Hamilton Beach 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

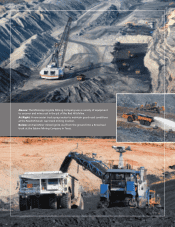

NORTH AMERICAN COAL

2013 Results

NACoal has delivered stable financial performance

over the years, and 2013, while no exception, was not

without its challenges. Tons delivered, income before

income taxes and net income at NACoal’s unconsoli-

dated and consolidated mining operations, excluding

Reed Minerals, increased year over year. Increased

deliveries and lower operating expenses at Mississippi

Lignite Mining Company (“MLMC”), increased

deliveries at the Florida limerock dragline operations

and increased deliveries and contractual escalation at

the unconsolidated mining operations all contributed

to the year-over-year improvements. Royalty and other

income from third parties also increased very signifi-

cantly. These improvements, combined with reduced

professional fees and employee-related costs, primarily

due to the 2012 Reed acquisition, and a favorable shift

in mix of income to entities with lower tax rates added

to the net income improvement. However, despite

these favorable developments, income before income

taxes decreased to $35.4 million in 2013 from $41.8

million in 2012 and 2013 net income decreased to

$31.9 million from $32.8 million in 2012, primarily

due to a significant loss at Reed.

Reed Minerals, a coal mining business in

Alabama that produces steam and metallurgical coal,

was acquired on August 31, 2012. The 2013 financial

results include revenues of $71.8 million and a net

loss of $9.8 million for 2013 from Reed compared

with revenues of $29.3 million and net income of $1.0

million for the four months ended December 31, 2012.

Reed experienced a number of difficulties during 2013.

Reduced demand and lower-then-anticipated metal-

lurgical coal prices, combined with significantly higher

mining costs due to the unexpected thinning of a coal

seam in an isolated area, substantial costs associated

with the development of a new mining area and

temporary mining restrictions which significantly

increased hauling distances and reduced equipment

and overburden removal productivity, in total led to

very poor 2013 operating results at Reed. While 2013

was a very difficult year at the Reed Minerals operation,

NACoal is optimistic that productivity improvements

made in 2013 and being made in the first half of

2014 will begin to turn that operation around. The

company’s short-term objective for Reed is to achieve at

least break-even operations in the second half of 2014.

NACoal generated cash flow from operations

of $29.5 million, but had negative cash flow before

financing activities of $26.7 million predominantly

due to $52.7 million of capital expenditures primarily

for equipment and coal reserve acquisitions as part

of NACoal’s plan to improve operating results and

mining efficiencies at Reed by increasing production

capacity and reducing costs. The negative cash flow

before financing activities of $6.1 million in 2012 was

also largely as a result of the Reed acquisition.

Outlook for 2014

NACoal remains focused on safety, environmental

compliance and continuous improvement programs.

These well-established programs and the company’s

unique lignite coal business model-based largely on

long-term cost reimbursable contracts, provide stable

cash flow with minimal capital investment and provide

a solid foundation for all of the company’s coal and

limerock mining operations.

NACoal expects improved operating performance

overall at its coal mining operations in 2014. At the

unconsolidated mining operations, steam coal tons

delivered in 2014 are expected to increase over 2013

provided customers achieve currently planned power

plant operating levels. Demery Resources Company’s

Five Forks Mine commenced delivering coal to its

customer in 2012 and full production levels are

expected to be reached in late 2015. Liberty Fuels also

commenced production of lignite coal in 2013 for

Mississippi Power Company’s new Kemper County

Energy Facility. Production levels at Liberty Fuels are

expected to increase gradually from 0.5 million to

1 million tons in 2014 to full production of approxi-

mately 4.7 million tons of lignite coal annually in 2019.

Unconsolidated mines currently in development

are expected to continue to generate modest income

in 2014. The three mines in development are not

expected to be at full production for several years.

In the first quarter of 2013, mining permits needed