Hamilton Beach 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

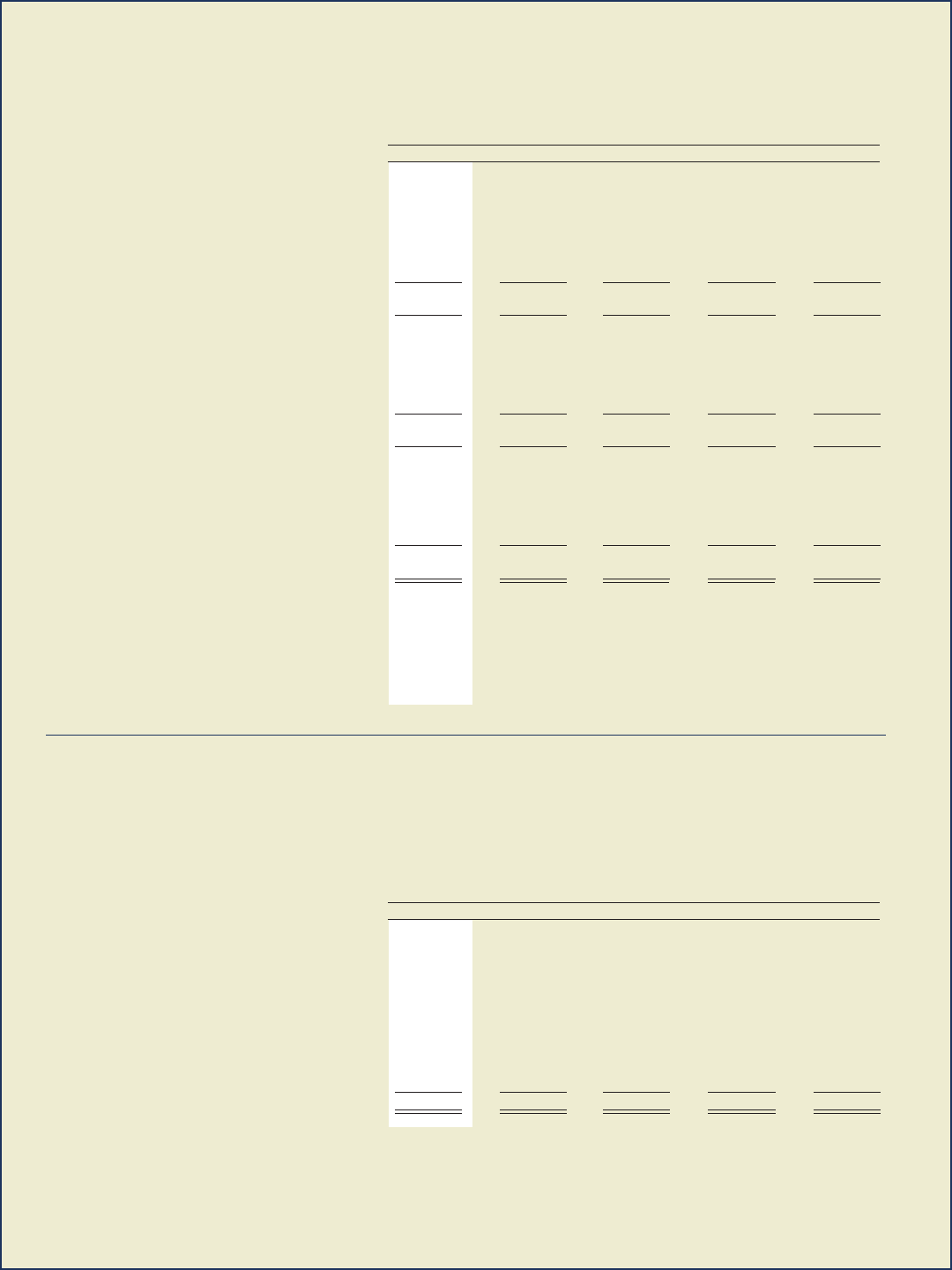

(5) Cash Flow before Financing Activities is equal to net cash provided by operating activities less net cash used for investing activities.

(6) Adjusted EBITDA is provided solely as a supplemental disclosure with respect to operating results. Adjusted EBITDA does not represent net income, as defined by

U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of our operating performance. NACCO defines Adjusted EBITDA

as income before discontinued operations, Applica settlement and litigation charges, goodwill impairment charge and income taxes plus net interest expense and

depreciation, depletion and amortization expense. Adjusted EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled

measures of other companies.

(7) Includes employees of Reed Minerals from 2012 and the unconsolidated mining subsidiaries for all years presented and excludes employees of Hyster-Yale and Red River

for all years presented.

$ 50.4

35.5

5.4

(41.8)

$ 49.5

$ (6.5)

(2.1)

(1.1)

(14.0)

$ (23.7)

$ 43.9

33.4

4.3

(55.8)

$ 25.8

$ (45.8)

$ 107.0

4,100

$ 25.9

15.0

6.3

(31.6)

$ 15.6

$ 6.9

(2.2)

(2.7)

0.7

$ (2.7)

$ 32.8

12.8

3.6

(30.9)

$ 18.3

$ (18.9)

$ 110.3

3,900

$ 31.7

24.2

4.9

39.8

$ 100.6

$ (10.7)

(3.7)

(2.3)

(0.1)

$ (16.8)

$ 21.0

20.5

2.6

39.7

$ 83.8

$ (22.4)

$ 80.0

4,000

$ 50.2

27.4

3.8

(7.1)

$ 74.3

$ (56.3)

(3.2)

(3.9)

(0.4)

$ (63.8)

$ (6.1)

24.2

(0.1)

(7.5)

$ 10.5

$ (24.5)

$ 81.9

4,300

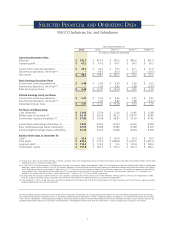

Year Ended December 31

2013 2012(1) 2011(1)(2) 2010(1)(2) 2009(1)(2)(3)

(In millions, except employee data)

Cash Flow Data:

Operating Activities

North American Coal Corporation . . . . . . . . . . . . . .

Hamilton Beach Brands . . . . . . . . . . . . . . . . . . . . . .

Kitchen Collection . . . . . . . . . . . . . . . . . . . . . . . . . .

NACCO and Other . . . . . . . . . . . . . . . . . . . . . . . . . .

Provided by operating activities from

continuing operations . . . . . . . . . . . . . . . . . . . . . . .

Investing Activities

North American Coal Corporation . . . . . . . . . . . . . .

Hamilton Beach Brands . . . . . . . . . . . . . . . . . . . . . .

Kitchen Collection . . . . . . . . . . . . . . . . . . . . . . . . . .

NACCO and Other . . . . . . . . . . . . . . . . . . . . . . . . . .

Used for investing activities

from continuing operations . . . . . . . . . . . . . . . . . . .

Cash Flow before Financing Activities(5)

North American Coal Corporation . . . . . . . . . . . . . .

Hamilton Beach Brands . . . . . . . . . . . . . . . . . . . . . .

Kitchen Collection . . . . . . . . . . . . . . . . . . . . . . . . . .

NACCO and Other . . . . . . . . . . . . . . . . . . . . . . . . . .

Consolidated Cash Flow before Financing Activities

from continuing operations(5) . . . . . . . . . . . . . . . . . .

Used for financing activities from

continuing operations . . . . . . . . . . . . . . . . . . . . . . .

Other Data:

Adjusted EBITDA(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total employees at December 31(3)(7) . . . . . . . . . . . . . .

$ 29.5

40.8

(10.1)

(7.1)

$ 53.1

$ (56.2)

(2.3)

(2.1)

(0.1)

$ (60.7)

$ (26.7)

38.5

(12.2)

(7.2)

$ (7.6)

$ (36.8)

$ 88.8

4,100

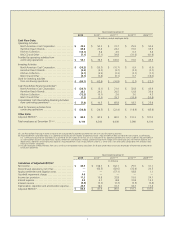

Year Ended December 31

2013 2012(1) 2011(1)(2) 2010(1)(2) 2009(1)(2)(3)

(In millions)

Calculation of Adjusted EBITDA(6)

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Discontinued operations, net of tax . . . . . . . . . . . . . . .

Applica settlement and litigation costs . . . . . . . . . . . . .

Goodwill impairment charge . . . . . . . . . . . . . . . . . . . .

Income tax provision . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation, depletion and amortization expense . . .

Adjusted EBITDA(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 108.7

(66.5)

—

—

15.8

6.1

(0.2)

18.0

$ 81.9

$ 31.1

20.5

1.1

—

24.1

13.2

(0.4)

17.4

$ 107.0

$ 79.5

(32.4)

18.8

—

15.6

10.8

(0.3)

18.3

$ 110.3

$ 162.1

(82.6)

(57.1)

—

32.8

8.8

(0.3)

16.3

$ 80.0

$ 44.5

—

—

4.0

11.3

4.8

(0.3)

24.5

$ 88.8