Hamilton Beach 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

modestly to $44.5 million, or $5.47 per diluted share,

in 2013 from $42.2 million, or $5.02 per diluted

share, in 2012. HBB achieved very strong operating

results on a solid revenue increase. However, operating

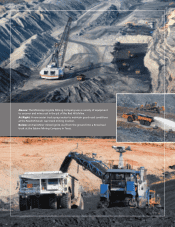

results at both NACoal and Kitchen Collection were

disappointing. NACoal’s results suffered from reduced

volume and temporarily higher costs at the Reed

Minerals operation. Kitchen Collection’s results were

hurt by fewer customer visits, reduced margins and

charges totaling $2.0 million, or $1.3 million after tax

of $0.7 million, for the impairment of certain fixed

assets, employee severance in connection with future

closings of unprofitable stores and a write-down of

certain inventory to fair market value.

In 2013, strong returns on capital employed(1)

(“ROTCE”) on a net debt basis were realized at both

NACoal (13.0 percent) and HBB (34.9 percent).

However, Kitchen Collection generated a loss.

The Company generated negative consolidated

cash flow before financing activities of $7.6 million

in 2013 as strong positive cash flow before financing

activities at HBB of $38.5 million was offset by negative

cash flow before financing activities of $26.7 million

at NACoal and $12.2 million at Kitchen Collection.

NACoal’s negative cash flow before financing activities

was primarily the result of equipment and coal reserve

acquisitions as part of NACoal’s plan to improve

mining efficiencies, increase volumes and reduce costs

at Reed, while Kitchen Collection’s negative cash flow

was primarily because of the significant 2013 operating

loss. The Company had consolidated cash on hand

of $95.4 million as of December 31, 2013 compared

with $139.9 million as of December 31, 2012. Debt as

of December 31, 2013 was $183.8 million compared

with $177.7 million as of December 31, 2012. NACCO

expects strong cash flow before financing activities

from NACoal and HBB in 2014 and improved cash

flow before financing activities at Kitchen Collection.

In November 2011, the Company’s Board of

Directors approved the repurchase of up to $50 million

of the Company’s outstanding Class A common stock

(the “2011 Stock Repurchase Program”). In November

2013, the Company’s Board of Directors terminated

the 2011 Stock Repurchase Program and approved

a new stock repurchase program (the “2013 Stock

Repurchase Program”) providing for the purchase

of up to $60 million of the Company’s outstanding

Class A Common Stock through December 31, 2015.

Neither of the share repurchase programs required

the Company to acquire any specific number of shares.

In total under the 2011 Stock Repurchase Program,

NACCO repurchased approximately 624,000 shares

of Class A common stock for an aggregate purchase

price of $35.6 million, including $30.4 million of stock

purchased during 2013. As of December 31, 2013,

the Company had repurchased approximately 16,100

shares of Class A common stock for $0.9 million under

the 2013 Stock Repurchase Program. A total of $31.3

million of Class A common stock was purchased in

2013 under both plans.

(1) See page 20 for the calculation of return on capital employed.