Hamilton Beach 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

INTRODUCTION

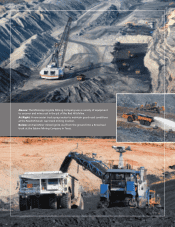

Just over a year ago NACCO Industries Inc.

completed a significant transformation in its business

through the spin-off of its Hyster-Yale forklift truck

business and its entry into the bituminous and

metallurgical coal business in Alabama. Since

then, NACCO has remained

focused on key strategic initiatives

for its North American Coal

Corporation (“NACoal”) and

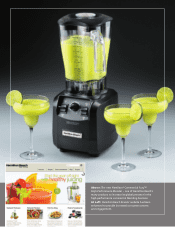

Hamilton Beach Brands (“HBB”)

subsidiaries and on realigning

its Kitchen Collection business to

compete profitably in the current

traditional and outlet mall retail

environment.

Coal deliveries from NACoal’s

lignite mines increased in 2013

as more electrical demand at its

customers’ power plants translated

into higher customer requirements

and the Company benefited from

a full year of deliveries from its

Reed Minerals (“Reed”) operation,

which was acquired in August 2012. However, as

a result of a downturn in the metallurgical coal

market, a decrease in metallurgical coal prices to levels

moderately below the Company’s expectations and

short-term cost challenges, tons delivered, revenues

and profits at Reed did not achieve the Company’s

expectations for its first full year of ownership.

Limerock customers increased requirements as a

result of significant demand related primarily to one

large project in the Florida construction market that

ended during the second half of 2013.

Middle-market mass consumers, which are

HBB’s and Kitchen Collection’s target customers,

remained under pressure in

2013. Customer visits to stores,

particularly at traditional and

outlet malls, continued to drop

in 2013, especially during the

fourth-quarter holiday selling

season. Despite this highly

challenging environment,

revenues and profits improved

at HBB as a result of increased

placements and promotions at its

largest customers. On the other

hand, Kitchen Collection, which

continued to make adjustments

to attract customers, was not

able to overcome the unfavorable

effect of the decline in customer

visits to its stores.

Given these conditions, 2013 was a challenging

year for NACCO Industries, Inc. While consolidated

revenues for NACCO grew to $932.7 million in 2013

from $873.4 million in 2012, primarily due to increased

deliveries at NACoal and higher sales volumes of

higher-priced and new products at HBB, consolidated

income from continuing operations increased only

MINING

TOOUR STOCKHOLDERS

SUBSIDIARY LONG-TERM

FINANCIAL OBJECTIVES:

• NACoal: Earn a minimum return on

capital employed of 13 percent, attain

positive Economic Value Income from

all existing consolidated mining opera-

tions and any new projects, maintain or

increase the profitability of all existing

unconsolidated mining operations and

achieve substantial income growth by

developing new mining ventures.

• HBB: Achieve a minimum operating

profit margin of 10 percent.

• Kitchen Collection: Achieve a minimum

operating profit margin of 5 percent.

• All businesses: Generate substantial

cash flow before financing activities.