000 and $105,000

related to MARVEL in those respective years. In addition, 2007 and 2006 net earnings included non-cash

expense of $44,370 and $31,770, respectively, related to the fair value adjustment related to the Lucas warrants

that were repurchased in May of 2007. The remaining decrease in 2008 operating cash flows was due to

decreased net earnings in 2008 compared to 2007. The higher cash flows from operations in 2007 compared to

2006 were primarily the result of increased earnings as well as the mix of products in 2007 net revenues.

Accounts receivable decreased to $611,766 at December 28, 2008 from $654,789 at December 30, 2007.

The accounts receivable balance at December 28, 2008 includes a decrease of approximately $61,100 as a

result of the stronger U.S. dollar in 2008. Absent the impact of foreign exchange, accounts receivable

increased slightly. Accounts receivable increased to $654,789 at December 30, 2007 from $556,287 at

December 31, 2006. The increase in accounts receivable was primarily the result of higher sales volume in

2007. The December 30, 2007 accounts receivable balance includes an increase of approximately $31,100

related to the currency impact of the weaker U.S. dollar. Fourth quarter days sales outstanding remained

consistent at 45 days in 2008, 2007 and 2006. The Company has a revolving accounts receivable securitization

facility whereby the Company is able to sell undivided fractional ownership interests in qualifying accounts

receivable on an ongoing basis. At December 28, 2008 and December 30, 2007, there was $250,000 sold at

each period-end under this program.

Inventories increased to $300,463 at December 28, 2008 from $259,081 at December 30, 2007. The

increase relates to lower revenues in the fourth quarter of 2008 as a result of the weak retail environment and,

to a lesser extent, the Company’s expansion into emerging markets. The December 28, 2008 inventory balance

includes a decrease of approximately $20,900 as a result of the currency impact of the stronger U.S. dollar in

2008. The increase in inventory to $259,081 at December 30, 2007 from $203,337 at December 31, 2006

reflected the growth of the Company’s business in 2007. In addition, inventories increased approximately

$9,400 due to the weaker U.S. dollar in 2007.

Prepaid expenses and other current assets decreased to $171,387 at December 28, 2008 from $199,912 at

December 30, 2007. This decrease is primarily due to utilization of a portion of the Marvel and the remainder

of the Lucas prepaid royalty advances. Generally, when the Company enters into a licensing agreement for

entertainment-based properties, an advance royalty payment is required at the inception of the agreement. This

payment is then recognized in the consolidated statement of operations as the related sales are made. At

29